Can I Get My 1099 G Form Online Oklahoma

If you have any questions please submit them through the departments Online Customer Service Center. Federal state or local governments file Form 1099-G if they made certain payments or if they received Commodity Credit Corporation loan payments.

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Effective October 30 2020 the online system for 1099-G information DOR e-Services will no longer be available.

Can i get my 1099 g form online oklahoma. The IRS does not require you to submit a paper copy of your 1099-G form with your taxes. Click on View 1099-G and print the page. Oklahomans can contact dedicated hotline and online Virtual Agent to get 1099-G resolution.

If you would like to inquire about a a 1099-G form please report it to the Virtual Agent on the OESC Homepage. Tax All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. If your responses are verified you will be able to view your 1099-G form.

If the taxpayer itemized deductions on his federal return the refund may be taxable. The ability to access 1099-G information will transition to the Department of Revenues new online e-services system myPATH starting on November 30 2020. The Oklahoma Tax Commission issues a Form 1099-G to taxpayers who overpay state income taxes.

Click on View and request 1099-G on the left navigation bar. You can view or print your forms for the past seven years. To get started on the form use the Fill Sign Online button or tick the preview image of the form.

Form 1099-G reports the amount of income tax refunds including credits or offsets that we paid to you in a tax year if you itemized your federal deductions. You can elect to be removed from the next years mailing by signing up for email notification. The department is now providing Form 1099-G online instead of mailing them.

How to Get Your 1099-G online. Enter your official contact and identification details. Your local unemployment office may be able to supply these numbers by phone if you cant access the form online.

To obtain your 1099-G From from the Oklahoma Unemployment Security Commission you can visit this link httpsunemploymentstateokus to request the form online. Click on the down arrow to select the right year. If you cannot access your 1099-G form you may need to reset your password within IDESs secure website.

Log in to your UI Online account. Yes all current year Oklahoma individual income tax returns can now be filed electronically. Tips on how to fill out the 1099 g 2018-2019 form online.

Click here to see which software has been approved to support the filing of resident nonresident and part-year resident returns. Select the appropriate year and click View 1099G. We have proactively established a dedicated team and resources to help Oklahomans with their 1099-G tax form.

To request the form you would scroll down to the bottom of the page and click on Claimant Access and continue through the screens to request the 1099-G. OKLAHOMA CITY The Oklahoma Employment Security Commission OESC has launched a dedicated hotline and online Virtual Agent to assist Oklahomans who have questions regarding 1099-G tax forms they received from OESC. The lookup service option is only.

The advanced tools of the editor will guide you through the editable PDF template. You can view 1099-G forms for the past 6 years. In some cases the amount of the 1099G may not be the same amount as the actual refund the taxpayer received.

Top of Electronic Filing E-File 2. This means if you cant print the information out youll simply need to note the pertinent number to plug into the unemployment compensation block as well as any refunds or credits that apply. When you enter the homepage click on the Virtual Agent icon in the bottom right of the screen.

If the taxpayer claimed the standard deduction the refund is not taxable and he may disregard the form. The 1099G is issued by the Oklahoma Tax Commission and reflects the total amount of the income tax refund available for the tax year shown in Box 3 as a result of filing an Oklahoma tax return. If you received unemployment benefits in 2020 but did not receive a 1099-G form in the mail or cant access it online please call the available hotline at 405-521-6099.

The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. 1099Gs are available to view and print online through our Individual Online Services. Part or all of the refund could have been used to pay an outstanding liability owed to the State of Oklahoma.

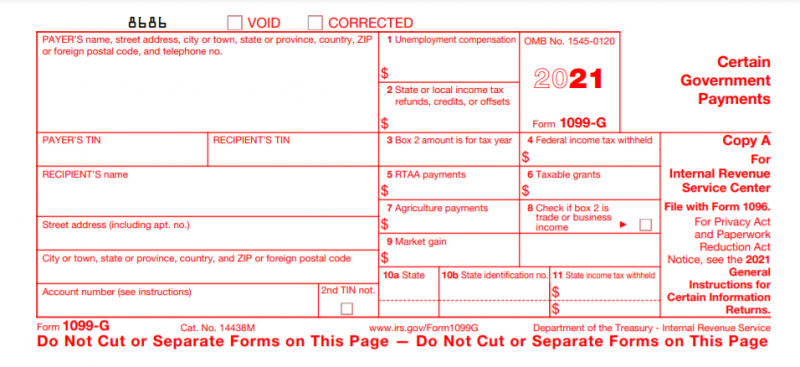

A new hotline is available for Oklahoma taxpayers who have questions about how unemployment benefits affect their tax returns. You may choose one of the two methods below to get your 1099-G tax form. Information about Form 1099-G Certain Government Payments Info Copy Only including recent updates related forms and instructions on how to file.

To access this form please follow these instructions. After the initial prompt select the Claimant option then 1099-G Form Inquiry. The dedicated hotline plus an online virtual agent will assist people in understanding the 1099-G tax forms they received from the Oklahoma Employment Security Commission.

What Is A 1099 Form 1099 Form 1099 Form Know How

What Is A 1099 Form 1099 Form 1099 Form Know How

Users Report Problems Accessing 1099 G Form On Florida S Unemployment Website

Users Report Problems Accessing 1099 G Form On Florida S Unemployment Website

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

1099 Form 2016 Understanding Your Tax Forms 2016 1099 G Certain Tax Forms Employment Form Job Application Form

1099 Form 2016 Understanding Your Tax Forms 2016 1099 G Certain Tax Forms Employment Form Job Application Form

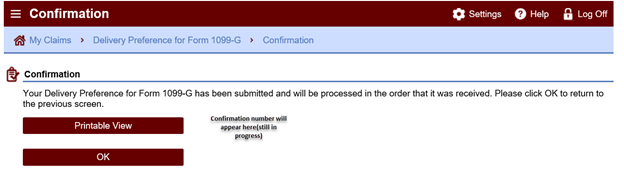

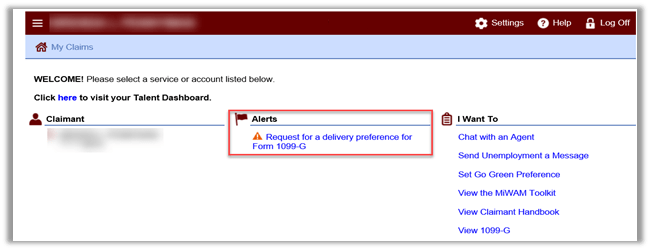

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

How To Fill Out An Irs 1099 Misc Tax Form Youtube

How To Fill Out An Irs 1099 Misc Tax Form Youtube

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

1099 G Form 4 Part Carbonless Zbp Forms

1099 G Form 4 Part Carbonless Zbp Forms

1099 G Form Copy C State Discount Tax Forms

1099 G Form Copy C State Discount Tax Forms

1099 G Form Copy A Federal Discount Tax Forms

1099 G Form Copy A Federal Discount Tax Forms

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

Performing 1099 Year End Reporting

Performing 1099 Year End Reporting

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

1099g Maryland Fill Online Printable Fillable Blank Pdffiller

1099g Maryland Fill Online Printable Fillable Blank Pdffiller

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

1099 G Form Copy B Recipient Discount Tax Forms

1099 G Form Copy B Recipient Discount Tax Forms