Does A Canadian Company Need To Fill Out A W8

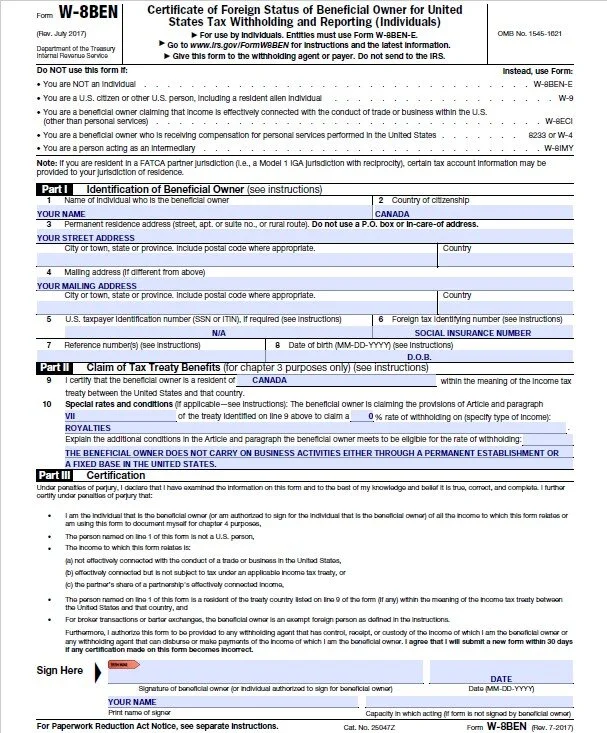

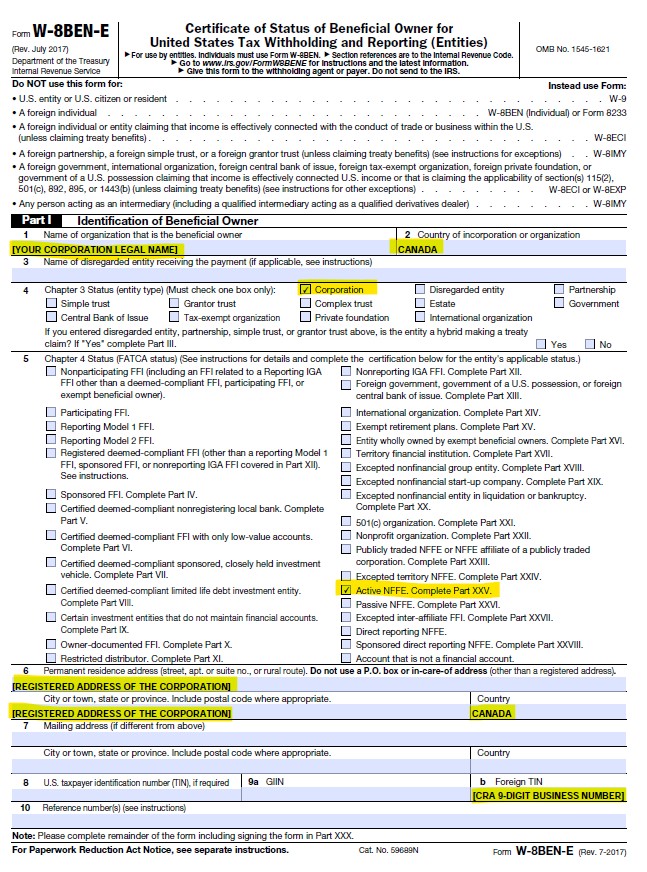

Private Canadian companies were among the first to face the new reporting requirements under FATCA and just like others were required to complete the new W-8BEN-E form in order to get paid by their US clients. In some cases Form W-9 is provided however Form W-9 should only be completed by US.

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

What you need to know about form w-8ben in Canada.

Does a canadian company need to fill out a w8. If youre a freelancer or sole proprietor and have started working with clients or customers in the US you might have been asked to complete a W8-BEN form. If you have a foreign contractor working for you that person will need to. If you make a payment to a US.

