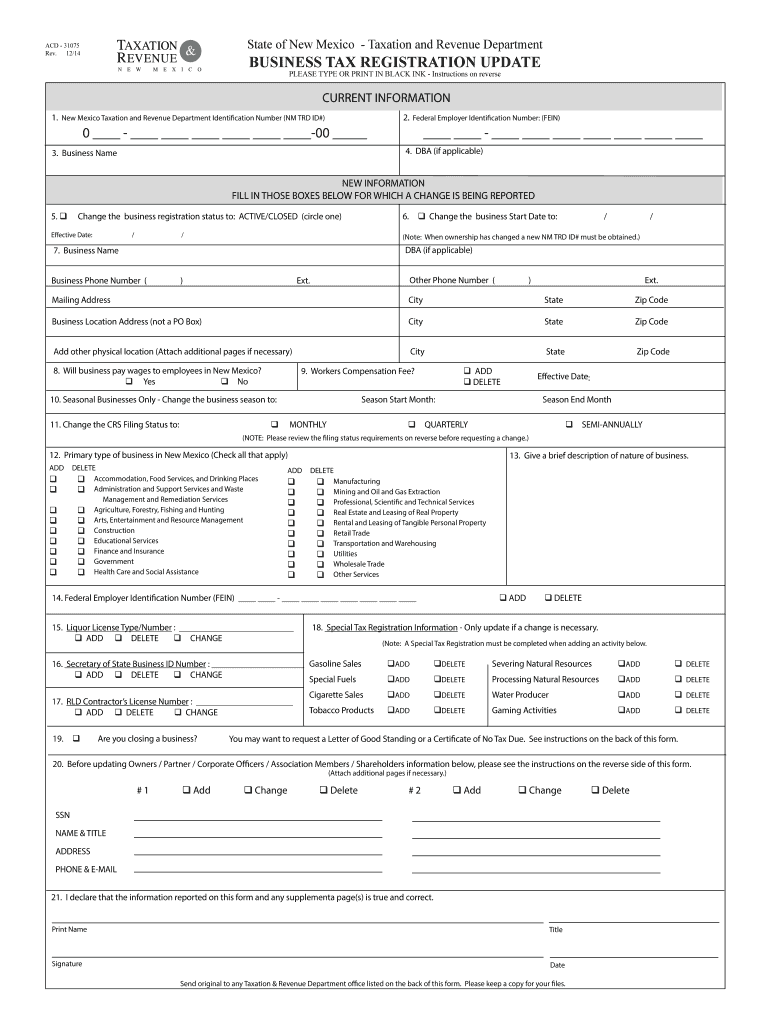

Nm Taxation And Revenue Business Tax Registration Update

This Business Tax Registration Application Update Form is for the following tax programs. If you have a tax-related question specific to your business you may contact the Department of Revenue for a response.

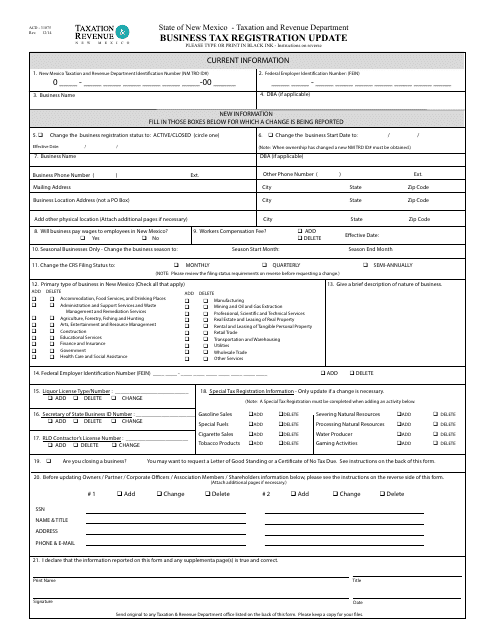

Update Business Name Address Or Agent

Update Business Name Address Or Agent

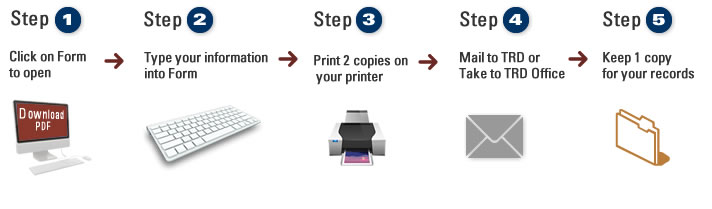

Others require a form to be downloaded completed and mailed or delivered to the relevant agency.

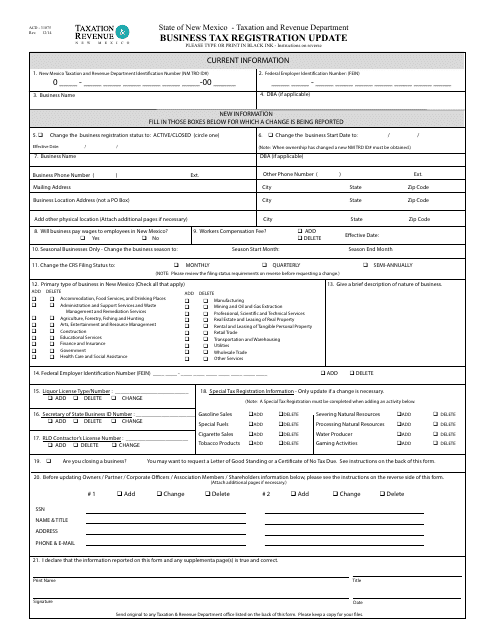

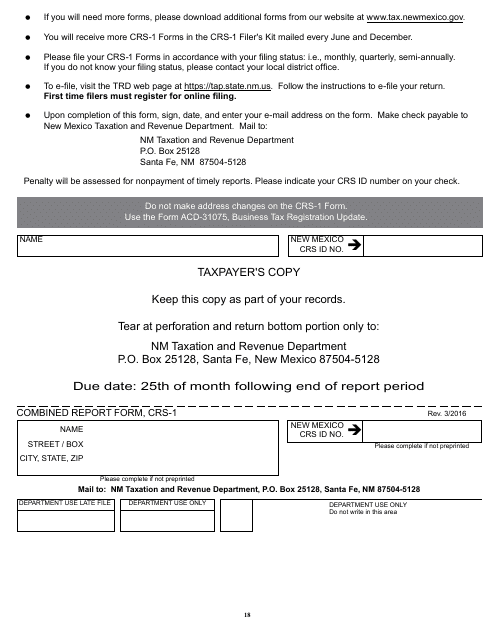

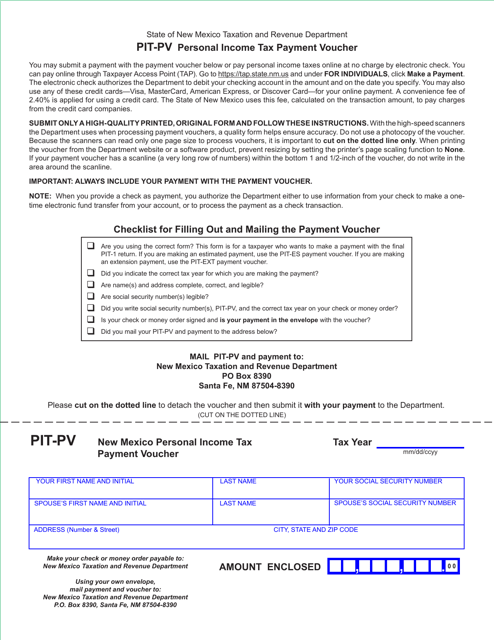

Nm taxation and revenue business tax registration update. 25TH OF THE MONTH FOLLOWING THE TAX PERIOD END DATE Do not make address changes on Form CRS-1. Use Form ACD-31075 Business Tax Registration Update to update any changes to your business. New Mexico Taxation and Revenue Department BUSINESS TAX REGISTRATION Application and Update Form Page 1 Section I.

Some changes can be made online. Gross Receipts Compensating Withholding Workers Compensation Fee Gasoline Special Fuels Cigarette Tobacco Products Severance Resource and Gaming Taxes. PAY STATE TAXES You must file a state tax return and if required pay state taxes on your business income.

Allow the pop-ups and double-click the form again. 0 - - 00- Date Issued. On Tuesdays and Wednesdays customers 79 and over can take advantage of special senior hours without an appointment from 800 1000 am.

Gross Receipts Compensating Withholding Workers Com-pensation Fee Gasoline Special Fuels Cigarette Tobacco Products Severance Resource and Gaming Taxes. Double-click a form to download it. Portions of such information may not be current.

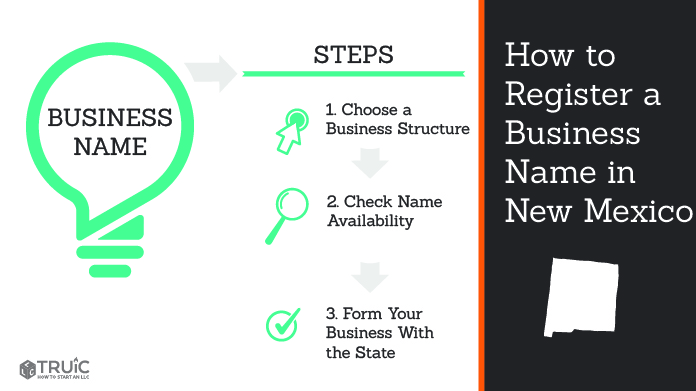

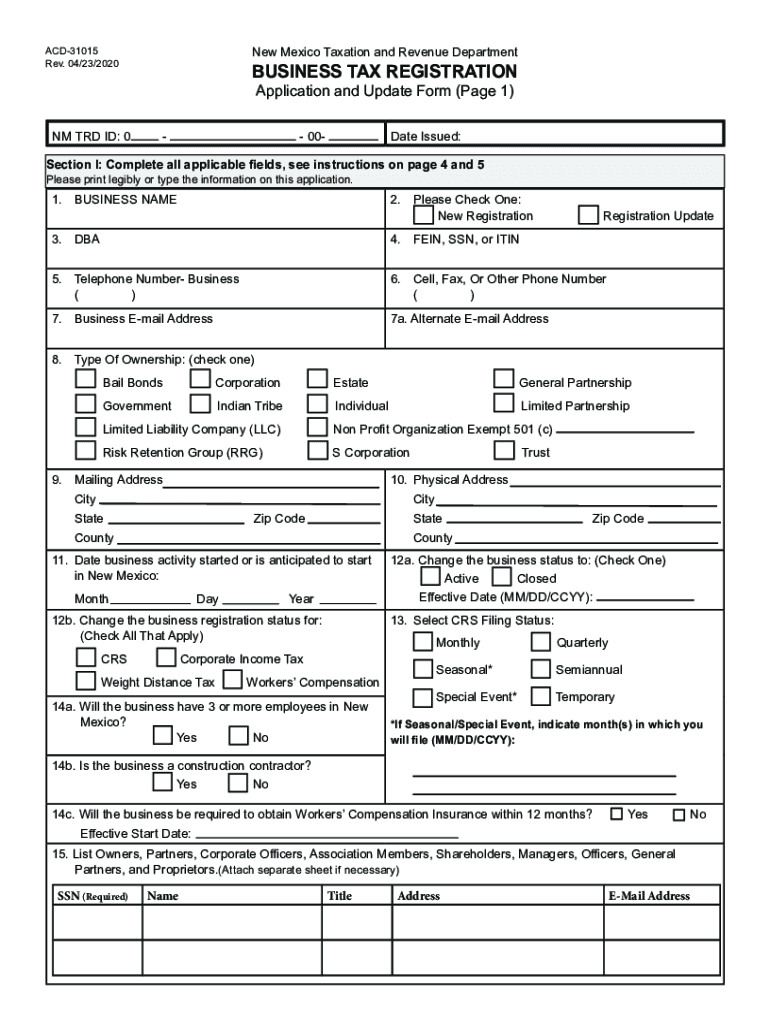

Register Your Business Anyone who engages in business in New Mexico must register with the Taxation and Revenue Department TRD. After registering you will receive a New Mexico tax identification number. Tax Clearance Request Form send to Department of Workforce Solutions.

0114 DEPARTMENT USE ONLY A. Select the BUSINESSES link for information on your business tax obligations to the state. Instructions on completing this form are also available You should change the business.

Control log number B. Submit Your Articles of Dissolution. You must complete and submit a form ACD-31015 Business Tax Registration.

New Registration Registration Update 3. The Department of Revenue reserves the right to revise and update this index at any time without notice. These steps will also change your businesss name in the Workers Compensation system.

Your browser may ask you to allow pop-ups from this website. New Mexico businesses are liable for many different types of state taxes and fees that are collected by the New Mexico Taxation and Revenue Department. For questions and inquiries please call 1-866-285-2996.

State of New Mexico - Taxation and Revenue Department AUDIT COMPLIANCE DIVISION REQUEST FOR TAX CLEARANCE ACD - 31096 REV. When you change your businesss name address registered agent qualifying party licensee in charge or other legal representative. Whether you are a small business owner a large multinational corporation a nonprofit organization or a sole proprietor these pages will help.

Complete a registration update Form ACD-31075 Business Tax Registration Update to cancel your account. We last updated the Business Tax Registration Update in February 2020 and the latest form we have available is for tax year 2019. New Mexico Taxation and Revenue Department ACD-31015 Rev.

Tax Clearance Request ACD-31096 and Business Tax Registration Update ACD-31075 send both forms to the New Mexico Taxation and Revenue Department. Go to the My Accounts page. Log into the New Mexicos Taxpayer Access Point TAP system select the TAP LOGIN link to access the system.

We may make an exception if your business is exempt from gross receipts withholding or compensating tax by state law. Please check this page regularly as we will post the updated form as soon as it is released by the New Mexico Taxation and Revenue Department. You can learn how to register your business file and pay your taxes either online or by paper return take certain tax credits change your contact information and close or sell your business.

Registration is required by New Mexico Statutes Section 7-1-12 NMSA 1978. NM Taxation and Revenue Department PO. For the best user experience on this website you should update.

Welcome to New Mexico Taxation. Select Edit and complete the form. Registration is required by New Mexico Statute Section 7-1-12 NMSA 1978.

Go to Names and AddressesBusiness Name page. Letter of Clearance send to New Mexico Secretary of State. You must update your business registration with the NEW MEXICO SECRETARY OF STATE select link your tax record with the NEW MEXICO TAXATION AND REVENUE select link and your unemployment insurance account with NEW MEXICO.

04232020 BUSINESS TAX REGISTRATION Application and Update Form Page 1 NM TRD ID. Box 25128 Santa Fe New Mexico 87504-5128 DUE DATE. Date Received Name of Taxpayer for Whom Clearance is Requested Doing Business as Street Address of Taxpayer Mailing Address of Taxpayer City Contact Name and Title.

To cancel or change an EAN you must contact the New Mexico Department of Workforce. New Mexico Motor Vehicle Division offices are open on an appointment-only basis and only for transactions that cannot be completed on line. This business tax registration application is for the following tax programs.

Complete all applicable fields see instructions on page 4 and 5 Please print legibly or type the information on this application. Complete all applicable fields see instructions on page 4 and 5 Please print legibly or type the information on this application. Information is provided on how to file and pay your taxes either online or by paper return take certain tax.

You must reactivate your account with the Department by completing the registration update should you become subject to the Workers Compensa-tion Act either by requirement or by election. Taxation and Revenue Department offices are currently closed to the public to reduce the spread of COVID-19. Expand the folders below to find what you are looking for.

This means that we dont yet have the updated form for the current tax year.

Tax Fraud Investigations Division Taxation And Revenue New Mexico

Tax Fraud Investigations Division Taxation And Revenue New Mexico

Online Services Taxation And Revenue New Mexico

Online Services Taxation And Revenue New Mexico

Https Www Tax Newmexico Gov Wp Content Uploads 2021 01 January Crs Redesign Release Ssc Pdf

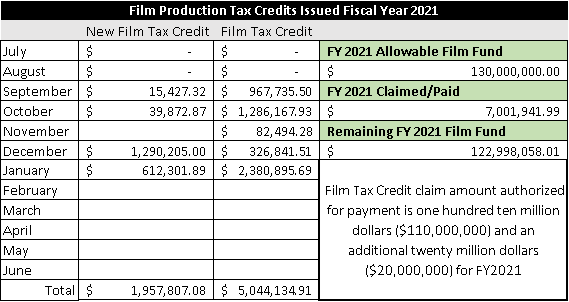

Film Production Tax Credit Tax Professionals

Film Production Tax Credit Tax Professionals

Home Taxation And Revenue New Mexico

Home Taxation And Revenue New Mexico

Administrative Services Division Taxation And Revenue New Mexico

Administrative Services Division Taxation And Revenue New Mexico

Fill Print Go Taxation And Revenue New Mexico

Fill Print Go Taxation And Revenue New Mexico

Https Www Tax Newmexico Gov Businesses Wp Content Uploads Sites 4 2021 02 Cab 01 App For Registration Rev 09 20 Pdf

How To Register A Business Name In New Mexico How To Start An Llc

How To Register A Business Name In New Mexico How To Start An Llc

News Alerts Taxation And Revenue New Mexico

News Alerts Taxation And Revenue New Mexico

![]() Update Business Name Address Or Agent

Update Business Name Address Or Agent

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report New Mexico Templateroller

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report New Mexico Templateroller

How To Choose Between Bonds Cds And Savings Accounts Family Money Saving Business Tax Economy Infographic

How To Choose Between Bonds Cds And Savings Accounts Family Money Saving Business Tax Economy Infographic

Form Acd 31075 Download Printable Pdf Or Fill Online Business Tax Registration Update New Mexico Templateroller

Form Acd 31075 Download Printable Pdf Or Fill Online Business Tax Registration Update New Mexico Templateroller

Https Www Tax Newmexico Gov Wp Content Uploads 2021 01 January Crs Redesign Release Ssc Pdf

2020 Form Nm Trd Acd 31015 Fill Online Printable Fillable Blank Pdffiller

2020 Form Nm Trd Acd 31015 Fill Online Printable Fillable Blank Pdffiller

New Mexico Taxation And Revenue Department Forms Pdf Templates Download Fill And Print For Free Templateroller

New Mexico Taxation And Revenue Department Forms Pdf Templates Download Fill And Print For Free Templateroller

How To Register For A Sales Tax Permit In New Mexico Taxvalet

How To Register For A Sales Tax Permit In New Mexico Taxvalet

2014 2021 Form Nm Trd Acd 31075 Fill Online Printable Fillable Blank Pdffiller

2014 2021 Form Nm Trd Acd 31075 Fill Online Printable Fillable Blank Pdffiller