Form Of Ownership The Business Itself Pays Income Taxes

This means that shareholders are subject to. If a sole proprietorship fails the owner is not liable for its debts since the business is a separate legal entity.

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

This means that the corporation files its own tax return and pays taxes itself.

Form of ownership the business itself pays income taxes. Remaining income paid to owner as distribution which is taxed at a lower rate. In forming a corporation prospective shareholders exchange money property or both for the corporations capital stock. In a partnership the business itself is subject to federal income tax.

Owners treat taxes as they would for a partnership or sole proprietorship. Each state may use different regulations you should check with your state if you are interested in starting a Limited Liability Company. Most owners of a one-owner LLC must fill out Form 1040 Schedule C.

A business owner needs to be very clear about the tax liability incurred whether the distribution is a salary or a draw. In the CORPORATION form of ownership the business itself pays income taxes. For the latest tax year your sole proprietorship had net income of 100000.

A general partner is personally liable only for the amount of money he has invested in the partnership. C corporations file Form 1120 where they both report and pay income tax. Each method generates a tax bill.

The owner has complete authority over all business decisions and activities. The shareholders of a C Corporation pay taxes on income and distributions from the business. Shareholders are taxed when dividends are paid.

Business Income and Expenses. For example if a corporation owns all or part of an LLC the tax for the LLC passes to. Your decision about a salary or owners draw should be based on the capital your business needs and your ability to perform accurate tax.

If an LLC normally a pass-through entity elects to be taxed as a corporation it pays corporate income taxes. Corporate profits are thus taxed twicethe corporation pays the taxes the first time and the shareholders pay the taxes the second time. The owners of the corporation are shareholders and they receive income in the form of dividends.

The owner receives all profits. Income from your business will be distributed to you as the sole proprietor and you will pay tax to the state on that income. Easy and inexpensive to create.

If the business is farming then Form 1040 Schedule F Farm Income must be completed. This can result in double taxation. Instead it passes net income income tax credits and other tax items through to each of the partners those people who.

Taxes are paid as personal income of the owner. In the form of ownership the business itself pays income taxes proprietorship from MGT 375 at University of Southern Mississippi. The IRS considers C corporations separate taxpaying entities.

This is the least regulated form of business ownership. A standard C Corporation is taxed on a corporate level. Most states do not restrict ownership so members may include individuals corporations other LLCs and foreign entities.

Owners of an LLC are called members. A corporation is its own separate tax entity and it pays income tax at the corporate tax rate. They pay taxes on this income at the dividend rate.

Corporations are taxed by the federal and state governments on their earnings. If the business deals with real estate or rental properties then Form 1040 Schedule E. For federal income tax purposes a C corporation is recognized as a separate taxpaying entity.

Work with a CPA to plan for your tax liability and any required estimated payments. Unlike the other business structures C. If your business is structured as a partnership you will use Form 1065 to file your return.

A corporation generally takes the same deductions as a sole proprietorship to figure its taxable income. Youll pay Social Security Medicare and income taxes through each type of business entity. When these earnings are distributed as dividends the shareholders pay taxes on these dividends.

A Limited Liability Company LLC is a business structure allowed by state statute. A corporation can also take special deductions. In the form of ownership the business itself pays income taxes proprietorship Course Hero.

The business itself pays no taxes. If a business owns another business the tax for the owning business passes through. A partnership unlike a corporation does not pay tax.

The 100000 in net income is distributed to you personally and you pay tax on that income on your individual state tax return.

Don T Be Passive About Canada S New Passive Income Rules Advisor S Edge

Don T Be Passive About Canada S New Passive Income Rules Advisor S Edge

How Corporations Are Taxed Nolo

How Corporations Are Taxed Nolo

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Doing Business In The United States Federal Tax Issues Pwc

Doing Business In The United States Federal Tax Issues Pwc

What Is A C Corporation What You Need To Know About C Corps Gusto

What Is A C Corporation What You Need To Know About C Corps Gusto

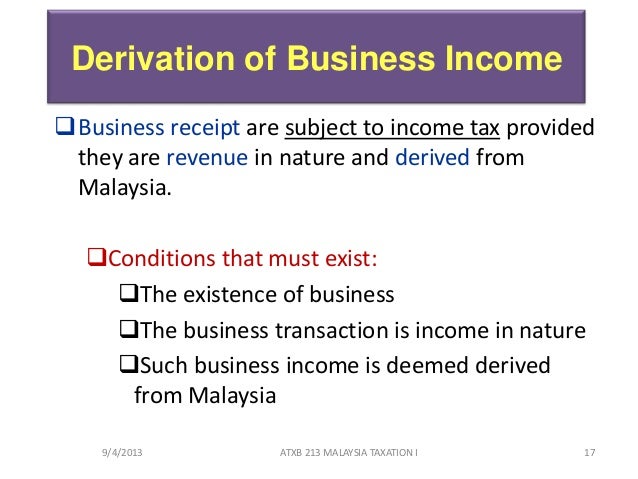

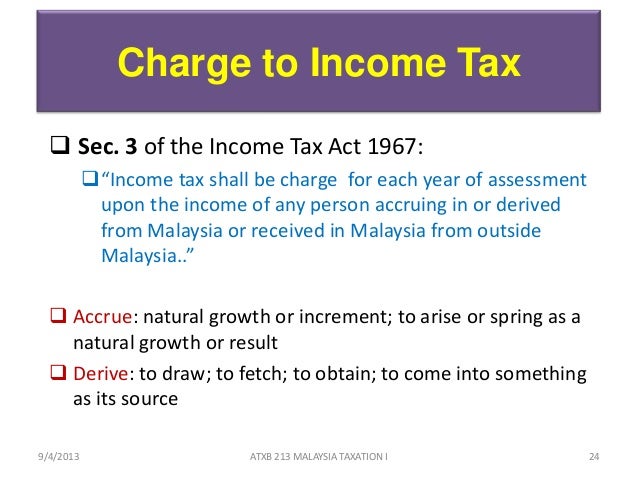

Chapter 6 Business Income Students 1

Chapter 6 Business Income Students 1

Chapter 6 Business Income Students 1

Chapter 6 Business Income Students 1

Understanding The 1065 Form Scalefactor

Understanding The 1065 Form Scalefactor

Chapter 6 Business Income Students 1

Chapter 6 Business Income Students 1

How Corporations Are Taxed Nolo

How Corporations Are Taxed Nolo

How To File Your Freelance Taxes And Save Money Financial Tips Saving Money How To Get Clients

How To File Your Freelance Taxes And Save Money Financial Tips Saving Money How To Get Clients

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

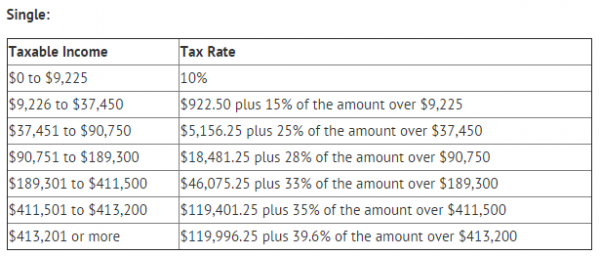

4 Steps To Determine How Much Your Business Will Owe In Taxes Projectionhub

4 Steps To Determine How Much Your Business Will Owe In Taxes Projectionhub

Https Www Irs Gov Pub Irs Tege Eotopicl00 Pdf

4 Steps To Determine How Much Your Business Will Owe In Taxes Projectionhub

4 Steps To Determine How Much Your Business Will Owe In Taxes Projectionhub

Chapter 6 Business Income Students 1

Chapter 6 Business Income Students 1

Biden Tax Plan And 2020 Year End Planning Opportunities

Biden Tax Plan And 2020 Year End Planning Opportunities

Year End Tax Deductions For Cash Basis Small Business Owners

Year End Tax Deductions For Cash Basis Small Business Owners

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes