Does A Foreign Entity Get A 1099

However in the US. Social Security Number SSN getting an Employer Identification Number is easy by applying online see below.

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

Citizen and the services provided are outside the US.

Does a foreign entity get a 1099. An exempt recipient is any payee that is exempt from the Form 1099 reporting requirements. Disregarded Entities and Form 1099 Reporting Question We have had a couple of situations recently where groups insist they must billsubmit claims under the name and TIN of the disregarded entity DE but they then want us to report the payments under the nameTIN of the owner. Subject to Form 1099 reporting requirements the IRS suggests that you request the recipient complete the appropriate Form W-8.

However you may be required to report the payment on Form 1099 and if applicable backup withhold. By signing Form W-8BEN the foreign contractor is certifying that he or she is not a US. Self-employed via internet- For businesses hiring foreign individuals for work remotely or over the internet a Form 1099 is not required.

Each Form 1099-DIV should be. Investors can receive multiple 1099-DIVs. Payments to foreign persons.

No W2 or Form 1099. You should get a form W-8BEN signed by the foreign contractor. An assistor takes the information assigns the EIN and provides the number to.

Generate 1099-MISC reports when the vendor is a foreign entity. Source Income Subject to withholding is used to report income paid to a non-resident regardless of whether the payment is taxable. The requirement to report a foreign income applies even if you do not receive Form W2 Form.

However foreign corporations are not issued this document. So you dont have to complete 1099s for non-US. Filing a 1099 is required if.

As long as the foreign contractor is not a US. If the foreign recipient is non-exempt ie. Foreign worker providing services inside the US- It is vital for tax purposes to monitor where services are performed because if a foreign worker performs tasks in the US heshe will.

Form 1099-DIV is a form sent to investors who have received distributions from any type of investment during a calendar year. How to get an EIN if you have a Social Security Number SSN. However they are not specific about foreign entities on that form.

Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required. The contractor is located internationally but is a US. And who are also citizens of the country.

They are not subject to. Self-employed workers who earn income from foreign clients must also report their foreign earnings on their federal income tax returns. May 31 2019 450 PM As long as the foreign contractor is not a US.

If a foreign reverse hybrid entity is receiving a payment for which the entity is claiming a reduced rate of withholding for its owners you must obtain from the entity a Form W-8IMY including its chapter 4 status if the payment is a withholdable payment along with a withholding statement and documentation for each owner for which the entity. If you have a US. Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required.

Entities can obtain an EIN immediately by calling 267 941-1099. Person you do not apply NRA withholding. A 1099 is normally issued to individuals living in the US.

However if you are a foreign individual and you do not have an SSN the process is complicated and tedious and you must take some specific steps discussed below to get your EIN. A 1099 form is used to report miscellaneous income such as gross rent for US residents and businesses only whereas a 1042-S Foreign Persons US. However the IRS doesnt require a company to withhold taxes or report any income from an international contractor if the contractor is not a US.

You only issue 1099s to non-corporate entities contractors consultants some LLPs and similar entities - read the specifics on the form that are US. Source income of foreign persons for reporting requirements relating to payments to foreign. 11441-1 b 3 it is generally easier to.

See the Instructions for Form 1042-S relating to US. You may assume that a foreign entity is not a disregarded entity unless you can reliably associate the payment with documentation provided by the owner or you have actual knowledge or reason to know that the. Any person making more than 600 per year is issued a 1099-MISC for income earned in the US.

If the owner is a US. The IRS considers a company to be a foreign entity if the company is located in a country other than the United States American Samoa Federated States of Micronesia Guam Marshall Islands Northern Mariana Islands Puerto Rico or the U. If your independent worker completes all tasks in hisher country of origin and receives compensation via PayPal a Form 1099 is also not necessary.

The IRS requires businesses to issue Form 1099-MISCs to most non-corporate independent contractors or service providers foreign or domestic to whom they paid a minimum of 600 during the.

2015 Form 1099 Misc Tax Forms Irs Forms 1099 Tax Form

2015 Form 1099 Misc Tax Forms Irs Forms 1099 Tax Form

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income Tax Forms Doctors Note Template Important Life Lessons

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income Tax Forms Doctors Note Template Important Life Lessons

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

What The Heck Is Irs Form 1099 S And Why Does It Matter Value Statement Examples Business Case Template Irs Forms

What The Heck Is Irs Form 1099 S And Why Does It Matter Value Statement Examples Business Case Template Irs Forms

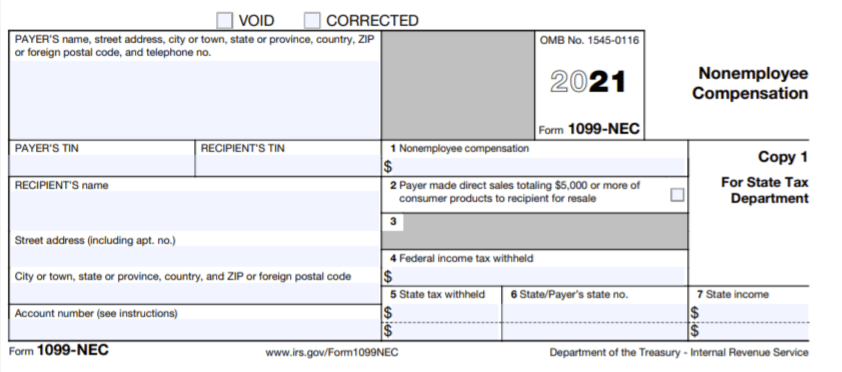

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Irs Form 1099 R What Every Retirement Saver Should Know Fox Business Irs Forms Retirement How To Plan

Irs Form 1099 R What Every Retirement Saver Should Know Fox Business Irs Forms Retirement How To Plan

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Misc Form 2017 Tax Forms Templates Form

1099 Misc Form 2017 Tax Forms Templates Form

Account Ability Includes Electronic Filing The Irs And Social Security Administration Ssa Require Filers Of Efile Accounting Social Security Administration

Account Ability Includes Electronic Filing The Irs And Social Security Administration Ssa Require Filers Of Efile Accounting Social Security Administration

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

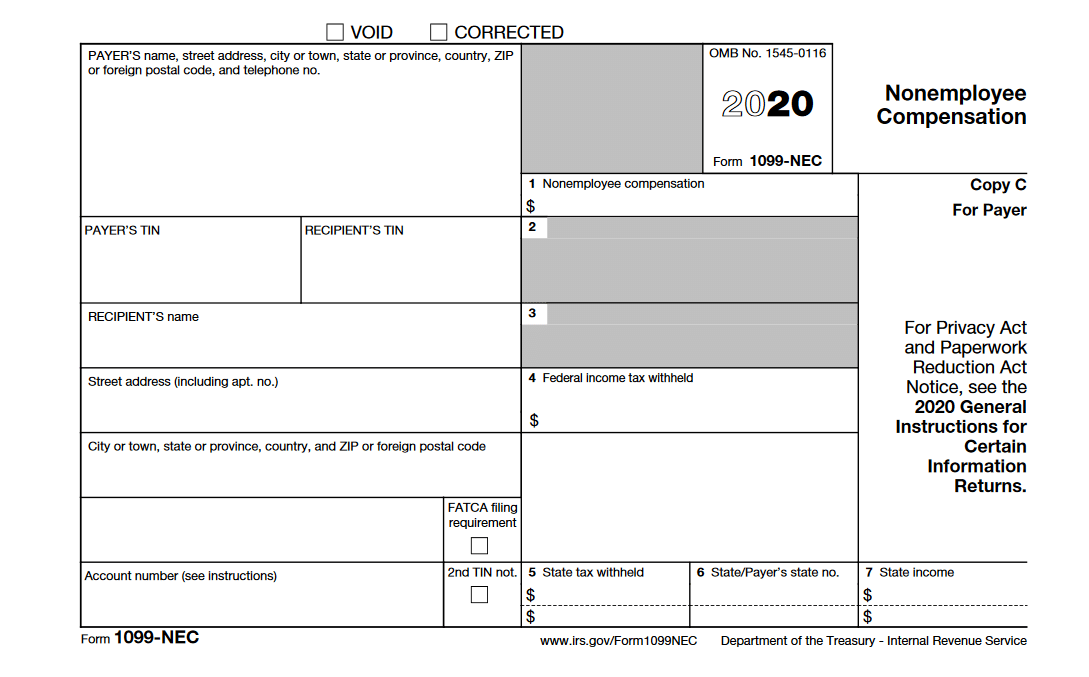

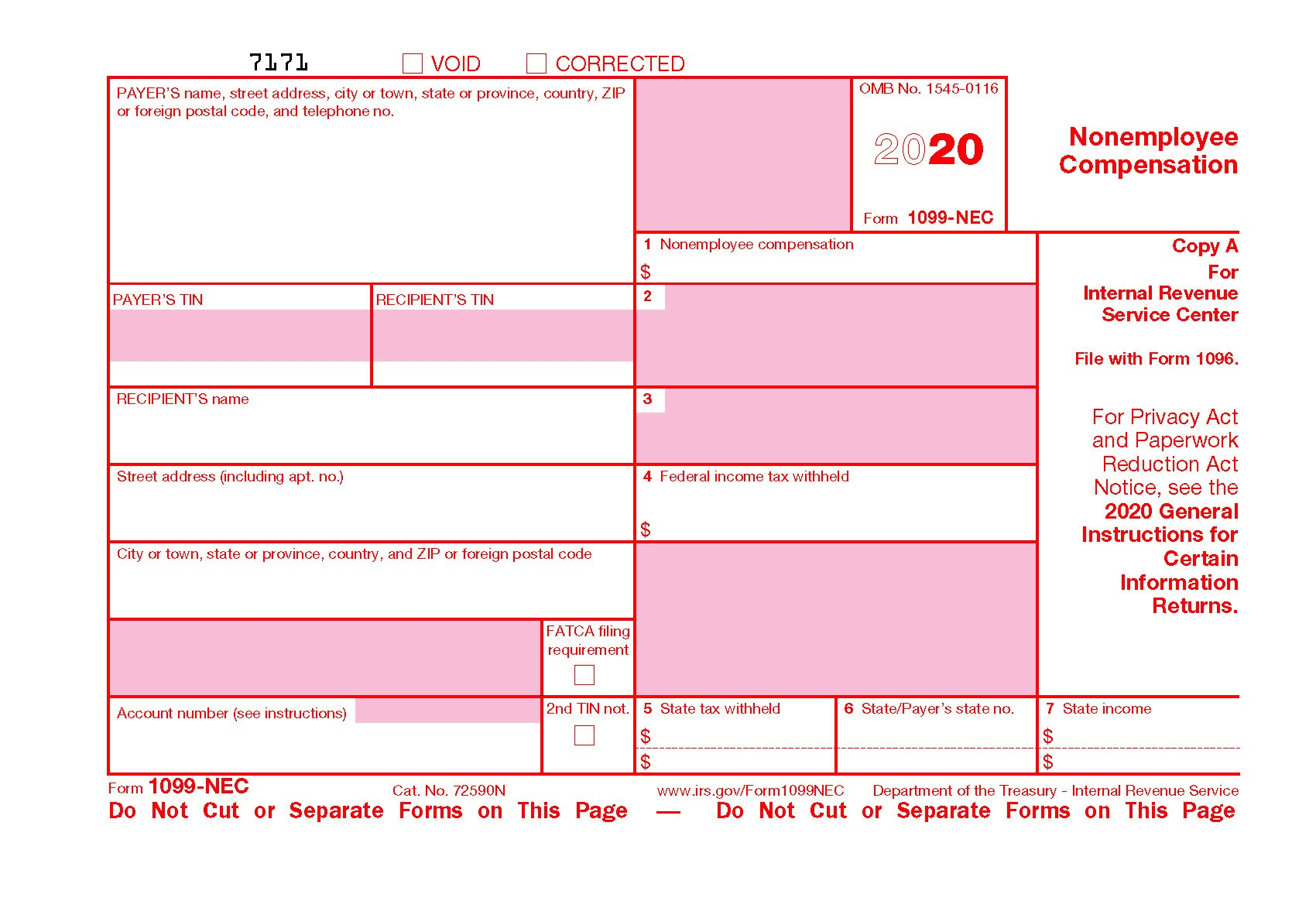

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile