Where To Send 1099 Misc Forms In California

When filing federal copies of forms 1099 with the IRS from the state of California the mailing address is. Just print it - put into envelope and send to FTB with certified mail.

Send A New Form 1099 Nec To The Ftb Windes

Send A New Form 1099 Nec To The Ftb Windes

California State Tax Forms By Mail.

Where to send 1099 misc forms in california. Order 1099 Forms From Irs By Mail. The IRS will forward your California returns to the FTB. The form is a summary of all the 1099-MISC forms youve filed.

When filing state copies of forms 1099 with California department of revenue the agency contact information is. IRS will send us original and corrected California information returns filed electronically. E-file Form 1099-NEC MISC INT DIV directly to the California State agency with TaxBandits.

You can access your Form 1099G information in your UI Online SM account. Instructions for Forms 1099-MISC and 1099-NEC Print Version PDF. Where Can I Buy Form 1099 Misc.

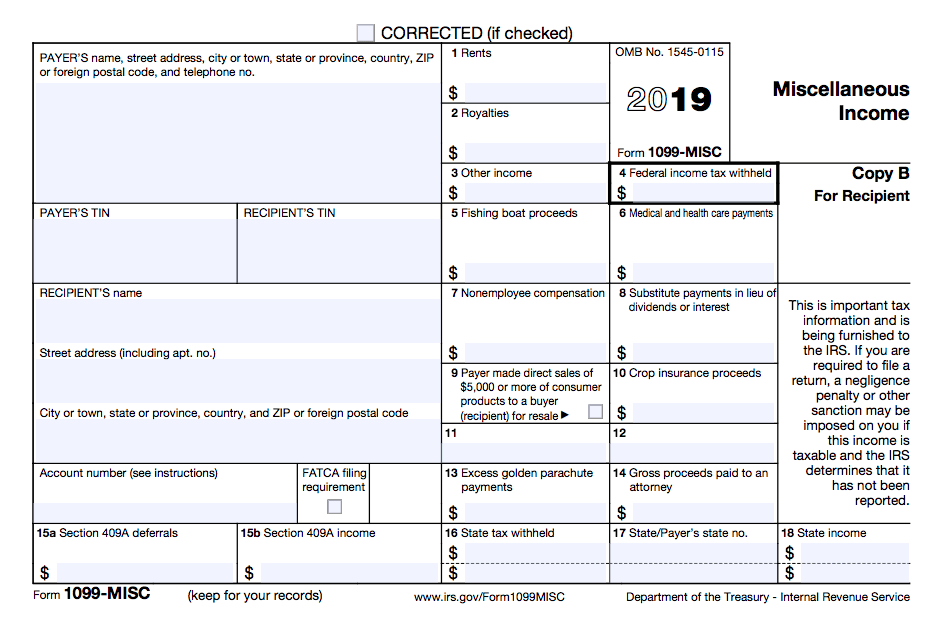

Instructions for Forms 1099-MISC and 1099-NEC 2020 Reportable payments to corporations. Form 1099-G Certain Government Payments. You may receive a 1099-MISC if you received at least 600 for.

1099-DIV 1099-G 1099-INT 1099-MISC 1099-OID 1099-PATR 1099-R and 5498. Department of the Treasury Internal Revenue Service Center Ogden UT 84201. Mail 1099-MISC forms to.

This income will be included in your federal adjusted gross income which you report to California. The IRS will not be sending copies of the new Form 1099-NEC Nonemployee Compensation to California or any other state. Where To Send 1099 Misc Forms In California.

Hello there Nickerz. In addition use Form 1099-MISC to report that you made direct sales of at least 5000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment. Only the following forms may be filed under this program.

Once you pay the independent contractor 600 or more OR enter into a contract for 600 or more then you have 20 days to report the independent contractor to the EDD. Irsgov Form 1099 Misc. Check the 1099 online reporting requirements for California and e-file in minutes.

Reportable payments to corporations. Irs Form 1099 Misc. You are not required to mail forms W-2 to the State of California.

You can mail it to the address listed on the instructions. Franchise Tax Board PO Box 942840 Sacramento CA 94240-6090. The IRS will continue to send all other Forms 1099 to the states As a result businesses must send copies of Form 1099-NEC directly to the FTB even if a copy was filed with the IRS.

Franchise Tax Board PO. The following forms may be filed under this program. Tax Form 1099 Misc.

This helps the department looking for parents who are behind on paying child support. Pacific time except on state holidays. If you e-file via the 1099 E-service your copies for the 1099.

No you do not need to buy official 1099-MISC forms to file with California FTB. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. If youve sent out 250 or more 1099-MISC forms you must submit your 1096 electronically.

You must complete and mail Form 1096 Annual Summary and Transmittal of information Returns to the IRS. Box 942840 Sacramento CA 94240-6090. Report the amount indicated on the form as income when you file your federal return.

What Is A 1099 Misc Tax Form. The IRS has introduced Form 1099-NEC for the 2020 tax year making a distinction between payments to non-employees and other types of miscellaneous payments a business might make. Form 1099-DIV Dividends and Distributions.

Visit your nearest Employment Tax Office. Form 1099-INT Interest Income. You can send both Form 1099s and 1096 to the state to comply with their requirements.

California 1099-NEC filing requirements. Form 1099-MISC Miscellaneous Income. You can print Copy 1 of your filed 1099-MISC these are downloadable on the page where you filed with QBO.

1099 Misc Tax Form Kit. Create your own form with all of the required information. NO Federal or California Income Taxes were wi.

In California you are required to report any 1099s to the Employment Development Department EDD. Call the Taxpayer Assistance Center at 1-888-745-3886 to obtain a form. It just separates payments made to non-employees onto this different form for reporting purposes.

The form doesnt replace Form 1099-MISC. Form 1099-OID Original Issue Discount. I have completed a Form 1099-MISC and provided a copy to the IRS and the Individual reporting Non-Employee compensation in Box 7 of 800.

We will mail you a paper Form 1099G if you.

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form 5 Part Carbonless Discount Tax Forms

1099 Misc Form 5 Part Carbonless Discount Tax Forms

1099 Misc Instructions And How To File Square

1099 Misc Instructions And How To File Square

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Misc Forms Set Discount Tax Forms

1099 Misc Forms Set Discount Tax Forms

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

What Is A 1099 Misc Form Financial Strategy Center

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

1099 Misc Form 1 Part E Filing Carbonless Form Discount Tax Forms

1099 Misc Form 1 Part E Filing Carbonless Form Discount Tax Forms