Small Business Rate Relief Application Form Sheffield

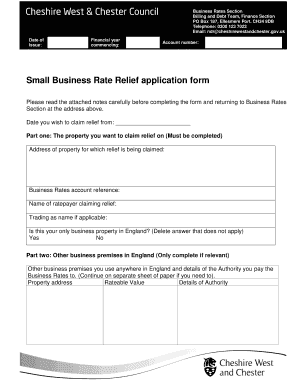

To apply for small business rate relief please complete the small business rate relief form. Small Business Rate Relief Application Form.

How To Qualify For Small Business Rate Relief Rating Walls

How To Qualify For Small Business Rate Relief Rating Walls

Write to us at.

Small business rate relief application form sheffield. To apply complete the small business rates relief application form available online or contact Revenues and Benefits Services on 01642 726006. You can apply using the form below or call the Business Rates Team. Business Rate Account Number.

__ Earliest date we can backdate the applicationrelief is the 1st April 2010. Apply for Business Rates relief. Non-Domestic Rating Small Business Rate Relief Amendment England Order 2006 SI 20093175.

This is the case even if you do not get small business rate relief. Rates relief is handled differently in Scotland Wales and Northern Ireland. You have to contact your local council to see if youre eligible and apply for.

This starts with 2 What date are you claiming SBRR from. Business rates Newcastle City Council Civic Centre Newcastle upon Tyne NE1 8QH. Eligible ratepayers with rateable values above 15000 and below 51000 will have their bills calculated using the small business.

Small business rates relief is reviewed annually. Eligible properties with a rateable value up to 12000 will receive 100 rate relief and have their bills calculated by using the small non-domestic rate multiplier. If different to the property address Business Rates Account Number.

The Government introduced the Small Business Rate Relief SBRR scheme to ease the National Non Domestic Rate NNDR burden on small businesses. The Small Business Rate Relief scheme provides a maximum of 100 mandatory rate relief for properties with a rateable value up to 12000 with relief declining on a sliding scale until at a rateable value of 15000 there is no entitlement. Backdating claims for small business rate relief.

Please read the attached notes before completing this application form. Small business rate relief. If this is your first application please confirm.

The address of the business property that you occupy for which you are making this application. You should fill in this form if you. Please give the exact date you believe you are entitled to Small Business Rate Relief from.

Address of the property. CURRENT EMPLOYER IF SELF EMPLOYED BUSINESS NAME TYPE OF BUSINESS CITY STATE ZIP CODE BUSINESS TELEPHONE NUMBER. The form must be completed in full or no relief shall be granted.

Rating appeals business rates relief A company of agents are contacting ratepayers in our area advising that for a fee they can submit appeals against rateable value assessments with the. Small Business Rate Relief Application 2017-2020 Please read the notes overleaf before completing this form. You can make an application for small business rates relief at any time during the current financial year for relief in that year.

You can apply for small business rate relief by filling in our online form. Our phone lines are closed on Wednesday. A business rate relief may be granted where the applicant can demonstrate that their occupation of premises in the Sheffield City Region Enterprise Zone supports the objectives of the Enterprise.

This starts with 4 Property Reference Number. Name that appears on bill 3. Guidance notes when applying for small business rate relief The criteria for relief are as follows.

Crystal Reports - Small Business Rates Relief VO List Application Form_100630_195220rpt Author. Small Business Relief. If you think that you may qualify after having read the notes below please complete the application form and return to this office at the address shown as soon as possible.

If your circumstances change you must notify Enfield at once. It is a criminal offence for a ratepayer to give false information when making an application for small business rate relief and checks will be done to verify the. The Rateable Value RV of the property that you occupy for business purposes.

You must keep paying the rates shown on your bill while you wait to hear from us unless weve agreed you dont have to. 0191 278 7878 ask for Business Rates Team 8am to 6pm Monday Tuesday and Thursday 8am to 430pm on Friday. The small business multiplier is 491p and the standard multiplier is 504p from 1 April 2019 to 31 March 2020.

Application for Small Business Rate Relief Please complete both sides of the application form in BLOCK CAPITALS Applicant. How to apply for small business rate relief.

How To Qualify For Small Business Rate Relief Rating Walls

How To Qualify For Small Business Rate Relief Rating Walls

How To Qualify For Small Business Rate Relief Rating Walls

How To Qualify For Small Business Rate Relief Rating Walls

Introduction To Business Rates South Ribble Borough Council

Introduction To Business Rates South Ribble Borough Council

How To Qualify For Small Business Rate Relief Rating Walls

How To Qualify For Small Business Rate Relief Rating Walls

Rates Rankle With Businesses After Ni Budget

Rates Rankle With Businesses After Ni Budget

Introduction To Business Rates South Ribble Borough Council

Introduction To Business Rates South Ribble Borough Council

How To Qualify For Small Business Rate Relief Rating Walls

Introduction To Business Rates South Ribble Borough Council

Introduction To Business Rates South Ribble Borough Council

How To Qualify For Small Business Rate Relief Rating Walls

How To Qualify For Small Business Rate Relief Rating Walls

Sofi Review Student Loan Refinancing And More Refinance Student Loans Student Loans Paying Off Student Loans

Sofi Review Student Loan Refinancing And More Refinance Student Loans Student Loans Paying Off Student Loans

How To Qualify For Small Business Rate Relief Rating Walls

Are Business Rates Fair Look Out For The Staircase Tax Insights Uhy Hacker Young

Are Business Rates Fair Look Out For The Staircase Tax Insights Uhy Hacker Young

Https Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 883666 Nndr1 2020 21 Stats Release 6 May 2020 Update Note Pdf

Covid 19 Grants And Business Rates Support

Covid 19 Grants And Business Rates Support

How To Qualify For Small Business Rate Relief Rating Walls

How To Qualify For Small Business Rate Relief Rating Walls