Are Covid Small Business Grants Taxable

COVID-19 Economic Injury Disaster Loan. Criteria are slightly different across England Northern Ireland Scotland and Wales.

Small Business Resiliency Fund Coronavirus

Small Business Resiliency Fund Coronavirus

Coronavirus Relief Fund CRF Payments from Local Governments.

Are covid small business grants taxable. Like most things in the world of taxes it depends. In addition recent legislation provides for the ability to deduct business expenses paid with forgiven PPP loans and other COVID-related loans and grants. Nearly half of self-employed workers are not aware that COVID-19 grants should be declared in future tax returns.

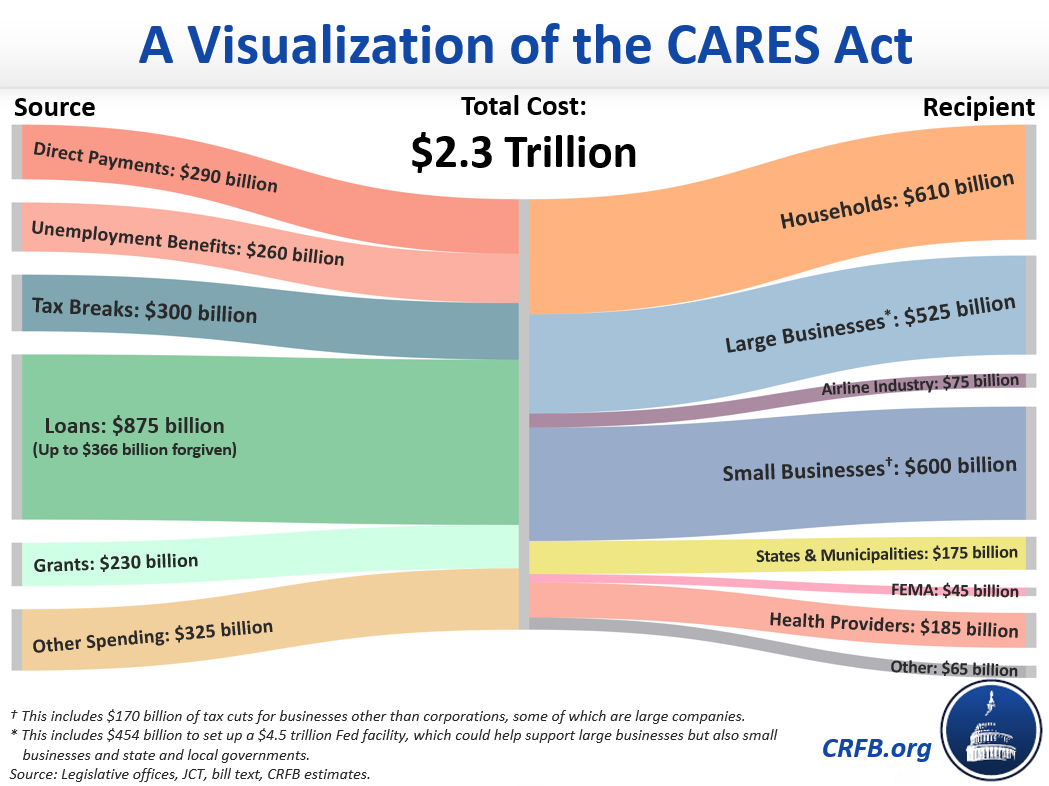

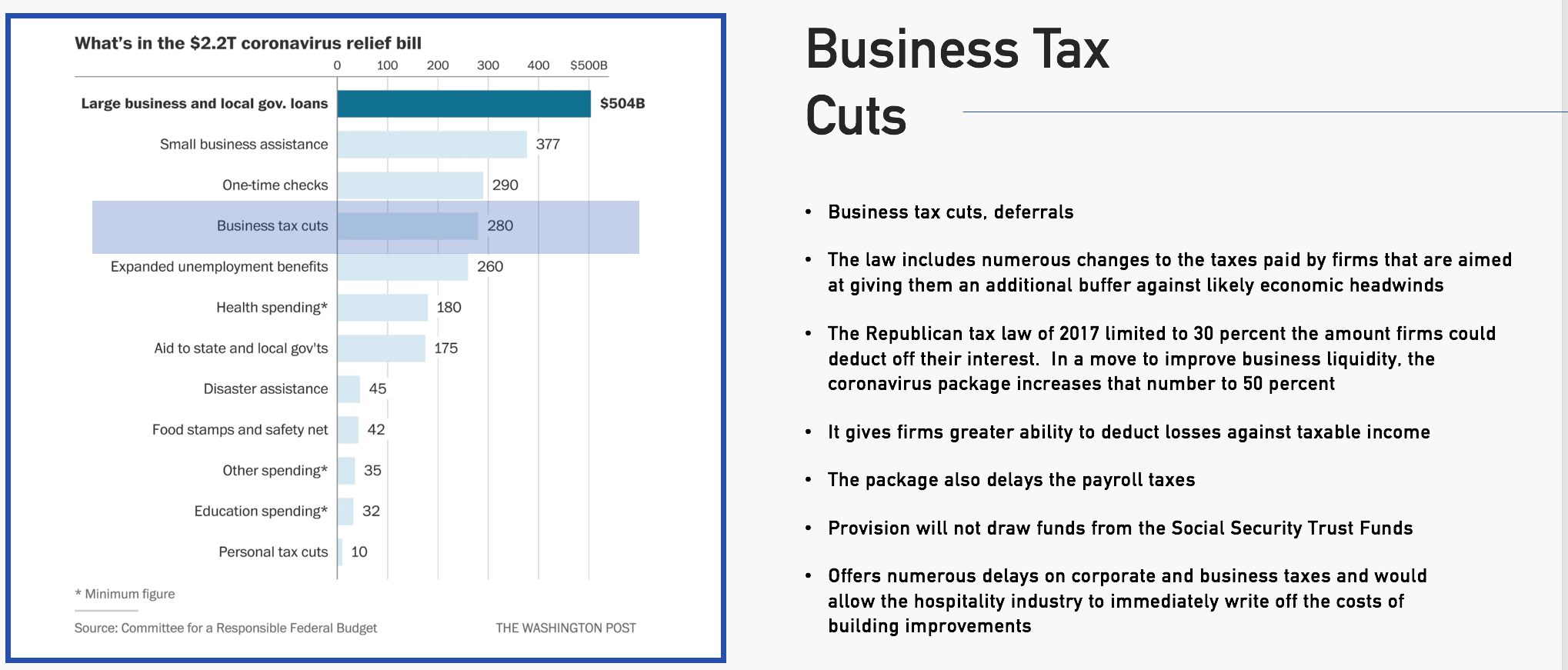

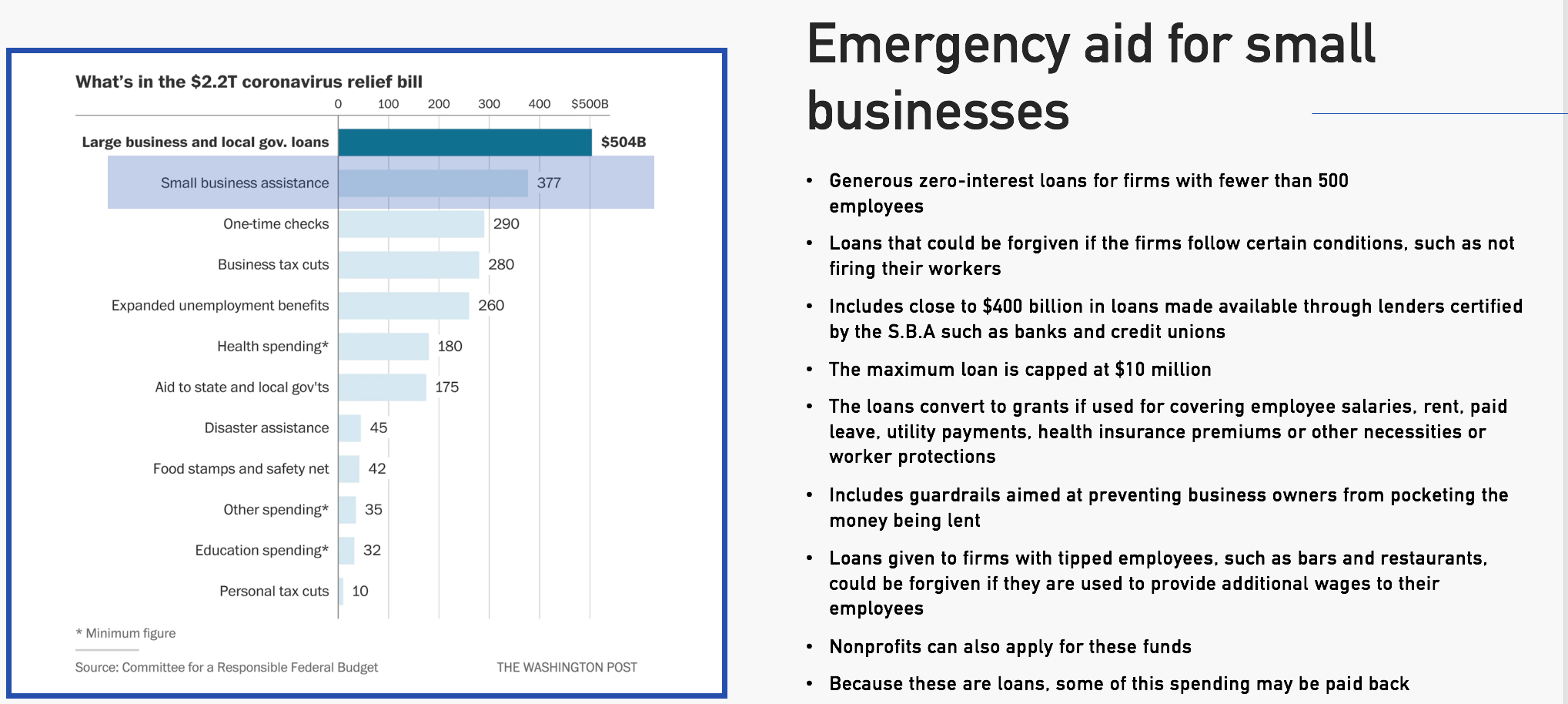

The 19 trillion COVID-19 relief bill signed March 11 by President Joe Biden provides billions of dollars in relief for individuals families and small businesses through forgivable low-interest loans tax credits emergency grants extended unemployment benefits and other assistance including direct stimulus payments to eligible adults and their dependents. Business support grant funding - guidance for local authorities Guidance for local authorities setting out details of the Small Business Grants Fund SBGF and Retail. In response to the coronavirus pandemic HHS is awarding emergency grants and cooperative agreements funded under the Coronavirus Aid Relief and Economic Security CARES Act 2020 PL.

116-123 Families First Coronavirus Response Act. A standard loan that must be repaid over a 30-year term or a cash advance that provided a 1000 grant. 2 days agoThe passage and signing of the American Rescue Plan Act in March kicked off another round of funding for COVID relief which includes several assistance programs for small businesses.

Get information on coronavirus COVID-19 tax relief for businesses and tax-exempt entities. This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue. This program is administered by the state Department of Employment and Economic Development.

To fully understand your eligibility for tax credits and deductions we recommend speaking with one of our Block Advisors small business certified tax pros to help you. 1 day agoGrants for qualifying businesses will be awarded at one funding level of 5000. Coronavirus Funding and Awards Data.

The expanded EIDL program includes two different types of aid. Emergency financial support such as the Self-Employment. Are these grants taxable.

Grant income is likely to be considered income for income or corporation tax purposes. The DOR is in the process of determining which businesses will be eligible for the payments but the following are some basic guidelines and answers. Coronavirus Preparedness and Response Supplemental Appropriations Act 2020 PL.

What Is a Grant. The grants are aimed at small businesses who are registered to pay business rates. How will EIDL loans and grants be treated for tax purposes.

Any links to that information. 2 days agoNew Jersey small businesses and non-profit groups crushed by the coronavirus pandemic are now eligible for 15 million in federal grants under a. Generally there are no federal income tax exclusions that apply to businesses for reimbursement of expenses that occur in the regular course of business.

Facebook Small Business Grants Program for Black-Owned Businesses -The grants program is a part of Facebooks overall commitment to invest 100 million this year in the Black community. To be eligible businesses must be a for-profit business based in Rhode Island have less than 1 million in gross receipts in the 2020 tax year and have received less than 25000 in state COVID-related financial assistance to date. In an effort to stave off economic devastation caused by the COVID-19 pandemic billions of dollars in grants are being handed out to individuals and businesses by the federal government and by state and local governments as well.

Recent legislation created the Mississippi COVID 19 Relief Payment Fund in order to assist Mississippi small businesses affected during this time. Some businesses took out Economic Injury Disaster Loan EIDLs from the Small Business Administration in order to help pay expenses during COVID-19 disruptions. Funded by the federal Coronavirus Aid Relief and Economic Security CARES Act the Were All In Small Business Grant Phase 2 program will provide grants to Wisconsin small businesses to assist with the costs of business interruption or for health and safety improvements wages and salaries rent mortgages and inventory.

Employee Retention Credit Available for Many Businesses Financially Impacted by COVID-19 The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees after March 12 2020 and before January 1 2021. So we know that the direct grants of up to 2500 per month for three months to the self employed are taxable - but has anybody found any utterances regarding the COVID-19 Small Business Grant Scheme assistance by grant to Business Rates payers taxable. Is COVID-19 Small Business Grant Scheme taxable.

Are Business Grants Taxable Everything You Need To Know

Are Business Grants Taxable Everything You Need To Know

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Https Covid Sd Gov Docs Smallbusinessfaqs Pdf

Https Coronavirus Nebraska Gov Assets Programfrequentlyaskedquestions Pdf

Us States Small Business Support Amid The Coronavirus Pandemic Best Accounting Software

Us States Small Business Support Amid The Coronavirus Pandemic Best Accounting Software

Https Covid Sd Gov Docs Smallbusinessfaqs Pdf

Is Covid 19 Financial Relief Taxable

Is Covid 19 Financial Relief Taxable

Covid 19 Related Government Grants Taxable Or Not

Covid 19 Related Government Grants Taxable Or Not

Are Covid 19 Local Authority Business Grants Taxable Income Whyatt Accountancy

Are Covid 19 Local Authority Business Grants Taxable Income Whyatt Accountancy

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Https Covid Sd Gov Docs Sdsmallbusiness Round2 Faqsv1 1 Pdf

New Jersey Economic Development Authority Grant Packages Njbia New Jersey Business Industry Association

New Jersey Economic Development Authority Grant Packages Njbia New Jersey Business Industry Association