Are Grants Taxable Income To A Business

In most instances grant funds are counted as taxable income on your federal tax return. In an effort to stave off economic devastation caused by the COVID-19 pandemic billions of dollars in grants are being handed out to individuals and businesses by the federal government and by state and local governments as well.

Understanding Section 179 Tax Deduction For Small Business Infographic Tax Deductions Small Business Infographic Finance Infographic

Understanding Section 179 Tax Deduction For Small Business Infographic Tax Deductions Small Business Infographic Finance Infographic

As explained below need-based grants to households likely fall under the general welfare exclusion and are therefore not taxable whereas grants to small businesses are likely not covered by this exclusion and would be taxable.

Are grants taxable income to a business. Government grants are taxable income to the recipient unless the tax law makes an exception. As a general rule of thumb you should expect that the majority of grants. But Congress has acted to make a few types of COVID-19-related government grants tax-free as described below.

The financial impact of a grant in tax time depends on several factors including your business structure. Do not report NJEDA grant or credit income on a New Jersey Gross Income Tax or Corporation Business Tax return. This simply entails that you will be expected to pay taxes on those funds.

Whether you record them as sales or other income in your accounts the grants are taxable income the tax treatment of such payments is well established so the Government isnt being unfair in any way by classing such payments as taxable. In most instances grant funds are considered a taxable income on your federal tax return. This means that you will be required to pay taxes on these funds.

Taxpayers are taxed on their gross income. NJEDA grants and tax credits are not subject to tax under the New Jersey Gross Income Tax Act and the Corporation Business Tax Act. As a rule government grants to help individuals after a disaster such as the COVID-19 pandemic are not taxable income under the general welfare exclusion.

There are a few exceptions but each grant will have its own set of requirements. But grants to businesses do. That makes it regular taxable income reported as usual as business income.

SBGF and RHLGF grants are classed as business income and should be recorded in your accounts as such. If the Taxable Grant was reported under the name and federal ID number for your business then you should report it as Other Income. The financial impact of a grant come tax time depends on multiple factors including your business structure.

The IRS has made clear that these state and local grants to businesses are taxable income. New LawsCOVID-19-Related Government Grants. Heres why this thinking is wrong.

You must report as income on IRS Form Schedule C any grant you receive. Generally though they should be taxable to businesses. Always make sure to read through the grant agreement or ask the funding organization for specifics.

Thus for example pandemic rental assistance is not taxable income. Grants to households ie individuals are taxed differently than grants to small businesses. The income would be offset by the appropriate and specific costs incurred for the narrow purposes of these grants.

State and local grants to businesses funded outside the CARES Act are also taxable income to the businesses. Businesses must have no more than 300 employees and must have experienced an economic loss of more than 30 determined by comparing gross receipts from specific periods. Even though grants are taxable income.

COVID-19-related grants to individuals are tax-free under the general welfare exclusion. Grants of up to 10000 are available to business owners in communities designated as low-income by the Internal Revenue Code. The answer is always yes.

Business grants are usually considered taxable income. Unfortunately when some family child care providers hear that they will have to report the grant as income they are reluctant to apply for it. State and local grants to businesses funded outside the CARES Act are also taxable income to the businesses.

EIDL Emergency Advances Are Tax-Free. The IRS has made clear that these state and local grants to businesses are taxable income. However nonresident aliens based on the Internal Revenue Code Section 117 must report those through Forms 1042 and 1042-S.

Where do I enter a taxable grant reported on 1099-G as business and not as private income so that self-employment tax is paid on this grant. Research your local laws and federal requirements for the type of grant and whether or not it is taxable. Business grants are exempted from tax under allowable conditions since business owners contribute to the improvement of the countrys economy.

Then enter a description SBIR Grant reported on 1099-G and the amount. COVID-19-related grants to businesses do not qualify as tax-free under the general welfare exclusion and are generally taxable including state and local grants made under the CARES Act Coronavirus Relief Fund. Grants for Shuttered Venue Operators Are Tax-Free.

Unfortunately this doesnt hold true for most business grants. Its supposed to cover extraordinary costs incurred to respond to the pandemic for that business to reduce the impact to that business. The receipt of a government grant by a business generally is not excluded from the businesss gross income under the Code and therefore is taxable.

You can enter it under your Business income in Other Income.

Top 10 Legal Blunders Every Startup Needs To Avoid In India Start Up Startup Mistakes Blunder

Top 10 Legal Blunders Every Startup Needs To Avoid In India Start Up Startup Mistakes Blunder

How To Catch Up On Your Bookkeeping For Etsy Sellers Small Business Finance Bookkeeping Starting An Etsy Business

How To Catch Up On Your Bookkeeping For Etsy Sellers Small Business Finance Bookkeeping Starting An Etsy Business

Is Child Support Considered Taxable Income Single Mom Money Single Mom Budget Health Insurance Plans

Is Child Support Considered Taxable Income Single Mom Money Single Mom Budget Health Insurance Plans

Write It Off Deduct It The A To Z Guide To Tax Deductions For Home Based Businesses Home Based Business Tax Deductions Business Tax

Write It Off Deduct It The A To Z Guide To Tax Deductions For Home Based Businesses Home Based Business Tax Deductions Business Tax

Learn How You Can Become Eligible For A Tax Refund Use Befiler Tax Facts To Get Your Numbers Right Tax Refund Filing Taxes Tax Services

