How To Remove Company From Vat Group

You will then be prompted to confirm if you are sure you want to remove that member. The remaining entities of the VAT group are referred to as group nonremitters.

Https Eservices Tax Gov Ae Mof Media Mof Media Downloads Registration User Guide Tax Groups Vatg113 English Pdf

Mac users should right click on the form link then select Save.

How to remove company from vat group. Form VAT 56 to change the representative member of a VAT group. Use form VAT51 to provide details of each. Use this form to provide HMRC with details of a VAT group Created Date.

Adding or removing companies from your group. A tax group is a group of 2 or more related parties registered as a single taxable person for the purpose of tax. This is the VAT Group company profile.

Glassdoor gives you an inside look at what its like to work at VAT Group including salaries reviews office photos and more. Click on the OKbutton if you would like to proceed and the Confirm and Remove form will be displayed on your screen as shown. Holding and subsidiary are members of the same VAT group VAT input tax.

In such cases you must obtain permission for inclusion in the group. Form VAT 50 to change or disband the group. Click on the icon for the member you wish to remove from the Tax group as shown.

Any transactions between companies that are no longer eligible for group treatment are liable to the normal VAT rules. Windows users should right click on the form link then select Save target as or Save link as. Following the approval of group registration you may wish to include a new company in the group.

Non-remitters must submit a Form VAT53 to their Revenue office. HMRC can refuse or can remove a company from a group but these powers are normally only used if they think the business is trying to save VAT with an artificial avoidance scheme. I dont know the FTA rules you mention but in principle if a company is no longer entitled to remain within a VAT group for whatever reason.

VAT 50 - Application for VAT group treatment Subject. A major benefit of registering as a tax group is that supplies between the members of a VAT Group are considered as out of scope of VAT and hence VAT is not applicable. Whatever browser you are using review your settings to make Adobe Reader the default program for opening PDF documents.

The group remitter must submit a Form VAT52 to their tax district. A business can apply to group de-group or to alter the membership of the group at any time. To a Limited company go to question 11 F I have transferredsold my business as a going concern go to question 11 G I am joining a VAT group you must also complete a VAT50 and VAT51 go to question 12 H My VAT group is disbanding you must also complete forms VAT50 and VAT51 for each group member go to question 13 I Other go to.

Holding Ltd is a property investment company that owns several properties some of which have an option to tax in force. VAT grouping is a facilitation measure by which two or more bodies corporate can be treated as a single taxable person a single VAT registration for VAT purposes. Read Group and divisional registration VAT Notice 7002 to find out about group and divisional registration and which forms you need to use to apply.

An application to de-group a company can be made on Form VAT 51. Form VAT 51 to provide details of the companies involved. In order to combat such avoidance HMRCs have the power to refuse an application to leave a group.

Subsidiary Ltd owns one property that has an option to tax in force. Even where a member is no longer eligible to be a member of the group they have some discretion around the date of exit from the group. This is a very concise summary of matters that should be considered when deciding to form or disband a VAT group.

This guidance provides information on VAT group treatment allowing two or more corporate bodies to account for VAT under a single registration number with one of the corporate bodies in the group. All content is posted anonymously by employees working at VAT Group.

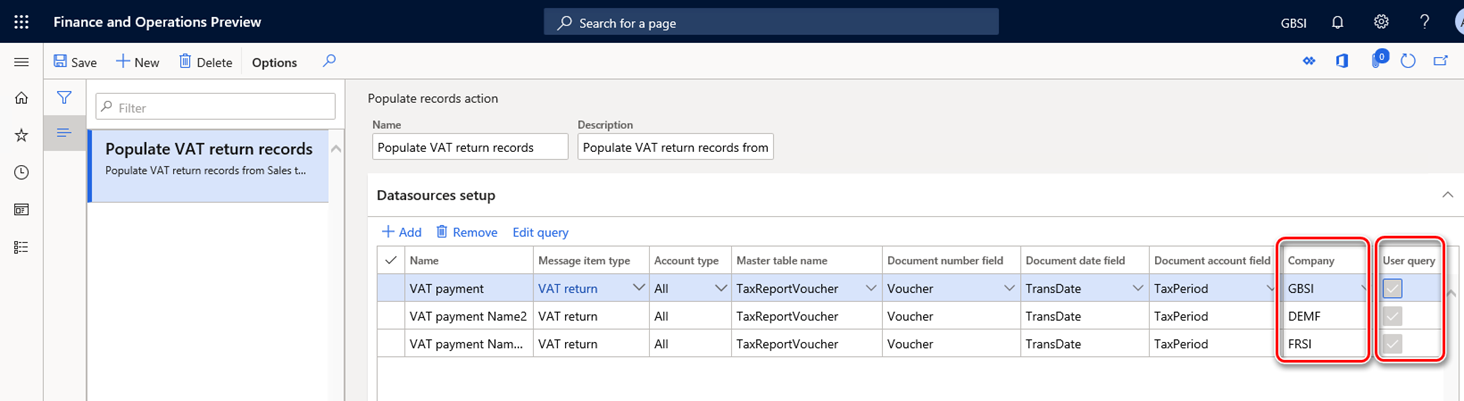

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Inter Company And Intra Company Transactions And Vat

Inter Company And Intra Company Transactions And Vat

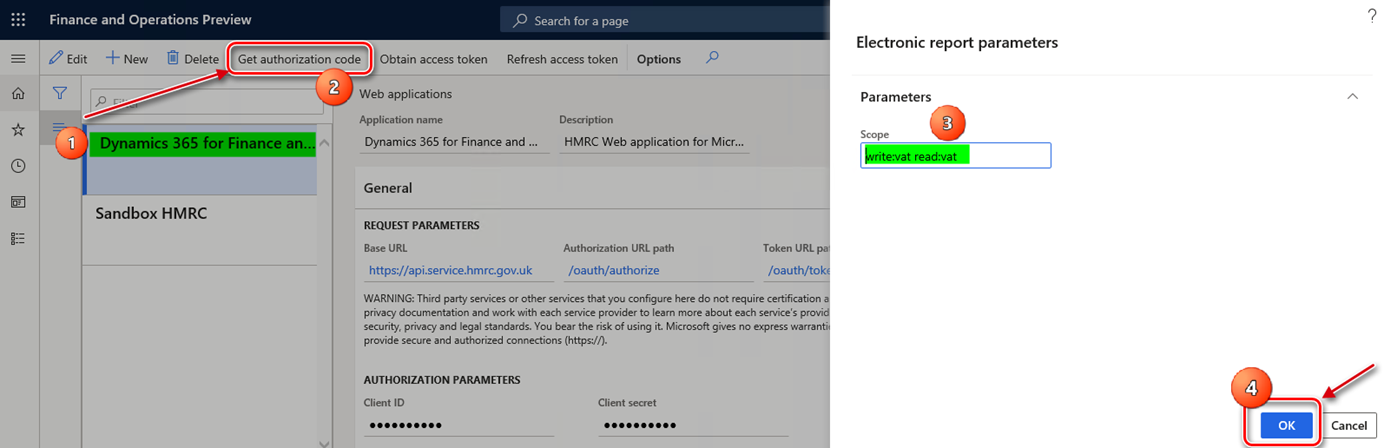

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Https Www Revenue Ie En Tax Professionals Tdm Value Added Tax Part02 Accountable Persons Vat Groups Vat Groups Pdf

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

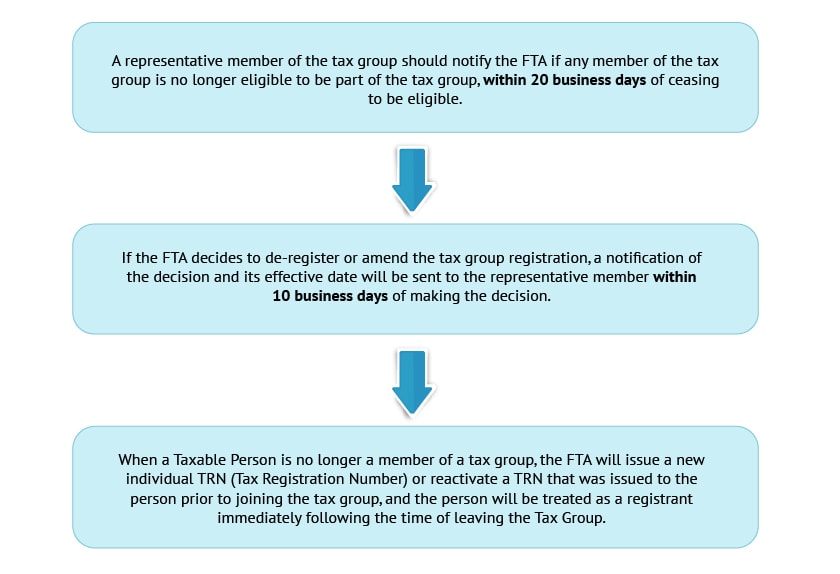

How Can Members Be Removed From A Tax Group De Registering Tax Group Members Cda

How Can Members Be Removed From A Tax Group De Registering Tax Group Members Cda

How To Deregister Or Amend A Tax Group Uae Vat

How To Deregister Or Amend A Tax Group Uae Vat

Https Www Dlapiper Com Media Files Service And Sector Highlights Vat Sa Guidance Re Draft Of Chapter 12 Pdf

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Configuring Vat Id Validation Magento 2 4 User Guide

Configuring Vat Id Validation Magento 2 4 User Guide

A Fresh Look At Vat Groups Tax Adviser

A Fresh Look At Vat Groups Tax Adviser

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Configuring Vat Id Validation Magento 2 4 User Guide

Configuring Vat Id Validation Magento 2 4 User Guide

Https Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 923702 2008268 Vat Grouping Call For Evidence Pdf

Https Eservices Tax Gov Ae Mof Media Mof Media Downloads Registration User Guide Tax Groups Vatg113 English Pdf