How Can I Get All My W2 Forms From Previous Years

Check the box for Form W-2 specify which tax year s you need and mail or fax the completed form. Allow 5 to 10 days from the IRS received date to receive the transcript.

Be the first to share what you think.

How can i get all my w2 forms from previous years. View Entire Discussion 0 Comments More posts from the Advice community. Sign the form and include your telephone number. The quickest way to obtain a copy of your current year Form W-2 is through your employer.

We will waive the fee for taxpayers impacted by a federally declared disaster. This option can be used to obtain copies of your W-2s filed during the past 10 tax years. You can order copies of your entire return attachments include Form W-2 from the IRS for a fee or Order Form W-2 information at no charge from the IRS as part of a transcript.

Be sure to confirm the date it was sent too. Most people get their W-2 forms by the end of January. Your employer first submits Form W-2 to SSA.

The IRS can provide Form W-2 information for up to 10 years. We only retain actual copies of Form W-2 Wage and Tax Statement when attached to your paper tax return. Try our Prior Year Forms Publications Search to quickly find and download prior year forms instructions and publications.

Allow the agency 10 business days to process your request. If you dont feel confident request another copy. Alternatively you may request a W-2 transcript by calling the IRSs toll-free number.

If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return you can order a copy of the entire return from the IRS for a fee. Visit SSAgov and search for get W-2 or call your local SSA office to request your copy. Write in the year for which you are requesting W-2 forms on line 9.

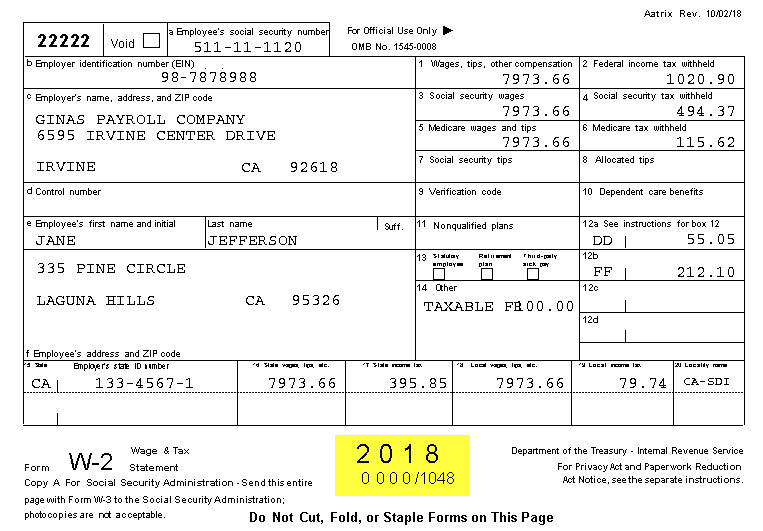

Where can I find and download my previous few years w2 form. Form W-2 Wage and Tax Statement shows your income and the taxes withheld from your pay for the year. The only way to get an actual copy of your Form W-2 from us is to order a copy of the entire return by using Form 4506 Request for Copy of Tax Return and paying a 43 fee for each return requested.

If you havent received your form by mid-February heres what you should do. All other requests carry a fee of 90. You can get free copies if you need them for a Social Security-related reason.

You can request up to 10 years of W-2 transcripts from the IRS excluding the current tax year. You need it to file an accurate tax return. But there is a fee of 90 per request if you need them for an unrelated reason.

Find the IRS office that serves your state on page 2 of Form 4506-T and mail or fax the form back to the IRS at the address indicated. Not using this body block at this time. Mail or fax Form 4506-T to the IRS at the address or fax number provided on the form.

We can give you copies or printouts of your Forms W-2 for any year from 1978 to the present. You can also contact the IRS by requesting a wage and income transcript directly from the IRS you will not get state and local information State and local information is not included on the W-2 that is requested through the wage and income transcript. You can also use Form 4506-T Request for Transcript of Tax Return.

Get Your W-2 Before Tax Time Employers must send you your W-2 by January 31 for the earnings from the previous calendar year of work. Youll also need this form from any former employer you worked for during the year. Check that your employer previous or current has mailed the form.

To get started enter keywords into the box below and click Search. If your employer cant give you your lost W-2 Forms you can get a copy of your Form W-2 from the Social Security Administration for a fee. If employers send the form to you be sure they have your correct address.

Confirm your mailing address and details right down to the spelling of the street name. If the reason you need a past-year W-2 form is because of a Social Security issue the SSA will provide a copy of your W-2 at no charge. This form shows the income you earned for the year and the taxes withheld from those earnings.

After SSA processes it they transmit the federal tax information to the IRS. You should first ask your employer to give you a copy of your W-2. You can also get a transcript or copy of your Form W-2 from the Internal Revenue Service.

Log in or sign up to leave a comment Log In Sign Up.

Wage Tax Statement Form W 2 What Is It Do You Need It

How Can I Get A Copy Of My W2 Online For Free 2020 2021 Turbotax Solution Meaning Online

W3 Form Instructions Seven Reasons Why W3 Form Instructions Is Common In Usa Tax Forms W2 Forms Letter Example

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

W 2 Form Filing Deadline And Faqs Square

What Forms Do I Use To Print W2s 1095s And 1099s

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Two Websites To Get Your W2 Form Online For 2020 2021

Understanding Your Tax Forms Form W 2 Wage And Tax Statement W2 Forms Tax Forms Irs Tax Forms

Important Tax Information And Tax Forms Camp Usa Interexchange

W3 Form Box 3 The Reason Why Everyone Love W3 Form Box 3 Irs Forms Power Of Attorney Form Tax Forms

Form W2 Everything You Ever Wanted To Know

Understanding Form W 2 The Annual Wage And Tax Statement W2 Forms Tax Forms Irs Tax Forms

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

How Can I Get A Copy Of My W 2 Applications In United States Application Gov

Instant W2 Form Generator Create W2 Easily Form Pros

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms