How Do I File An Extension For My Llc Taxes

When you request partnership extension your LLC will get an automatic five-month extension to file Form 1065. You can file an extension application online or through your business tax software or your tax preparer.

Tick Tock Goes The Clock 19 More Days Until The Irs Tax Extension Deadline Is Here Call Providence For Help Not Much Ti Irs Taxes Tax Services Tax Extension

Tick Tock Goes The Clock 19 More Days Until The Irs Tax Extension Deadline Is Here Call Providence For Help Not Much Ti Irs Taxes Tax Services Tax Extension

You cannot file your 2020 tax return by May 15 2021.

How do i file an extension for my llc taxes. You automatically have until October 15 to file before we charge a late filing penalty. Filing Taxes as an S Corporation. You do not have to submit a separate form requesting an extension to file.

File Limited Liability Company Return of Income Form 568 by the original return due date. You must file by the deadline to avoid a late filing penalty. An extension to file your tax return is not an extension to pay.

Form 41ES is for business income tax. If your LLC files on an extension refer to Payment for Automatic Extension for LLCs FTB 3537 Visit Limited Liability Company Tax Booklet 568 Booklet for more information. Your choice will directly influence the tax filing rules you are subject to.

We will notify you only if your extension request is denied. The due date for a calendar-year partnerships 2020 return is March 15 2021. Corporation Income Tax Return.

To file for an LLC extension file Form 7004. This extension is for filing only. For taxpayers following the calendar year the due date falls on April month 15th.

To file an automatic extension of time for corporations S corporations partnerships and multiple-member limited liability companies filing as partnerships use Form 7004. Filing this form gives you until Oct. Information on e-filing Form 7004 Information about Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns including recent updates related forms and instructions on how to file.

Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. Income Tax Return for an S. E-file Your Extension Form for Free.

If you think you may need more time to prepare your return you should file for an extension using Form 7004. Businesses calculate the quarterly income tax liability by utilizing form 1120-W. As a C corporation you must file US.

Use Payment for Automatic Extension for Individuals FTB 3519 to make a payment by mail if both of the following apply. The due dates for estimated income tax fall on the following dates. Once you have made this election file US.

You must file your extension request no later than the regular due date of your return. Both can be e-filed or mailed to the IRS though you can obtain the 4868 LLC tax extension by paying your estimated tax bill with a credit or debit card. If you operate your business using a limited liability company LLC then you have more flexibility in choosing how the IRS taxes your business earnings.

However extensions dont give you. This form requires you to estimate the amount of taxes you will owe. A multi-member LLC elected as C-Corp must file Form 1120 by the 15th day of the fourth month after the tax period ends.

Application for Automatic Extension of Time to File Certain Business Income Tax Information and Other Returns. Estimated income tax deadline 2021. If your LLC has designated itself as a corporation you can choose to become an S corporation which you do by filing Election By a Small Business Corporation.

Multi-Member LLC taxed as C-Corporation. Use Form 7004 to request an automatic 6-month extension of time to file certain business income tax information and other returns. To get the extension you must estimate your tax liability on this form and should also pay any amount due.

If you need to make a payment you can mail the form at the bottom of the worksheet with your check. 15 to file a return. For a partnership Form 1065 is submitted instead of Form 1120S.

The IRS allows the LLC to use partnership corporate or sole proprietor tax rules. There is no set of tax rules that specifically apply to LLCs. Income Tax Return for C corporation Form 1120 with fiscal tax years ending June 30 is due by the 15th day of the 3rd month after the end of the entitys tax year that is September 15 2021.

An extension to file cannot exceed 6 months and does not extend the date for paying the tax. You can also get an extension by paying all or part of your estimated income tax due and indicating that the payment is for an extension using Direct Pay the Electronic Federal Tax Payment System EFTPS or a credit or debit card. You must mail Form IT-303 before the statutory return due date and attach a copy to the return when filed.

The deadline is October 15 2021. IRS Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns gives you an automatic extension to file your corporation S corporation partnership trust or estate return. The due date for your partnership return will be extended until September 15 2021.

