Business Closure Form Kansas

The Regulated Industries Division is responsible for inspecting all taxicab vehicles livery vehicles pedicabs and sightseeing vehicles that are permitted to pick up passengers within the city limits of Kansas City Missouri. Obtain a Certificate of Good Standing CGS.

Stumped How To Form A Georgia Llc The Easy Way

68-2-10 this information must be submitted to the board within five days of termination of operation.

Business closure form kansas. They also need to file this form if business use of certain Section 179 or listed property drops to 50 or less. Complete the Copy Order Form Form CO and mail or fax the completed form and payment to. Include any copies of Kansas registrations and renewals.

Also report the date your business was acquired. Dissolve Cancel or Withdraw a Business Entity. This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing.

Include information on the date the business was closed. Kansas Department of Revenue PO Box 3506 Topeka KS 66625-3506 or FAX to 785-291-3614. Kansas secretary of state Kansas Limited Liability Company Certificate of Cancellation GENERAL FILING INSTRUCTIONS All information on this form must be complete and accompanied by the correct filing fee or the document will not be accepted for filing.

A dissolution withdrawal or cancellation may be filed online at httpswwwkansasgovdissolutionsindexdo. File a cancellation online at sosksgov. Dec 15 2020 Form 4797 Sales of Business Property if they sell or exchange property used in their business.

LLCs with series must use Form KC. Complete the Notice of Business Closure CR-108 Return the completed form to. Office of the Secretary of State Business Services Division 120 SW 10th Ave Topeka KS 66612.

What to do when you close your business. Close a business in Kansas with the Secretary of State. All forms must be typed be complete and include all supporting documentation before they will be processed by the board.

Kansas Statement Form Related Closing Forms. Certificate of Good Standing. Form 8594 Asset Acquisition Statement if they sell their business.

Federal Employers ID No. If there is no business activity to reportfor certain periods the online applications for zero-based. Accident Prevention Program.

Schedule SE Form 1040 if theyre liable for self-employment tax. This includes more than 500 taxicab vehicles 200 livery vehicles two dozen horse-drawn carriages and a small number of pedicab vehicles. Current and Historic Benefit Levels.

Indicate if the form of the organization has changed. Kansas senate majority leader called a police officer donut boy after arrest following a wrong-way highway chase court docs say Grace Panetta 2021-04-08T191542Z. In addition all annual reports must be filed prior to filing the dissolution withdrawal or cancellation.

NOTICE OF TAX ACCOUNT CLOSURE KANSAS DEPARTMENT OF REVENUE CUSTOMER RELATIONS PO BOX 3506 TOPEKA KANSAS 666 25-3506 PHONE. Indicate whether the acquisition was total or partial. Order a CGS for a business on file with the Secretary of State.

Include the name and address of the new owner. Complete the Notice of Business Closure CR-108 What to do when you sell your business. To include name address phone number and FEIN.

Kansas Tax Account No. 300 N Summit St Girard KS 66743. If a paper amendment form is needed it may be obtained from the Secretary of States website.

Kansas Department of Revenue 915 SW Harrison Street Topeka KS 66625-9000 or FAX to 785-291-3614. Include information on the date the business was sold. Closing Forms for Each State.

Kansas Department of Revenue - Business Closed Sold or No Activity. Self-Insurance and Business Section. Kansas Department of Labor PO Box 400 Topeka KS 66601-0400 be transferred to your successor.

Complete the Notice of Business Closure CR-108 Return the completed form to. Search for a business on file with the Secretary of State. What do I need to file with the Secretary of State.

I am closing my Kansas business or as a foreign entity I am no longer doing business in Kansas. Httpssoskansasgov Please enter the business name andor entity identification number in the field below to begin online filing. Enter the successors information.

Complete the Notice of Business Closure CR-108. Make sure all tax filings are current up to the date of sale. Make sure all tax filings are current.

Kansas Business Forms Inc. This settlement statement is verified and signed by both the seller and the buyer. Browse the FAQ section for more information regarding dissolution cancellation or withdrawal of a business entity.

If you had no business activity.

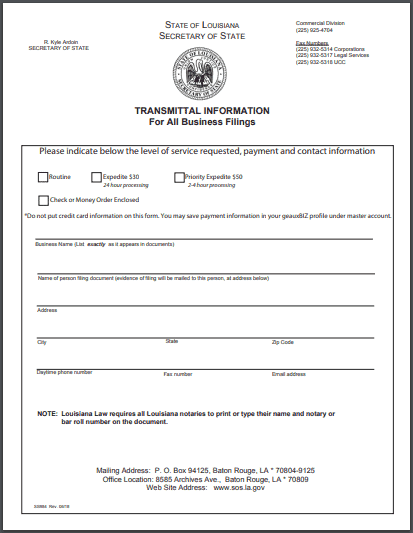

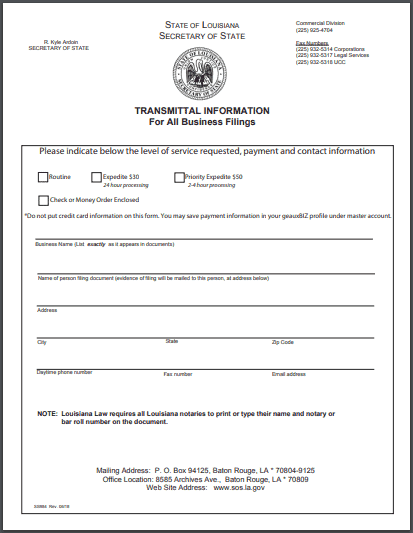

Louisiana Llc 35 Out The Door Louisiana Llc Formation

Louisiana Llc 35 Out The Door Louisiana Llc Formation

Stumped How To Form An Illinois Llc The Easy Way

Kentucky Llc Steps To Form An Llc In Kentucky

Illinois Foreign Llc Registration Get An Illinois Certificate Of Authority

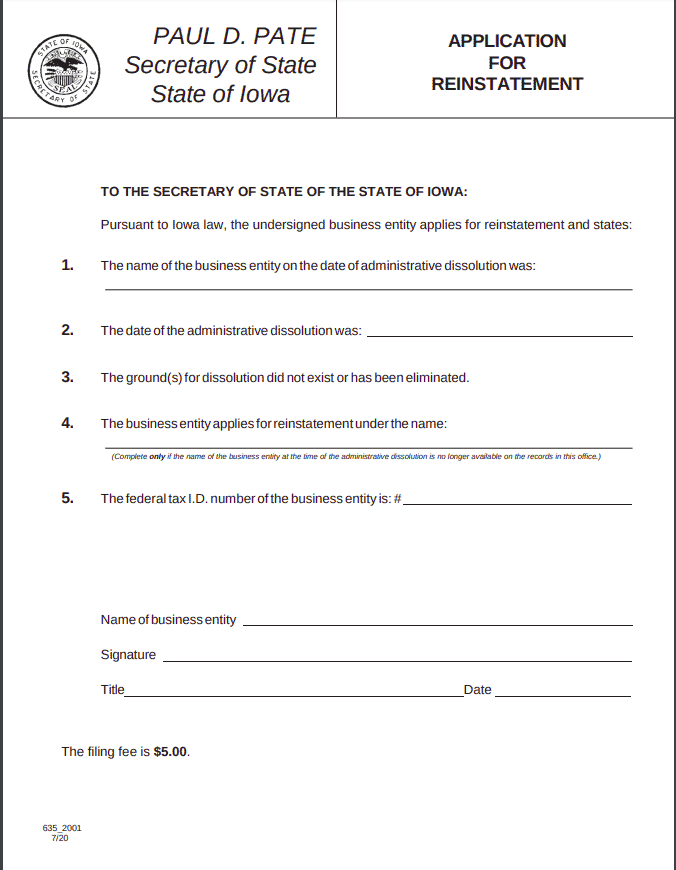

Free Guide To Reinstate Or Revive An Iowa Limited Liability Company

Free Guide To Reinstate Or Revive An Iowa Limited Liability Company

Stumped How To Form A District Of Columbia Llc The Easy Way

Free Partnership Dissolution Agreement Free To Print Save Download

Free Partnership Dissolution Agreement Free To Print Save Download

Stumped How To Form An Indiana Llc The Easy Way

Custom Text And Your Logo Here On Faux Marble Pencil Case Zazzle Com Marble Pencil Case Pretty Pens Pencil Case

Custom Text And Your Logo Here On Faux Marble Pencil Case Zazzle Com Marble Pencil Case Pretty Pens Pencil Case

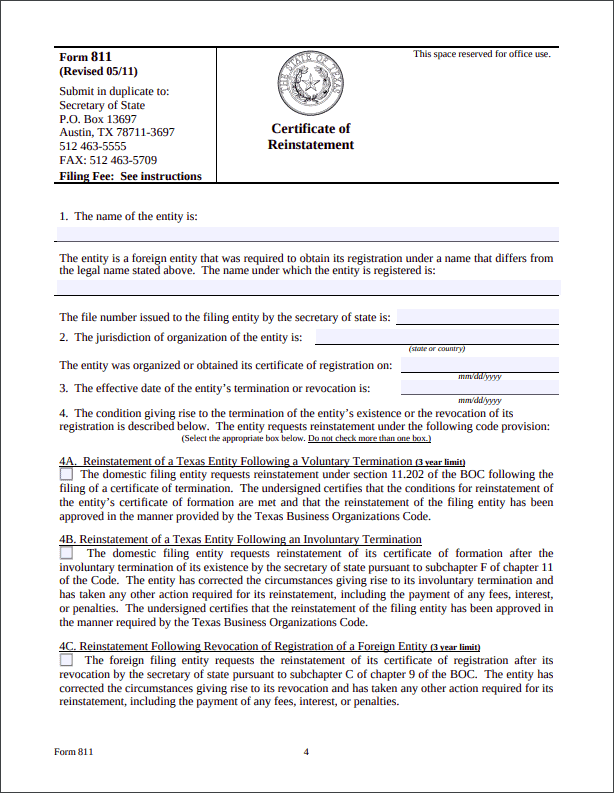

Free Guide To Reinstate Or Revive A Texas Limited Liability Company

Free Guide To Reinstate Or Revive A Texas Limited Liability Company

Ohio Llc Steps To Form An Llc In Ohio

Project Closure Report Template Free Great Project Closure Report For Project Closure Report Template Ppt Report Template Templates Free Download Template Free

Project Closure Report Template Free Great Project Closure Report For Project Closure Report Template Ppt Report Template Templates Free Download Template Free

Incorporate In Kansas Do Business The Right Way

Start Your Own Small Business With Professional Business Forms And Support Resident Pressure Washing Business Pressure Washing Services Pressure Washing Tips

Start Your Own Small Business With Professional Business Forms And Support Resident Pressure Washing Business Pressure Washing Services Pressure Washing Tips

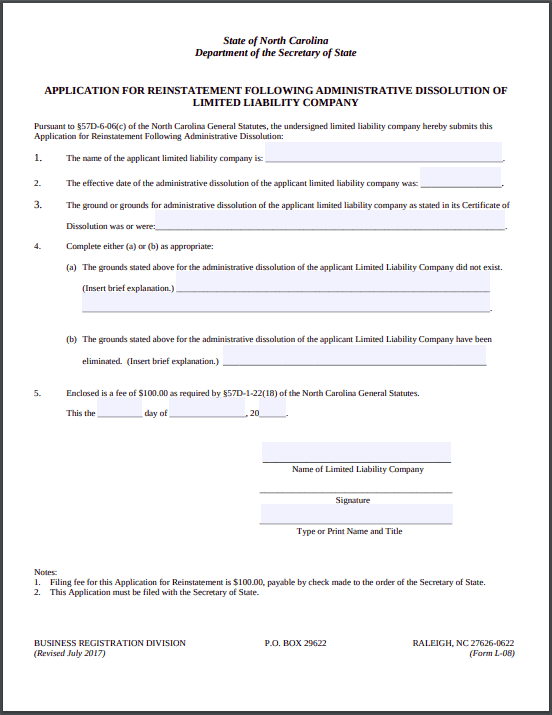

Free Guide To Reinstate Or Revive A North Carolina Limited Liability Company

Free Guide To Reinstate Or Revive A North Carolina Limited Liability Company

Kansas Department Of Revenue Business Tax Home Page

Kansas Department Of Revenue Business Tax Home Page

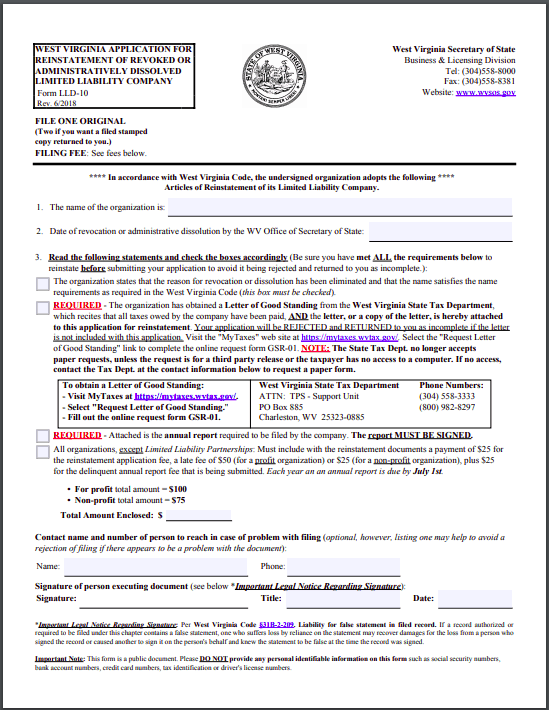

Free Guide To Reinstate Or Revive A West Virginia Limited Liability Company

Free Guide To Reinstate Or Revive A West Virginia Limited Liability Company