Learn How You Can Become Eligible For A Tax Refund Use Befiler Tax Facts To Get Your Numbers Right Tax Refund Filing Taxes Tax Services

Tax Credits And Deductions For Parents Of College Students Grants For College College Parents Tax Credits

Tax Credits And Deductions For Parents Of College Students Grants For College College Parents Tax Credits

Scholarships Taxes How To Not Create Taxable Income To The Scholarship Recipient The University Network Scholarships Digital Marketing Guide Scholarships For College

Scholarships Taxes How To Not Create Taxable Income To The Scholarship Recipient The University Network Scholarships Digital Marketing Guide Scholarships For College

Scholarship And Grants Are All Taxable Yes You Heard Right Whenever We Qualify For A Scholarship We Become Delight Scholarships Payroll Taxes Paying Taxes

Scholarship And Grants Are All Taxable Yes You Heard Right Whenever We Qualify For A Scholarship We Become Delight Scholarships Payroll Taxes Paying Taxes

Tax Write Off For Small Business Owners Business Tax Small Business Tax Small Business Owner

Tax Write Off For Small Business Owners Business Tax Small Business Tax Small Business Owner

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Are Student Loans Taxable Income Student Loan Planner Student Loans Paying Off Student Loans Student Loan Forgiveness

Are Student Loans Taxable Income Student Loan Planner Student Loans Paying Off Student Loans Student Loan Forgiveness

12 Types Of Income You Must Pay Taxes On And 5 The Irs Can T Touch Irs Paying Taxes Business Grants

12 Types Of Income You Must Pay Taxes On And 5 The Irs Can T Touch Irs Paying Taxes Business Grants

11 Simple Ways To Lower Income Tax Better Prepare Earlier Than Later Money Habits Money Saving Tips Smart Money

11 Simple Ways To Lower Income Tax Better Prepare Earlier Than Later Money Habits Money Saving Tips Smart Money

Irs 501 C Subsection Codes For Tax Exempt Organizations Harbor Compliance Irs Nonprofit Startup Federal Income Tax

Irs 501 C Subsection Codes For Tax Exempt Organizations Harbor Compliance Irs Nonprofit Startup Federal Income Tax

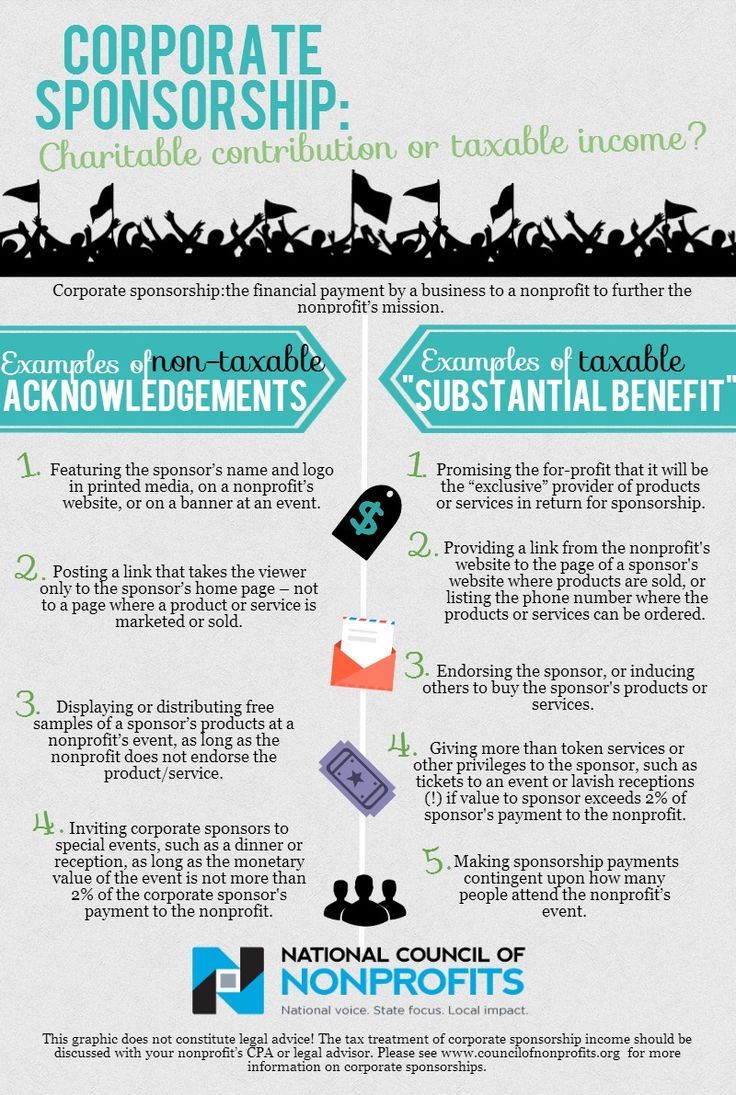

Corporate Sponsorship Charitable Contribution Or Taxable Income Sponsorship Nonprofit Cha Sponsorship Proposal Charitable Contributions Sponsorship Levels

Corporate Sponsorship Charitable Contribution Or Taxable Income Sponsorship Nonprofit Cha Sponsorship Proposal Charitable Contributions Sponsorship Levels

Accounting Financial Statements Tax Credits Financial Statement Debt Resolution

Accounting Financial Statements Tax Credits Financial Statement Debt Resolution

Tax Facts Education Grants Education Education Reform

Tax Facts Education Grants Education Education Reform