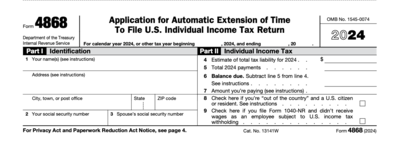

To avoid other penalties and interest you must pay any tax owed by the regular due date and file. Form 4868 filing helps in an automatic extension of six months. Form 51 is for individual income tax.

You may need to file a federal tax return extension for many reasons including delays in receiving tax statements living in another countryor you simply need more time getting organized. If they couldnt file by the due date an extension of time has to be sought by filing. We have two worksheets to help you make sure you have a valid extension to file late.

After you finish the worksheet do one of the following. Pay the amount you owe by May 15 to avoid penalties and interest.

How To Apply For A Tax Extension For An S Corporation Legalzoom Com

How To Apply For A Tax Extension For An S Corporation Legalzoom Com

File Llc Tax Extension Form Online Single Multi Member Llc Extension

File Llc Tax Extension Form Online Single Multi Member Llc Extension

Tax Information Center Tax Tips H R Block Filing Taxes Income Tax Tax Day

Tax Information Center Tax Tips H R Block Filing Taxes Income Tax Tax Day

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

Extension Filers Deadline Approaches Taxes Humor Tax Return Filer

Extension Filers Deadline Approaches Taxes Humor Tax Return Filer

Does My Llc Need To File A Tax Return Even If It Had No Activity Filing Taxes Tax Return Tax Deductions List

Does My Llc Need To File A Tax Return Even If It Had No Activity Filing Taxes Tax Return Tax Deductions List

Tick Tock Goes The Clock You Ve Had Your Time To Procrastinate Now It S Time To Get To Work The Tax Extension Deadline Tax Services Tax Extension Tax Prep

Tick Tock Goes The Clock You Ve Had Your Time To Procrastinate Now It S Time To Get To Work The Tax Extension Deadline Tax Services Tax Extension Tax Prep

Tax Forms Directory Comprehensive Irs Tax Forms Guide Irs Taxes Irs Tax Forms Business Tax Deductions

Tax Forms Directory Comprehensive Irs Tax Forms Guide Irs Taxes Irs Tax Forms Business Tax Deductions

What You Need To Know About The 2020 Tax Deadline Extension In 2020 Tax Deadline Small Business Accounting Business Bank Account

What You Need To Know About The 2020 Tax Deadline Extension In 2020 Tax Deadline Small Business Accounting Business Bank Account

How Do I File A Business Tax Extension 2020 Forms And Tips

How Do I File A Business Tax Extension 2020 Forms And Tips

Need A Last Minute Bookkeeper If You Filed An Extension For Your Taxes Your S Corporation And Partnership Taxes Tax Extension Filing Taxes Income Tax Return

Need A Last Minute Bookkeeper If You Filed An Extension For Your Taxes Your S Corporation And Partnership Taxes Tax Extension Filing Taxes Income Tax Return

Not Ready To File How To Request A U S Tax Extension Based On Your Business Structure Freshbooks Blog

Not Ready To File How To Request A U S Tax Extension Based On Your Business Structure Freshbooks Blog

Panicked About Tax Season Here S How To File For Extension In 2020

Panicked About Tax Season Here S How To File For Extension In 2020

How To File A Tax Extension A Complete Guide Infographic Tax Extension Filing Taxes Tax Help

How To File A Tax Extension A Complete Guide Infographic Tax Extension Filing Taxes Tax Help

E File An Irs Tax Extension E File Com

E File An Irs Tax Extension E File Com

How To File An Extension For Taxes Form 4868 H R Block

How To File An Extension For Taxes Form 4868 H R Block

Account Suspended Tax Extension Business Tax Tax Prep

Account Suspended Tax Extension Business Tax Tax Prep

How To E File Form 7004 Tax Extension For An Llc Youtube

How To E File Form 7004 Tax Extension For An Llc Youtube