Hmrc Business Mileage Claim Calculator

You can then calculate the VAT cost to make a claim. Claiming Mileage Tax Relief How much can I claim back per mile.

Did You Know That If Your Business Turns Over Less Than 1 000 In Your Business You May Not Need To Pay Any Tax Or Ev Allowance Tax Free Small Business Finance

Did You Know That If Your Business Turns Over Less Than 1 000 In Your Business You May Not Need To Pay Any Tax Or Ev Allowance Tax Free Small Business Finance

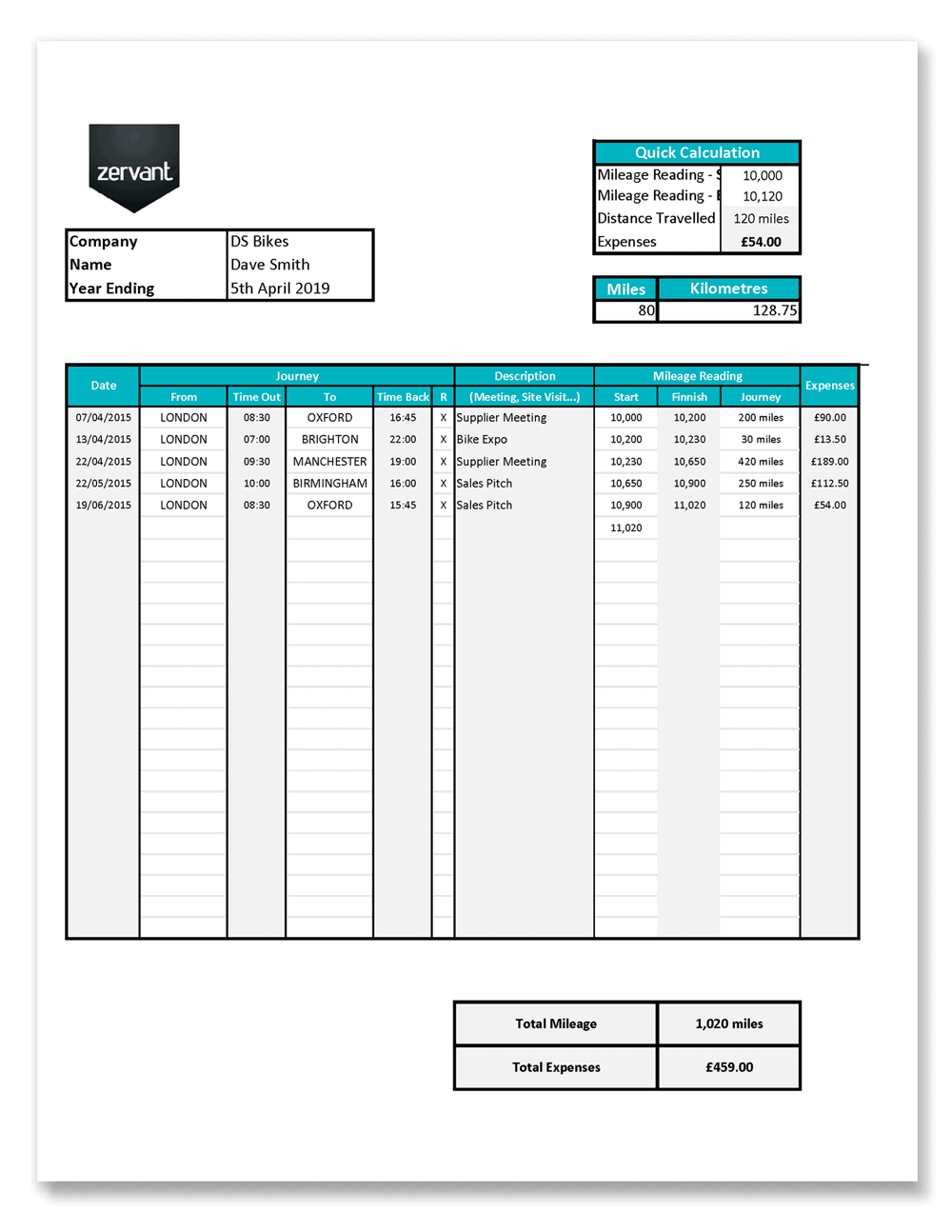

Self-Employed Mileage Log Example Below is an example of a completed mileage.

Hmrc business mileage claim calculator. To get a specific figure you need to check which of your work journeys are eligible for tax relief by considering things like if youre going to a temporary workplace and which mileage. To claim back your self-employed mileage allowance you simply need to include the amount in the expenses section of your self-assessment tax return. 3000 were personal journeys and the remaining 11000 were business-related.

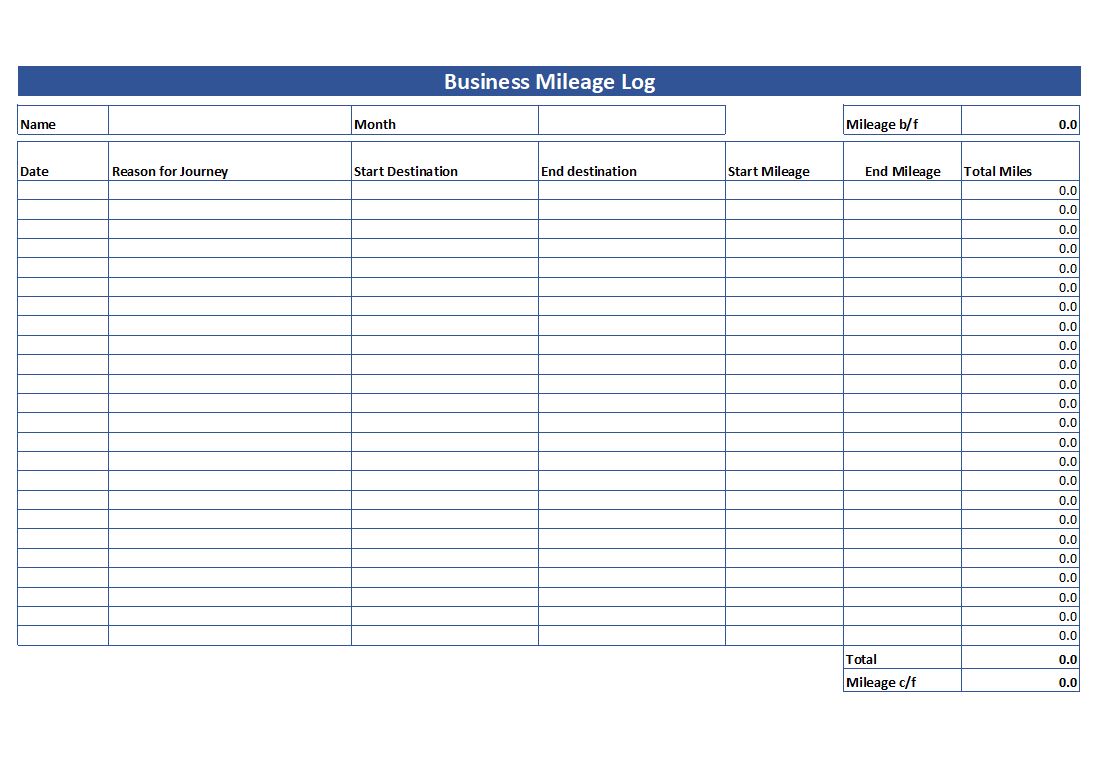

Use HMRC s MAPs working sheet if you need help. In the main section enter the date of travel the reason for the journey and either start and end mileage which will calculate the miles or enter the total miles. If your employer pays you less than this you can get your tax back on the difference.

This gives you 4500. After 10000 miles the rate changes to. Multiply the first 10000 by the current AMAP rate of 45p.

Approved mileage rates from tax year 2011 to 2012 to present date. Is there anything else I should know about mileage claim rates. The current rates are.

If you have a company car but pay for your own fuel and reclaim mileage from your employer then HMRC publish advisory rates for how much you can claim. Now heres the clever bit. To get started simply register your application online and well send a pre-printed application form to you ready for signing.

So youd calculate your mileage deduction as follows. According to the current AMAP rates you can claim 45p per mile on the first 10000 business miles and 25p per mile on anything over this limit. The mileage tax relief calculator uses the current approved mileage rates of 45p per mile for the first 10000 business miles and 25p per mile for every business mile after that.

You can reclaim VAT on the business portion of any fuel purchased by keeping a detailed mileage log to distinguish between business and personal use. Calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle for example insurance repairs servicing fuel. And the HMRC recommended rate for cars is 45 pence per mile reducing to 25 pence per mile after 10000 miles.

Alternatively HMRC provide Advisory Fuel Rates to make calculation and record keeping easier. Electricity is not classed as a fuel for car fuel benefit purposes. Step 4 - Make A Claim.

45p per mile for your first 10000 miles and 25p per mile for everything above 10000 miles. Youve travelled 14000 miles by car. So to calculate your mileage deduction youd multiply your mileage as follows.

You can find previous rates at the Govuk website Advisory Fuel Rates page. 10000 x 45 5000 x 25 This means your total mileage deduction for 2017 18 would be 5750. HMRC say that the 45p per mile or 25p that you can claim for using your own car not only covers petrol but it also covers wear and tear and other running costs.

Advisory Fuel Rates from 1 December 2019. When an employee or the business owner uses their own vehicle for business trips they can claim an allowance for their mileage. Fully electric cars only.

To find out more check out the infographic in our blog claiming mileage expenses. The total mileage will be calculated for you and you can then make a reclaim. Using the advisory fuel rates above you can calculate what percentage of the business mileage rate applies to fuel and calculate the VAT on that element.

45p for cars and vans for the first 10000 miles. The RIFT mileage expenses calculator is the first step towards claiming your business mileage back from HMRC. Currently HMRC states that you can claim 45p per mile up to 10000 miles after which the rate drops to 25p if you drive a car or a van 24p for a motorcycle and 20p for a bicycle.

From tax year 2011 to 2012 onwards First 10000 business miles in the tax year. The Business Mileage Calculator gives you an estimated amount of business mileage tax rebate that you could be owed. Hybrid cars claim at the petrol or diesel rate.

The rate at which you. The Mileage Allowance Relief is based on HMRCs approved mileage rates. To calculate the approved amount multiply your employees business travel miles for the year by the rate per mile for their vehicle.

You can calculate car and car fuel benefits by. In that case a business will need to show HMRC that the input tax claimed relates only to business mileage and that none of the cost of private mileage is borne by the business. HMRC does not automatically pay mileage tax rebates instead you will need to submit an application to claim back the tax that is owed to you.

If you are keeping track of things yourself remember the HMRCs flat rates. Mileage tax relief is by far the largest part of most tax refund claims and refund claims can stretch back over 4 years so its not too late to get back the mileage expenses youre already owed.

Daily Mileage Worksheet Printable Worksheets And In Gas Mileage Expense Report Template Great Cretive Templates Professional Templates Gas Mileage Mileage

Daily Mileage Worksheet Printable Worksheets And In Gas Mileage Expense Report Template Great Cretive Templates Professional Templates Gas Mileage Mileage

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Business Checklist

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Business Checklist

Being Self Employed Means Doing It All One Way I Save My Sanity Is By Using Quickbooks Self Emplo Virtual Assistant Freelance Tools Virtual Assistant Business

Being Self Employed Means Doing It All One Way I Save My Sanity Is By Using Quickbooks Self Emplo Virtual Assistant Freelance Tools Virtual Assistant Business

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Templates Business Template

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Templates Business Template

Self Employed Guide How To Claim For Business Mileage

Self Employed Guide How To Claim For Business Mileage

Spreadsheet Free Gas Mileage Log Template Great Sheet Uk For With Regard To Gas Mileage Expense Report Template Mileage Free Gas Templates

Spreadsheet Free Gas Mileage Log Template Great Sheet Uk For With Regard To Gas Mileage Expense Report Template Mileage Free Gas Templates

11 Mileage Log Templates Doc Pdf Free Premium Templates

11 Mileage Log Templates Doc Pdf Free Premium Templates

Travel Expenses Per Mile Uk Travel Travel Cost United Kingdom Travel

Travel Expenses Per Mile Uk Travel Travel Cost United Kingdom Travel

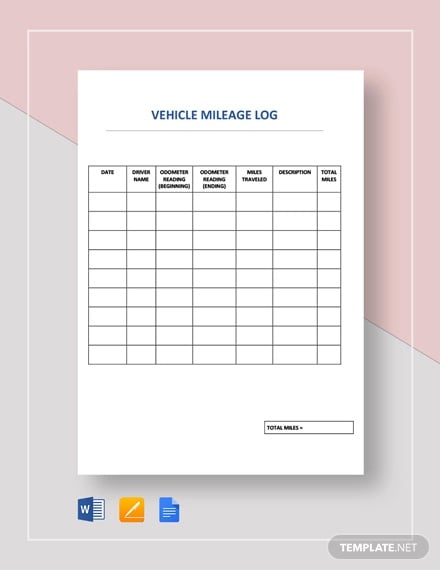

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Tracker Printable Mileage

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Tracker Printable Mileage

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Free Uk Mileage Log Excel Zervant Blog

Free Uk Mileage Log Excel Zervant Blog

Mileage Log Form For Taxes Inspirational Free Mileage Log Templates Blog Business Plan Template Business Plan Template Mileage

Mileage Log Form For Taxes Inspirational Free Mileage Log Templates Blog Business Plan Template Business Plan Template Mileage

3 Ways To Record Business Miles Wikihow

3 Ways To Record Business Miles Wikihow

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

Premium Vehicle Auto Mileage Expense Form Mileage Tracker Mileage Tracker Printable Mileage Tracker App

Premium Vehicle Auto Mileage Expense Form Mileage Tracker Mileage Tracker Printable Mileage Tracker App

Simple Mileage Log Free Mileage Log Template Download

Simple Mileage Log Free Mileage Log Template Download

How To Calculate Tonnage Tax Shipping Company Accounting Tax

How To Calculate Tonnage Tax Shipping Company Accounting Tax

How To Claim Business Mileage Why It S Ok For The Business

How To Claim Business Mileage Why It S Ok For The Business

Mileage Log Tracker Business Printable Direct Sales Organizer Etsy Direct Sales Planner Direct Sales Organization Mileage Tracker

Mileage Log Tracker Business Printable Direct Sales Organizer Etsy Direct Sales Planner Direct Sales Organization Mileage Tracker