How To Register A Sole Trader Company With Companies House

If youve decided to register your business with Companies House and become a limited company visit the GovUK website to do so online. Youll need to file a tax return every year.

Sole Trader Vs Limited Company How To Set Up A Business

Sole Trader Vs Limited Company How To Set Up A Business

Get your certificate of incorporation within hours.

How to register a sole trader company with companies house. Registering as a sole trader Setting up a sole trader business is straightforward. All you need to do is inform HMRC that youre self-employed and operating as a sole trader by registering for self-assessment. To set up as a sole trader you need to tell HMRC that you pay tax through Self Assessment.

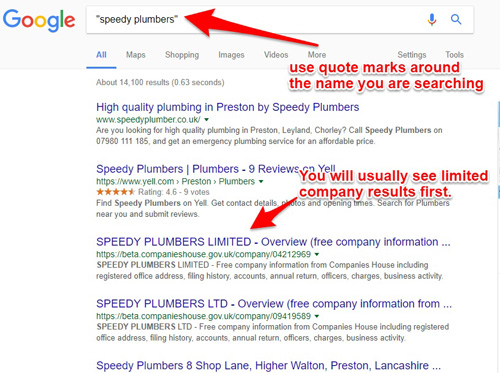

Only limited companies are required to register their companies with this governing agency. For example your name cant be the same as another registered companys. But as a sole trader you are still required to register for self-assessment through HMRC.

Register a limited company and open a business account all in one go for FREE. If thats the case then you dont need to register with Companies House. All limited companies must register with Companies House who will make the company information publicly available on their website.

The confirmation statement confirms details such as registered office names of directors and the business activity. There are indeed some tax savings to be made by making the switch from sole trader to limited company. When youre registering a company name you must follow a set of rules as outlined on the HMRC website.

Here are the steps you need to take to complete the process. You can trade under your own name or you can choose our name reservation service to register your business name at Companies House while trading as a sole trader see more information in our FAQ. It typically takes around 10 days to get an activation code for the government gateway account.

The company also needs to file a confirmation statement annually which updates or confirms the details held by Companies House are still correct. However sole trader. If you are forming a sole trader business you are not required to register with Companies House.

Limited companies dont have to make Income Tax payments on account for example but sole traders do. Non-limited companies are typically sole traders or partnerships and are liable for any problems encountered. Registering your sole trader business.

Instead you should register with HMRC to let them know they should expect an annual Self Assessment tax return from you. You must notify HMRC within 3 months or face a fine. The cost of downloading a copy of a file is 2000 TTD files are in PDF format.

You dont have to register a company name or complete any Companies House forms such as the annual Confirmation Statement. Normally when you register with Companies House you have to supply them with a wealth of paperwork including a Memorandum of Association and your Articles of Association. Complete a simple form in 5 min Once your payment has been accepted youll be directed to fill out our short 100 online application.

If you do this then you will need to register your company with Companies House. We pay the 12 incorporation fee on your behalf. If its a Friday night it can take until Monday help.

This means companies must provide the details of who their shareholders and directors are as well as file a copy. Alternatively you can register directly with Companies House online at a cost of 12. Once you have your government gateway account setup then you can complete the sole trader registration form.

However if youre starting a limited company or limited liability partnership LLP you are legally required to. Sole traders Its simpler to set up as a sole trader but youre personally responsible for your businesss debts. You are registering as self employed and each year you must complete a self assessment tax return.

You need to register as a sole trader with HM Revenue Customs HMRC. Switching from sole trader to limited company could save you tax. You can do this online or by post.

There are over 1750000 documents indexed. This is also true of business partnerships. Sole traders have an easier accounting job.

Some businesses start out as sole traders and then change to operate as limited companies. Its possible to trade under your own name or to choose an alternative name for your sole trader business. What is Companies House.

Register for Self Assessment. On the other hand a non-limited company has unlimited liability. Instead they must simply register with HMRC and complete an annual Self Assessment tax return.

Apply within minutes in one streamlined process. If you intend to trade as a sole trader you must notify HMRC. One such example involves a plumber if a plumber were to accidentally flood your house and cause damage to your property you would have grounds to sue them.

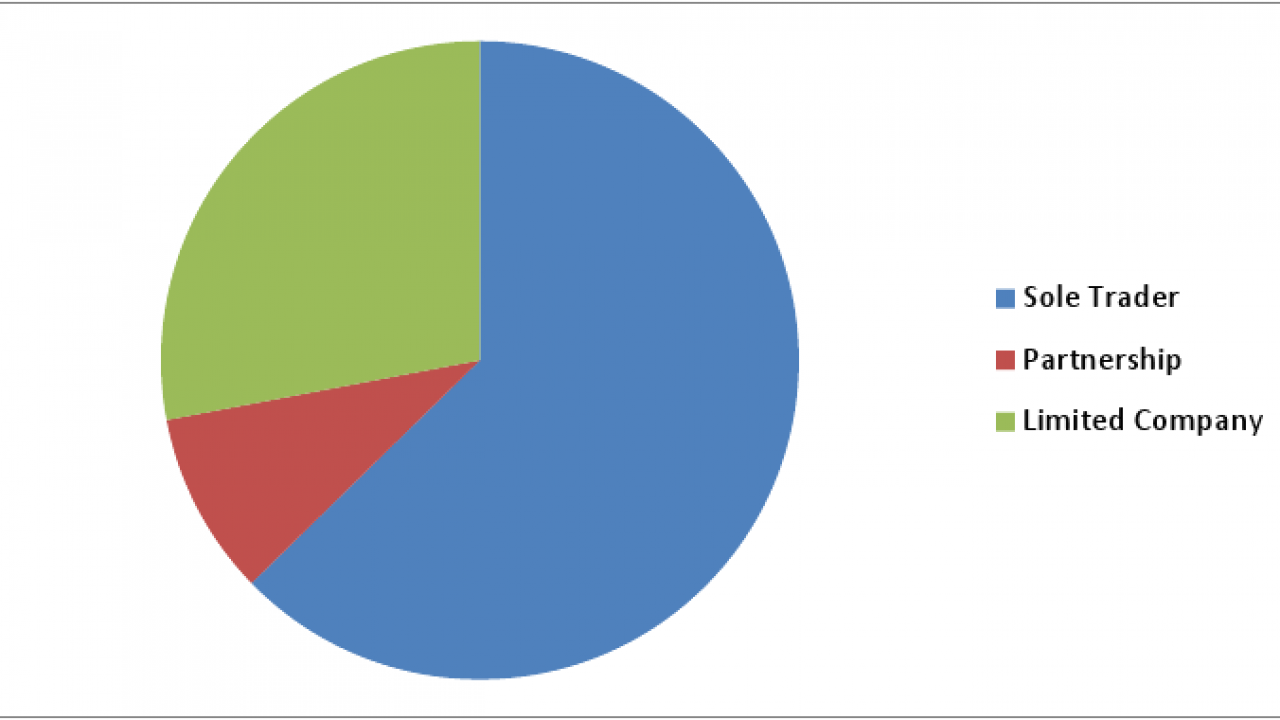

Are you a sole trader. Most businesses register as a sole trader limited company or partnership. Yes its really free.

To register as a sole trader yourself directly with HMRC you must have a government gateway account. You have to then fill out all the necessary forms and processes and if anything were to go wrong youd be responsible for all correspondence to sort things out. You can do this online at govuk or you can ask your accountant to do this for you.

You need to register for self-assessment with HMRC after which you need to wait up to 10 days for an activation. The quick answer is that no a sole trader business does not need to register with Companies House. Sole traders do not need to register with Companies House.

If you are planning to trade as it is highly advisable that you register your company as dormant with Companies House.

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Sole Proprietorship What Is A Proprietorship

Sole Proprietorship What Is A Proprietorship

How To Change Trading Name For A Sole Trader 14 Steps

How To Change Trading Name For A Sole Trader 14 Steps

Should I Be Self Employed A Sole Trader Or Run A Limited Company

Should I Be Self Employed A Sole Trader Or Run A Limited Company

A Limited Company Is A Business Structure That Offers Its Members Shareholders And Directors Limited Company Public Limited Company Limited Liability Company

A Limited Company Is A Business Structure That Offers Its Members Shareholders And Directors Limited Company Public Limited Company Limited Liability Company

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Sole Traders Are The Most Common Type Of Business

Sole Traders Are The Most Common Type Of Business

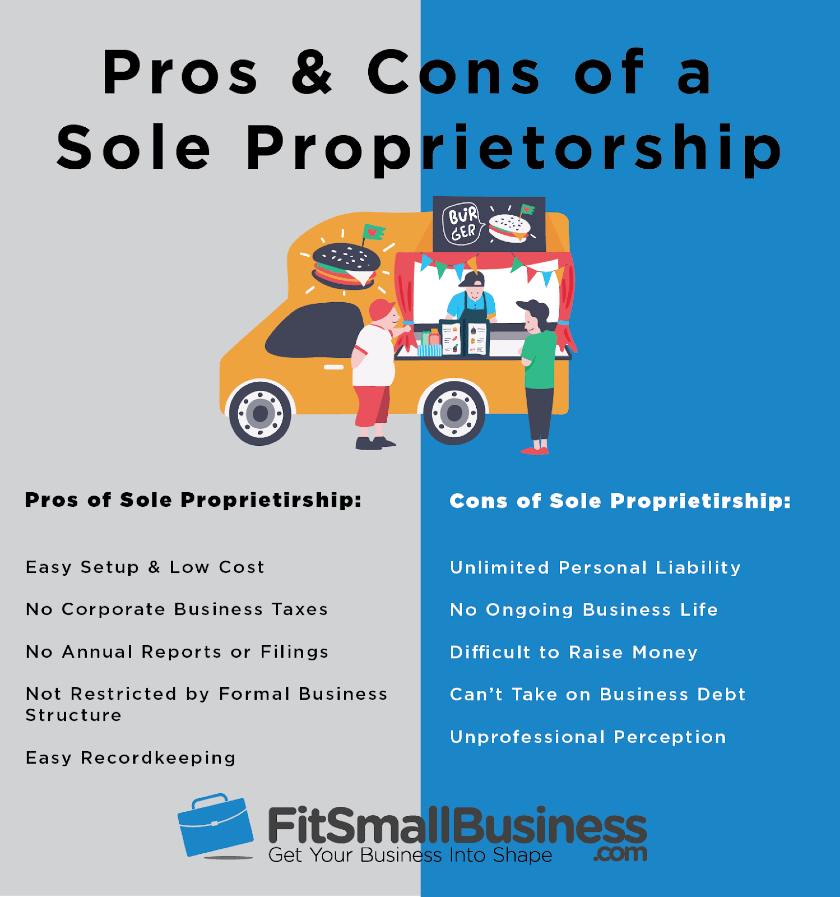

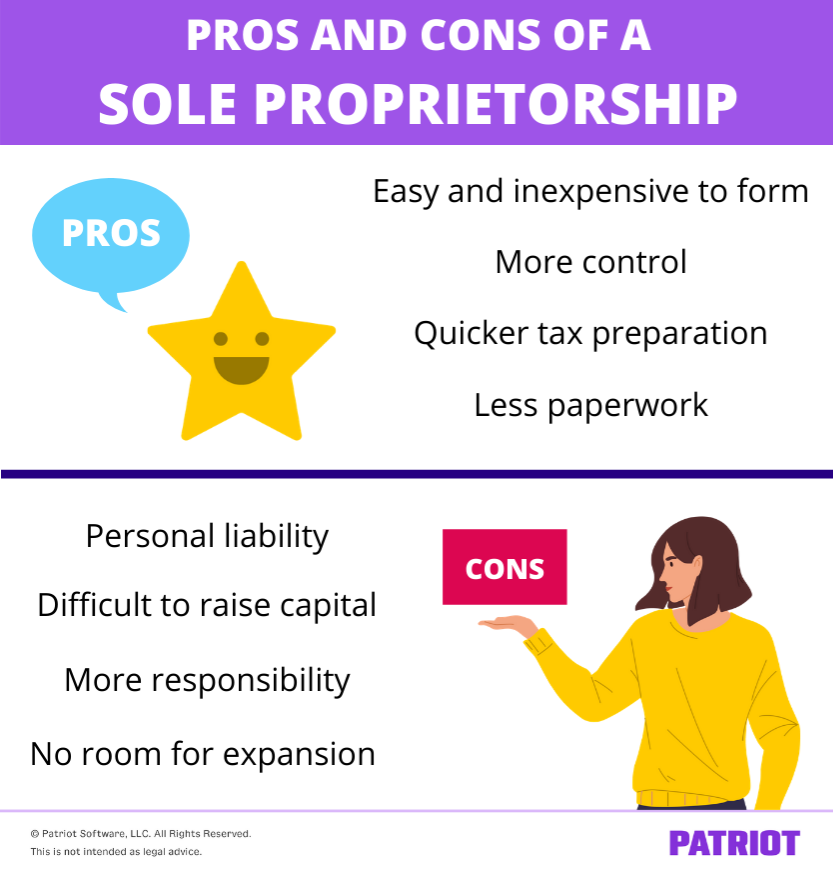

5 Sole Proprietorship Pros And Cons

5 Sole Proprietorship Pros And Cons

Pros And Cons Of A Sole Proprietorship

Pros And Cons Of A Sole Proprietorship

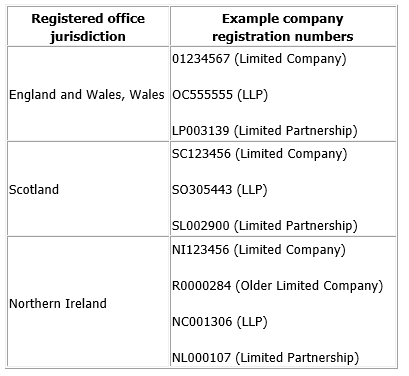

Company Registration Number What Is It

Company Registration Number What Is It

Does A Sole Trader Need To Register With Companies House The Accountancy Partnership

Does A Sole Trader Need To Register With Companies House The Accountancy Partnership

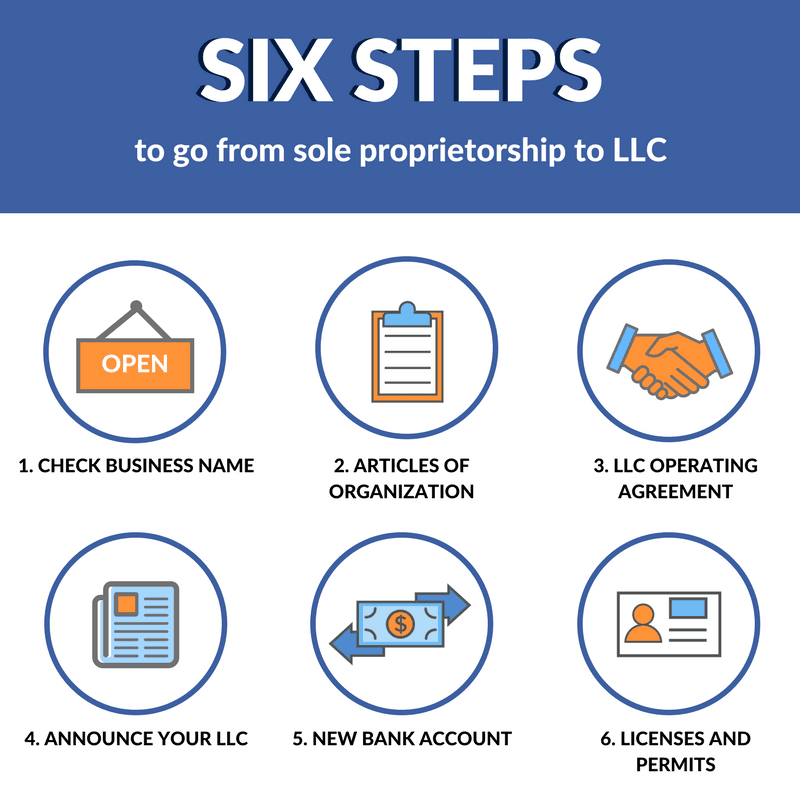

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

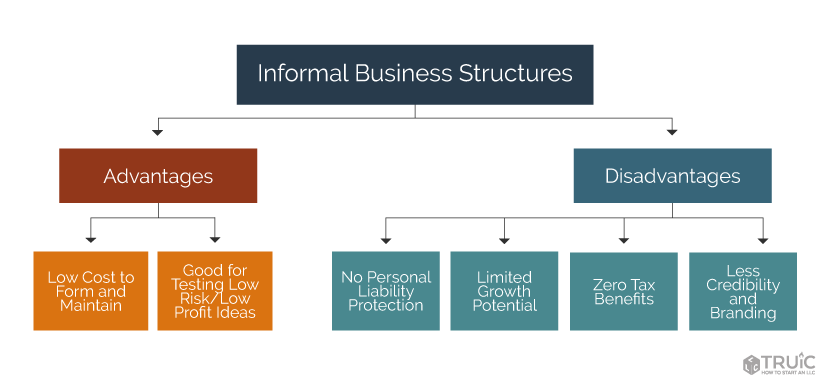

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Companies And Businesses The National Archives

Uk Letterhead Legal Requirements A Quick Guide To Help You Get It Right

Uk Letterhead Legal Requirements A Quick Guide To Help You Get It Right

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

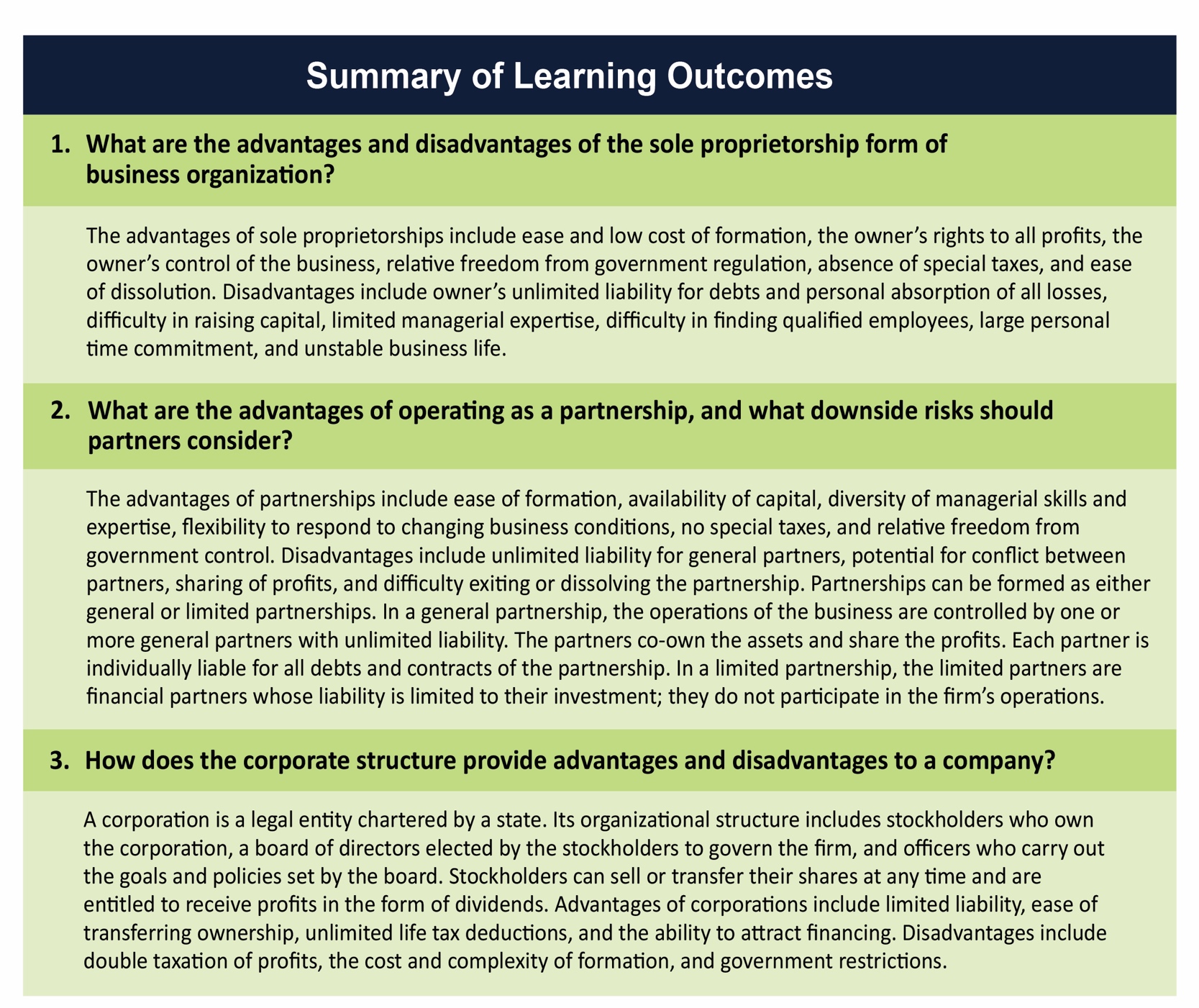

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business