Can 1099 Employee Get Ppp

As youre calculating your payroll costs you cant include contractors because contractors are their own entity and may apply for a PPP loan on their own. Why Does the Application Ask If You Have 1099 Employees If You Cant Include Them.

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto In 2021 Tax Forms Federal Income Tax Tax Season

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto In 2021 Tax Forms Federal Income Tax Tax Season

Yes 1099 employees are eligible for the Paycheck Protection Program.

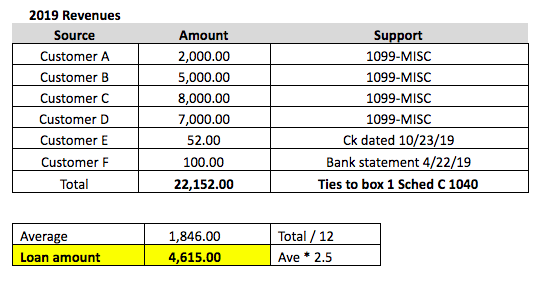

Can 1099 employee get ppp. Independent contractors who collect 1099-MISC forms but for the PPP youll need to submit a Schedule C not your 1099s. With your Paycheck Protection Program loan application you can only include payroll costs for employees who receive W-2s. Essentially 1099 employees are supposed to apply for PPP loans on their own.

Contract workers gig workers sole proprietors and self-employed people can qualify for up to 50000 in forgivable PPP loans. Small businesses and solopreneurs are able to begin applying for PPP loans today Friday April 3. Gig workers you can now qualify for more money from a Paycheck Protection Program PPP loan.

Independent contractors and self-employed individuals that have been adversely impacted by the COVID-19 pandemic have been eligible to apply for these loans since April 10 2020. Millions of American workers are eligible for up to 50000 in FREE MONEY. Your boss can apply for PPP because he has employees you and you can separately get your own PPP based on your 1099self-employed earnings.

Yes that means that instead of receiving a maximum of 2083333 you can get a maximum of 4166666. You work for a company as an employee and get a W2 tax form for employees and separately work via a 1099 or are otherwise Self-Employed. Independent contractors--who file their taxes using 1099 forms-.

He told me yes so not sure hes just giving me lip service bc funds ran out or if its true. Yes if you had ANY 1099 or other self-employed income in 2019 or 2020 you should definitely apply for a PPP loan. 1099 employees are considered their own businesses under the PPP.

We built Fast Lane as a simple 5 minute process to help you get your PPP application submitted ASAP. Gig economy workers who take on-call jobs provided by companies such as Uber DoorDash Lyft TaskRabbit and Instacart. You started working on a 1099 late in 2019 or early 2020.

No 1099 employees should not be included in a small businesss payroll calculations for their PPP loans. Paying workers with a 1099 is NOT having employees. Frequently asked questions Whats the biggest loan I can get.

For sole proprietors or independent contractors with no employees the maximum possible PPP loan is therefore 20833 and the entire amount is automatically eligible for forgiveness as owner compensation share. For other business types and for everything else you need to know about PPP see our PPP Resource Center. The requirements are straightforward.

In fact according to PPP rules businesses are supposed to leave 1099 employees out of their payroll expenses entirely. What does that mean. You can have a Limited Liability.

Boa called me today and I asked the rep if I qualify because all my workers are 1099. You own a company that applied for PPP and have a Schedule C for which you are also applying for PPP. Didnt see a penny out of ppp.

As of April 10 2020 1099 employees are eligible to apply for their own PPP loan. Any amounts that an applicant has paid to an independent contractor or sole proprietor should be excluded from the eligible business payroll costs. The only stipulation is that your business was operational as of February 15 2020.

The PPP limits compensation to an annualized salary of 100000. Your boss can apply for PPP because he has employees you and you can separately get your own PPP based on your 1099self-employed earnings. Owners may not receive more than 20833 in owner compensation paid via PPP funds across all entities.

Heres how to apply with Womply. You must provide the 2019 or 2020 whichever you used to calculate your loan amount IRS Form 1040 Schedule C with your PPP loan application to substantiate the applied-for PPP loan amount and a 2019 or 2020 whichever you used to calculate your loan amount IRS Form 1099-MISC detailing nonemployee compensation received box 7 invoice bank statement or book of record that. Start your free PPP application now.

But someone on this subreddit said he got approved for 1099 employees. This article is for self-employed people and those who work on a 1099. Receiving other forms of income eg from an employer or passive income source or investments does not disqualify you from getting a PPP loan.

You may be eligible to receive PPP twice. The Paycheck Protection Program PPP allows lenders to offer low-interest loans that may be 100 forgiven in certain circumstances. It is important to note that the independent contractor 1099 and or the sole proprietor can be eligible themselves for a PPP loan if.

If you did have employees you would issue W2s and pay employment taxes and Workers Compensation Insurance.

How To Apply For The 1099 Ppp Loan

How To Apply For The 1099 Ppp Loan

How To Get Ppp Loans If You Re Self Employed Austin Business Journal

Self Employment 1099s And The Paycheck Protection Program Bench Accounting Self Employment Paycheck Payroll Taxes

Self Employment 1099s And The Paycheck Protection Program Bench Accounting Self Employment Paycheck Payroll Taxes

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

Ppp Loans For 1099 Independent Contractors Regent Bank

Ppp Loans For 1099 Independent Contractors Regent Bank

Paycheck Protection Program Ppp Tips For The Self Employed

Paycheck Protection Program Ppp Tips For The Self Employed

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

How To Apply For The 1099 Ppp Loan

How To Apply For The 1099 Ppp Loan

How To Apply For A Ppp Loan When Self Employed Divvy

How To Apply For A Ppp Loan When Self Employed Divvy

1099 Nec Tax Services Accounting Firms Accounting Services

1099 Nec Tax Services Accounting Firms Accounting Services

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting