1099 For Sale Of Business Assets

This is the taxpayers only income for. Except for assets exchanged under the like-kind exchange rules both the buyer and seller of a business must use the residual method to allocate the sale price to each business asset sold.

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

A lender who acquires an interest in your property in a foreclosure or repossession should send you Form 1099-A showing the information you need to figure your gain or loss.

1099 for sale of business assets. Forms 1099-A and 1099-C. Must be received by contractors by January 31 of the following tax year. Then there is the matter of how a sale of business assets will be taxed as long-term capital gains or as ordinary income.

Ensure Form 1099-MISC is sent out timely to independent contractors that you paid 600 or more during the year. You can setup one service type item called business assets which points to an other income gl account called proceeds of asset sale Use this item on each line - and then manually add the correct description quantity and price for each item on the sales agreement - include any sales tax coding as per the sales agreement. Form 1099-S - Sale of Real Estate Property Report proceeds from real estate transactions on IRS Form 1099-S Proceeds From Real Estate Transactions.

Sale of your main home. IRS Form 8594 Asset Acquisition Statement Under Section 1060 can be used to provide this information. I will get a 1099-k because I sold about 25k and 300 transactions.

Attach one Form 1096 the transmittal form to all 1099s being filed with the IRS. Form 1099-S - Sale of Real Estate Property Form 1099-S Proceeds From Real Estate Transactions is used to report proceeds from real estate transactions. You could request a corrected 1099 from the company.

This method determines gain or loss from the transfer of each asset and the buyers basis in the assets. The gain or loss on each asset is figured separately. Alternatively if they wont.

If a taxpayer receives a Form 1099-B where gross proceeds exceed the gross income filing threshold must heshe file a federal tax return-EXAMPLE. Main home timesharevacation home investment property business or. Taxpayer receives Form 1099-B for 100k gross proceeds of a stock sale.

Yes - the 1099 is erroneous if it is for nonemployee compensation when in fact you were paid not for personal services but for the sale of a piece of property. Where this information is reported depends on the use of the property - main home timesharevacation home investment property business use or rental use. Reporting real estate for business or rental use.

Some for gains and some for loses. So I bought cards from 2015-2017 and needed money so I sold most of them. First to the IRS the sale of a business usually is not considered to be the sale of a single asset.

The fair market value of all the assets being sold as part of the package is 350000 including individual assets and the capital gain or loss on each minus the fair market value of liabilities at 100000 equals 50000. Does the 650 count as business income or personal and do I need to fill out a Schedule C. Do I need Business Turbo Tax.

Instead with few exceptions all the individual assets of the business are treated as if they were being sold separately. When sold these assets must be classified as capital assets depreciable property used in the business real property used in the business or property held for sale to customers such as inventory or stock in trade. I know what I bought them for and what I sold them for.

Also in a sale of stock the IRS does permit the buyer to elect to have the transaction treated as a purchase of assets ie buyer can get a step-up in basis for the assets if the buyer pays tax on the difference between each assets current basis and its fair market value in the year of the transfer. When a business is bought or sold both the buyer and seller of business assets must report to the IRS the allocation of the sales price and other business assets. If Form 1099-S was for the sale of business or rental property then its reportable on Form 4797 Sales of Business Property and Schedule D.

1099s are filed with the IRS. The 1099 probably should have reported the income as other income not a s nonemployee compensation. On smaller devices click in the upper left-hand corner then click Federal.

Where you report information on the form depends on how you use the property. From within your TaxAct return Online or Desktop click Federal. The sale of capital assets results in capital gain or loss.

You keep a copy for your records. The difference of 50000 is for goodwill and other intangible assets.

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Form Irs 1099 Misc 2013 Irs Forms Irs Form

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

What Is A C Corporation What You Need To Know About C Corps Gusto

What Is A C Corporation What You Need To Know About C Corps Gusto

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

The Small Business Accounting Checklist Infographic Small Business Finance Small Business Accounting Bookkeeping Business

The Small Business Accounting Checklist Infographic Small Business Finance Small Business Accounting Bookkeeping Business

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Cancellation Of Debt Form 1099 C What Is It Do You Need It

How To Sell Your Online Course On Pinterest Online Courses Pinterest Traffic Drive Website Traffic

How To Sell Your Online Course On Pinterest Online Courses Pinterest Traffic Drive Website Traffic

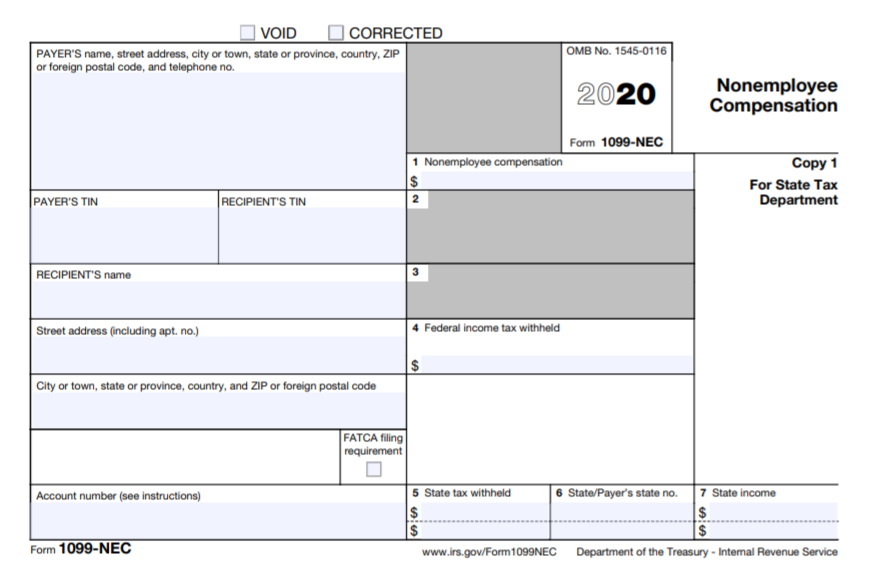

What Is Form 1099 Nec For Non Employee Compensation

What Is Form 1099 Nec For Non Employee Compensation