What Is A Payroll Register And What Is It Used For

As a business function it involves. You print the register after processing the payroll for each pay period.

Weekly Employee Payroll Record Google Search Payroll Template Payroll Sign In Sheet Template

Preliminary payroll register the key document used to locate errors Sorted list of wages paid focus on excessively high or low wage amounts to spot potentially inaccurate hours worked or wage rates Trend line of payroll expense by department can indicate wages being charged to.

What is a payroll register and what is it used for. Payroll is a list of employees who get paid by the company. You can think of it as a summary of all the payroll activity during a period. For example if you elect to use the twelve weeks beginning February 15 2019 and your Total SBA Payroll Cost is 216000 for that period.

Government contractors submit federal Form WH-347 weekly to the agency overseeing the government contract. In other words a payroll register is the document that records all of the details about employees payroll during a period. A payroll register is.

Which column exists in the employees earnings records but not in the payroll register. Developing organization pay policy including flexible benefits leave encashment policy etc. They can help assure filing deadlines and deposit requirements are met and greatly streamline business operations.

The detail included in a register for payroll makes it possible to confirm how gross salary and wages are calculated the types of deductions that are made for each employee on the payroll and the amount of each deduction. The register lets you access. A payroll register is a record of all pay details for employees during a specific pay period.

A payroll register is the record for a pay period that lists employee hours worked gross pay net pay deductions and payroll date. A payroll register is a spreadsheet that lists the total information from each payroll. The form lists every employee their wages their benefits the type of work they did and the hours they worked.

PAYE is HM Revenue and Customs HMRC system to collect Income Tax and National Insurance from employment. Pay Payroll checks with stubs is An immediate document which has selected layouts of pay stubs wherever the person can edit so as to use it by need. Total gross pay the total of each type of deduction and total net pay are set out in a payroll register.

Then i divide 216000 by 12 18000 this is the average weekly SBA Payroll Cost. The calculations for each individual employee for total gross pay withholding and deduction amounts and total net pay are set out in an employee earnings record and the totals from all employee. Employers Outsourcing Payroll Responsibilities Many employers outsource some of their payroll and related tax duties to third-party payroll service providers.

The payroll register lists information about each employee for things such as gross pay net pay and deductions. Under the Paycheck Protection Program PPP small business owners can apply for approximately 25x their average qualified monthly payroll expenses up to 10 million to be used for eligible payroll costs and other certain operating costs including rent mortgage interest and utilities. A spend stub is often a sort of evidence of salary or payment for your employee.

Certified payroll is a federal payroll report. Defining payslip components like basic variable pay HRA and LTA. Payroll also refers to the total amount of money employer pays to the employees.

What is the connection between the employees earnings records and payroll tax reporting. Record the following expenses in your payroll account. You do not need to register for PAYE if none of your employees are paid 120 or more a.

Payroll accounting is the recording of all payroll transactions in your books. And then multiply 18000 by 433 77940 ie the new monthly Average Payroll Cost. Payroll registers are hard copy or electronic documents that record all the deductions connected with a specific payroll period.

A payroll register is a breakdown of each employees wages and deductions for the pay period. The primary journal entry for payroll is the summary-level entry that is compiled from the payroll register and which is recorded in either the payroll journal or the general ledger. As a business owner you use payroll journal entries to record payroll expenses in your books.

The register also lists the totals for all employees combined during the period. Employees earnings records contain details of payroll tax reporting and may be considered as source documents. This entry usually includes debits for the direct labor expense salaries and.

Payroll journal entries fall under the payroll account and are part of your general ledger.

Self Employment Ledger Forms Beautiful Printable Payroll Ledger Payroll Template Bookkeeping Templates Payroll

Weekly Employee Payroll Form Google Search Time Sheet Printable Payroll Template Payroll

Browse Our Sample Of Employee Payroll Ledger Template For Free Payroll Payroll Template Good Essay

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Wage Payroll Payroll Template Office Templates

