Independent Contractor Self Employment Tax Rate

As an independent contractor youll have to pay 2 or 3 taxes depending on where you live. Self-employment tax FICA consists of your federal Social Security tax 124 and Medicare tax 29 for a total of 153.

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

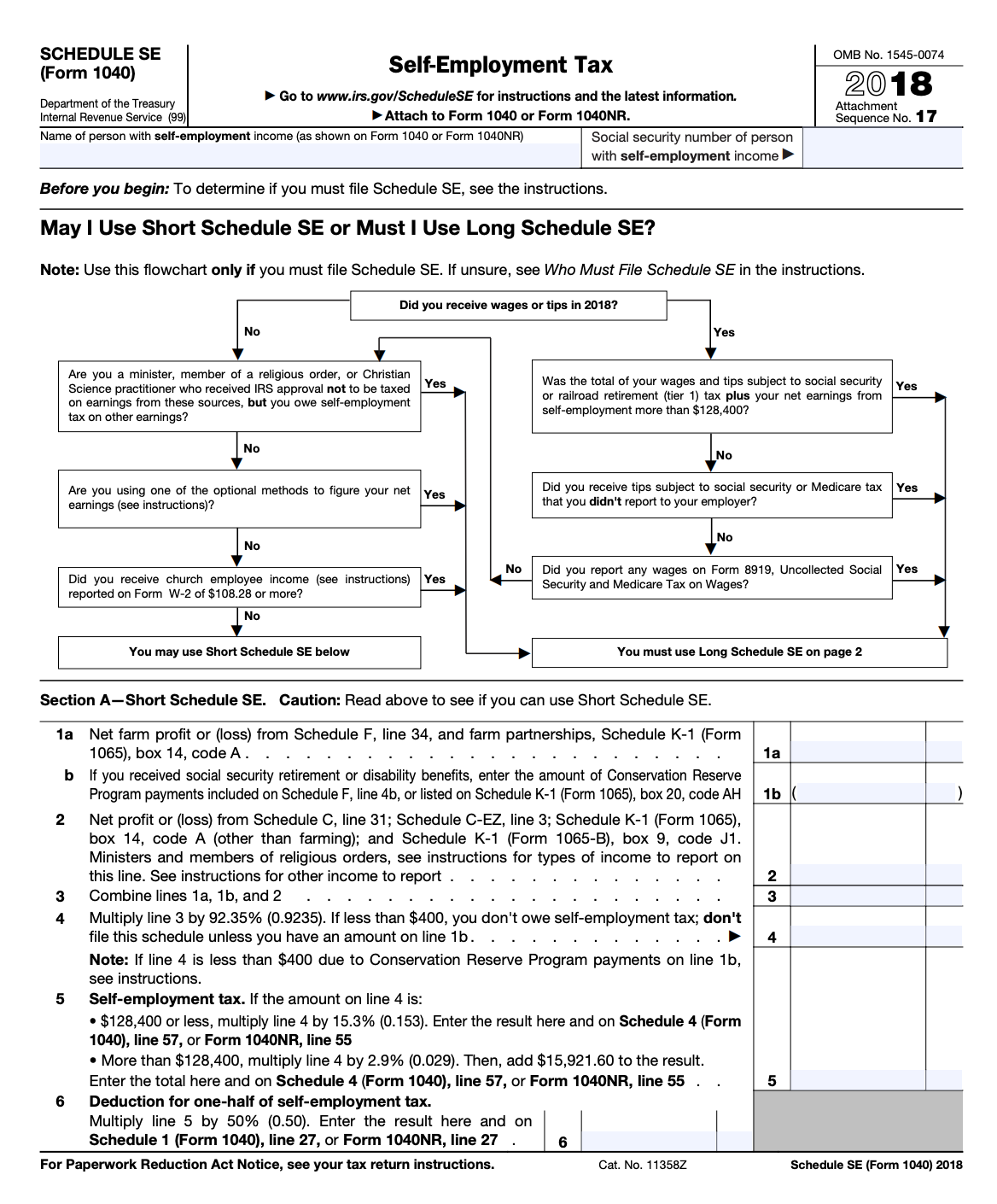

The result of the Schedule SE calculation shows they owe 254332 153 for self-employment tax.

Independent contractor self employment tax rate. The tax only applies to self-employed taxpayers whose income exceeds 250000 if married and filing jointly or 200000 if single. Half of this amount 127166 is deducted. You are a member of a partnership that carries on a trade or business A partnership is the relationship between two or more people or business entities who join to carry on a trade or business.

If you 1 are self-employed as a sole proprietorship an independent contractor or freelancer and 2 earn 400 or more you may need to pay SE tax. Once a taxpayers income exceeds the applicable threshold the effective Medicare tax rate is 38--the standard 29 rate plus an extra 09. Self-employment taxes total roughly 153 which includes Medicare and Social Security taxes.

If youre self-employed you use your individual IRD number to pay tax. The current rateis 153 on all income up to the social security maximum this rate increases every year. There is no maximum on Medicare tax.

Usually a self-employed person can start in business without following any formal or legal set up tasks. That rate is the sum of a 124 Social Security tax and a 29 Medicare tax on net earnings. When youre self-employed you need to pay self-employment tax which is 153 of your net business income as well as state and federal income tax.

If you worked as a contractor for a federal agency but were unable to work due to facility closures andor other restrictions you might be able to receive reimbursement. The self-employment tax rate is 29 Medicare only above the social security maximum. This federal tax is how independent contractors pay into Social Security and Medicare based on the level of income as a self-employed person.

Do I have to pay Self-Employment Tax. As noted the self-employment tax rate is 153 of net earnings. The self-employment tax rate is 153.

The self-employment tax is comprised of two taxes. Self-Employed Independent Contractors and Taxes. An additional 09 Medicare surtax applies to high-income earners.

The Medicare tax applies to all of your self-employment income no. Youll also have to pay self-employment tax which covers the amounts you owe for Social Security and Medicare taxes for the year. The IRS states that the self-employment tax 2019 rate is 153 percent on the first 132900 of net income plus 29 percent on the net income in excess of 132900.

You pay tax on net profit by filing an individual income return. Up to 10 cash back Self-employed individuals are responsible for paying both portions of the Social Security 124 and Medicare 29 taxes. Self-employment includes contracting working as a sole trader and small business owners.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. For 2020 the first 137700 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad. The Social Security tax and the Medicare tax.

The tax rate is 153 on net earnings up to 132900 for the year 2019 and 29 on net earnings above that threshold. Federal income tax self-employment tax and potentially state income tax. The IRS taxes 1099 contractors as self-employed.

Your income tax bracket determines how much you should save for income tax. They must also pay self-employment tax on 16623 935 of 18000 of their business income. For more information on employer-employee relationships refer to Chapter 2 of Publication 15 Circular E Employers Tax Guide Chapter 2 of Publication 15-A Employers Supplemental Tax Guide Independent Contractor Self-Employed or Employee.

As of the tax year 2018 the Social Security tax rate is 124 percent and the Medicare tax rate is 29 percent. They also pay both halves of FICA taxes which add up to 153. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

Ultimately for the self-employment tax 2019 youll have to pay both portions of employer and employee social security and Medicare which breaks down as follows. And Tax Topic 762 Independent Contractor vs. They get credit for this amount of Social Security benefits.

If you made more than 400 you need to pay self-employment tax. You can calculate your self-employment tax using Schedule SE on Form 1040. The self-employed pay federal state and local income taxes.

As of 2019 the self-employment tax rate is 153. The rate consists of two parts. What taxes are independent contractors subject to.

Learn about the Pandemic Unemployment Assistance PUA program and unemployment benefits for self employed taxpayers as a result of the second stimulus payment package.

How Much Should I Set Aside For Taxes 1099

How Much Should I Set Aside For Taxes 1099

What Is Self Employment Tax And What Are The Rates For 2020 Workest

What Is Self Employment Tax And What Are The Rates For 2020 Workest

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

Self Employed Vs Independent Contractor What S The Difference

Self Employed Vs Independent Contractor What S The Difference

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

An Independent Contractor S Guide To Taxes Smartasset

An Independent Contractor S Guide To Taxes Smartasset

Paying Self Employment Tax For The First Time Credit Karma

Paying Self Employment Tax For The First Time Credit Karma

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

Independent Contractor Taxes Guide 2021

Independent Contractor Taxes Guide 2021

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Self Employed And Taxes Deductions For Health Retirement

Self Employed And Taxes Deductions For Health Retirement

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips