Business Central 1099 Report

This one shows a SUMMARY of all payments with the 1099. 1099 reports will show data if the invoice that has a 1099 amount 1099 form box code as well was settled with a payment.

Vendor 1099 S In Dynamics 365 Business Central Western Computer Youtube

Vendor 1099 S In Dynamics 365 Business Central Western Computer Youtube

Change the code in the Data Item Number 2 - A Record as follows.

Business central 1099 report. Run the Report called Vendor 1099 Information -setting the date filters of course. This amount is the same as the value of the 1099 amount field. 1099Gs are available to view and print online through our Individual Online Services.

Delete the following line. Dynamics 365 Business Central will record 1099 transactions so you can report them at the end of the year. On the lines of many journals you cant enter an S-2 amount.

1099- R Tax Year 2019 V 1. The paper form to the vendor should be mailed by January 31 st of the following year. Businesses are required to register with the Ohio Secretary of State to legally conduct business in the State of Ohio this is commonly called a business license.

If its a corporation you can leave it blank. You can use the Tax 1099 detail report to view detailed 1099-S information. The report can be found in the vendor lists window under Reports General or within the vendor card under Report Vendor 1099 Information.

The codes are defined on the IRS 1099 Form Box page where you can also add new 1099 codes. 1099 Form Boxes. 1099s are issued to any vendor who received a check dated during the year reported.

The form information exported by this report is the same as the print reports for 1099 forms. The minimum reportable amount should match up to the IRS threshold on amounts of money that needs to be paid to a vendor in order for the vendors income to be reported. Generally 1099s are ready to process when all payables are paid through check date 1231 of the year to be reported.

This report includes all 1099 information for the vendors that been set up using the IRS 1099 Form-box tables. In this blog post we will walk you through some of the important steps related to 1099 report processing. Or expand the Array and add the new field array to the report.

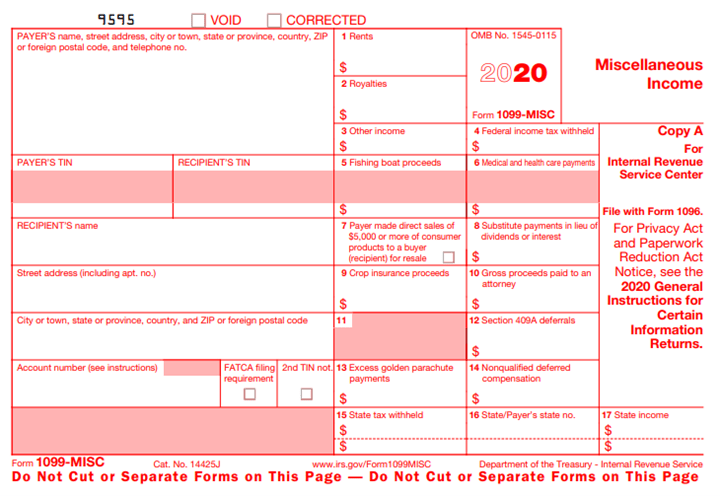

The 1099 documents respect the Minimum Reportable setting within the IRS Forms-Box setup while the 1099 Information report does not. These include 1099-DIV 1099-INT and 1099-MISC. Open Ledger for customer you need to report and add two Columns 1099 Code and 1099 Amount.

However you can enter S-2 details on the 1099 tab in these forms. Most regular 1099 vendors are MISC-03 or MISC-02 i cant remember. The 1099 Toolkit a Business Central add-in is the only tool available that allows you to prepare and print the 1099 forms right from Business Central and without the time-consuming manual preparation.

To update the magnetic media format change the code in the Vendor 1099 Magnetic Media report 10115. The report uses the codes that apply to the form amount boxes from the IRS 1099 Form-Box table. To review the 1099 vendor amounts you can use the Vendor 1099 Information report.

1099s are contingent upon check date not invoice date. The Ohio Department of Job and Family Services ODJFS this month is issuing 17 million 1099-G tax forms because of a federal law that requires reporting of unemployment benefits. The Ohio Department of Taxation follows the 1099-R specifications as required by the Internal Revenue Service and accepts CD-ROM as described below.

If you have had no employees and paid no wages for any calendar quarter you may file your quarterly Contribution and Wage Report by telephone. So look at the report section and the 1099 form and then see what box you want it in. Also you will need to add in their Tax ID and Federal ID No.

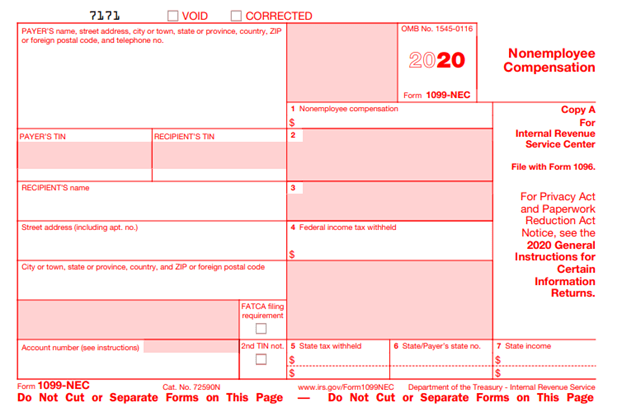

For each tax liable vendor you can then specify the relevant 1099 code on the Payments FastTab on the Vendor card. Use this report to electronically file federal 1099 forms. Business Central has added new 1099 Form Box codes NEC-01 MISC-14 and a new Vendor 1099 NEC form all of which are relevant for the reporting year 2020.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. In Business Central the most common 1099 codes are already set up for you so you are ready to generate the required reports. So if you have unsettledopen invoices that have 1099 codes and 1099 amounts they wont show up in the reports.

Thus you may see some vendors listed on the 1099 Vendor Information report that have 1099able amounts below the Minimum Reportable. Before users submit their reporting for 2020 users must first upgrade their Business Central to handle the new requirements by running the action Update Form Boxes on the 1099 Form-Boxes page. 1099 Reporting Businesses required to file with IRS and provide individual reports to recipients annually End-of-year process for Accounts Payable department.

Only the settled invoices with 1099 will show up. BEGIN MISC InvoiceEntrySETRANGE1099 CodeMISC-MISC-99. The toll free number is 1-866-44-UC-TAX 448-2829.

Ohio Business Central 100 of all filings needed to start or maintain a business in Ohio may now be submitted online. You will need to have both your ODJFS employer number and your federal employer identification number FEIN in order to file your report. The 1099 Form Boxes window stores the Minimum Reportable amounts for 1099s to be printed.

INSTRUCTIONS FOR FILING 1099-Rs. To do this follow these steps. But it will only record them if you have them set as a 1099 vendor.

Hope that helps everyone facing this problem. Edit these to match the 1099 code used and the 1099 Amount to report. FOR TAX YEAR 2019.

You will need to modify the report to accept the MISC code and then map it to one of the other valid codes for the box you want. Its new capabilities also make transitioning to the new 1099 NEC form quick and simple. You can elect to be removed from the next years mailing by signing up for email notification.

An individual 1099 report is associated with each 1099-S invoice. If you get one but did not apply for unemployment that is a major red flag that you might be the victim of.

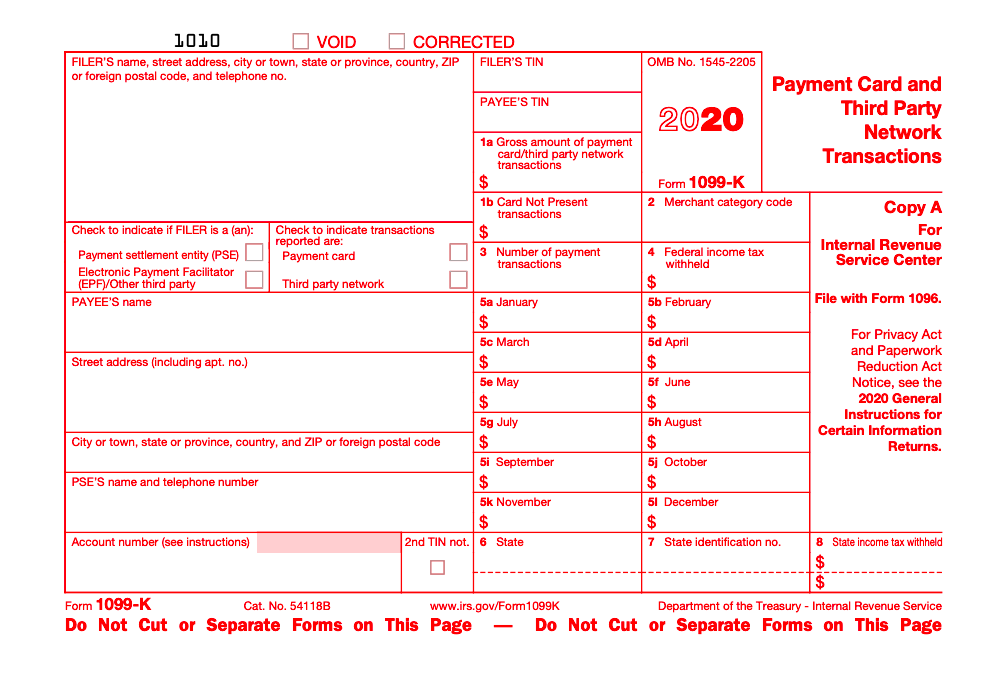

Form 1099 K Everything You Need To Know Bench Accounting

Form 1099 K Everything You Need To Know Bench Accounting

New 2020 Form 1099 Nec Non Employee Compensation Virginia Cpa

New 2020 Form 1099 Nec Non Employee Compensation Virginia Cpa

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

1099 Report Processing In Dynamics Ax 2012 R3

1099 Report Processing In Dynamics Ax 2012 R3

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

The Company Need To E File 1099 Int Form To Show The Interest To The Irs Http Www Onlinefiletaxes Com Income Tax Bookkeeping Services Accounting Services

The Company Need To E File 1099 Int Form To Show The Interest To The Irs Http Www Onlinefiletaxes Com Income Tax Bookkeeping Services Accounting Services

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

One Of My Calgb Trial Status Report Emails Project Organization Jewell Whistleblower

One Of My Calgb Trial Status Report Emails Project Organization Jewell Whistleblower

1099 Report Processing In Dynamics Ax 2012 R3

1099 Report Processing In Dynamics Ax 2012 R3

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

1099 Report Processing In Dynamics Ax 2012 R3

1099 Report Processing In Dynamics Ax 2012 R3

Have You Been Blowing Off Your Small Business Bookkeeping Check Out This List Of Small Business Bookkeepi Diy Crafts To Sell Diy For Teens Christmas Decor Diy

Have You Been Blowing Off Your Small Business Bookkeeping Check Out This List Of Small Business Bookkeepi Diy Crafts To Sell Diy For Teens Christmas Decor Diy

Coinbase To Issue 1099 Misc Removing Major Tax Headache

Coinbase To Issue 1099 Misc Removing Major Tax Headache

Understanding Your Form 1099 K Faqs For Merchants Clearent

Understanding Your Form 1099 K Faqs For Merchants Clearent

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

New 2020 Form 1099 Nec Non Employee Compensation Virginia Cpa

New 2020 Form 1099 Nec Non Employee Compensation Virginia Cpa