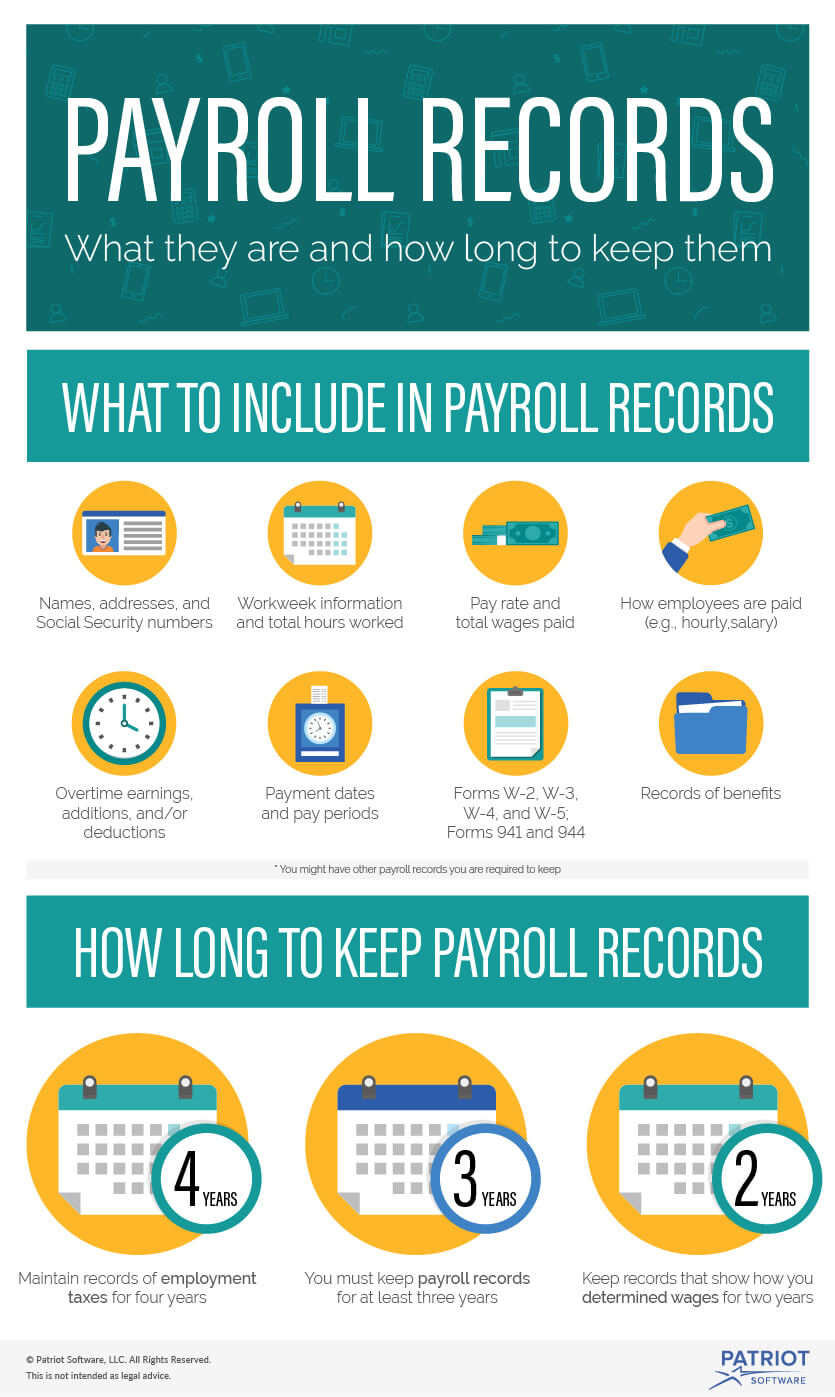

How Long To Keep Payroll Records Retention Requirements

Download Salary Sheet With Attendance Register In Single Excel Template Exceldatapro Attendance Register Salary Budget Spreadsheet Template

Download Salary Sheet With Attendance Register In Single Excel Template Exceldatapro Attendance Register Salary Excel Templates

Get Our Sample Of Employee Payroll Register Template For Free Payroll Template Payroll Spreadsheet Template

13 Free Salary Check Templates Professional Designs In Word Excel Pdf Payroll Template Payroll Payroll Software

Image For Item 23 100 Employee Payroll Record 25 Pack Payroll Binder Organization Payroll Template

Free Payroll Template For Excel Payroll Template Payroll Bookkeeping Templates

Image Result For Employee Payroll Ledger Template Payroll Template Payroll Templates

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Worksheet Template

Payroll Reconciliation Excel Template Inspirational 5 Sample Payroll Register Business Template Example In 2021 Payroll Template Business Template Payroll

What Should I Include In My Employee Payroll Records

Payroll Reconciliation Excel Template Inspirational 5 Sample Payroll Register Business Template Example In 2021 Excel Templates Business Template Reconciliation

Weekly Employee Payroll Record Google Search Payroll Templates Records

Image Result For Employee Payroll Ledger Template Payroll Template Payroll Payroll Checks