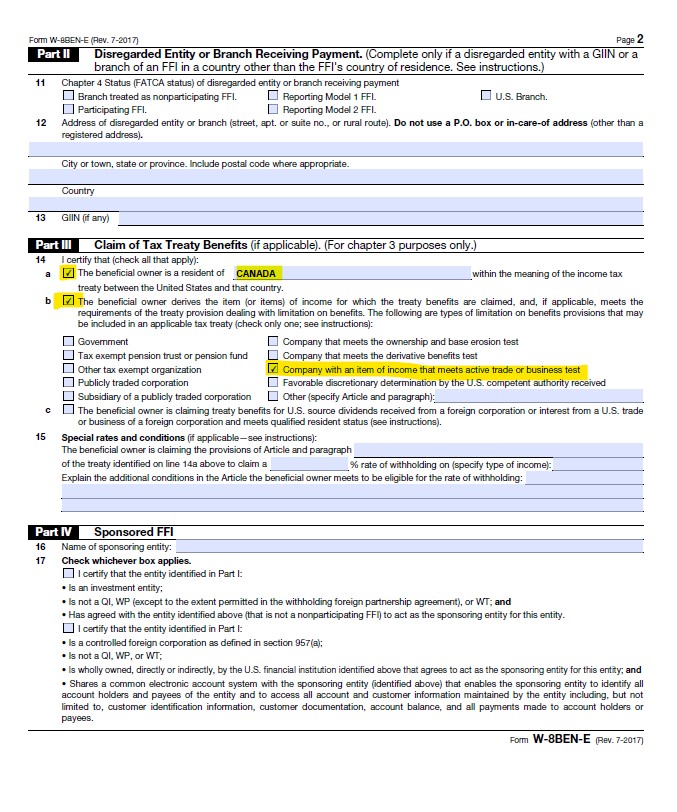

For most active Canadian companies the W8-BEN-E form will be used to determine that no withholding taxes should apply on the money paid to you due to the Canada US tax treaty. When paying foreign vendors must you get a W8 like you have to for W9 or can you pay without getting W8. The ITO will provide these forms after review of the Business Visitor Questionnaire.

Branch does not give you a Form W-8ECI. A new W-8BEN and Form 8233 must be provided each calendar year the tax treaty is claimed. You need to know that US entities are not supposed to pay you any invoice before you send them the W8 form correctly filled and signed so this is serious business.

Withholding agent who is requesting it from you. We are not sure which textboxes need to be checked off a-e and under 10 what we write for the article section and the text that applies. Sources must fill out the form but they can use it to claim exemption from withholdings due to income tax agreements between the US.

In order to determine its status the US. We have an EIN and are trying to fill out the W8-BEN formOur questions. 8 years ago.

W-8 BEN must be filled out by US non residents. I have a foreign supplier that does not want to fill out the form since they never have before with their US customers. Businesses working with customers across the border should now complete the proper paperwork and satisfy the enhanced FATCA provisions in order to avoid the 30 US tax withholding.

Note a sole proprietor not a corporation or partnership must use the W. Clients may request the Canadian business to complete Form W-8BEN W-8ECI W-8IMY or W-8EXP depending on the situation. We provide you with all the information you need in this article to fill out the W8 form and to.

He indicates the US source income mentioned in the W8 forms do not apply if you reside in a different country such as Canada to payments from US. Collect the appropriate W8 form from the organization. If you are resident in Canada and working for a US company and they ask for a W9 you should instead send them a W8 BEN or W8 24K views.

Dont skip the formDo not panic either. For example if your business operates out of one office located in Canada your firms fixed place of business PE is in Canada and should fill out a W-8BEN form to avoid the tax. If you are a self employed contractor working for a Canadian customer there is no equivalent of the W9.

Also are supplies an exception. This form must be submitted to the payer or the. There are four W8 forms available for foreign entities non-individuals.

You need to fill out a W-8 form instead of a W-9 if you live in Canada but do consulting work for an US company but if you live in US and do work as a. Canadian independent contractors earning income from US. Sellers who sell on Amazon Shopify eBay WooCommerce and other eCommerce platforms are often required to present this form to identify themselves as a foreign company in the US.

Provide this form before income is paid or credited to. How do we fill out Part II question 9 and 10. However if your firm operates out of two locations one located in Canada the other in the United States you possess two fixed places of business which will receive different tax treatment from the US.

Nonresidents must fill out when they earn income from US. Sources in order to determine their required tax withholdings. This is an important piece of paper as it ensures you.

Branch of a foreign bank or insurance company that does not provide a withholding certificate but has provided an EIN the payment is presumed to be effectively connected with the conduct of a trade or business within the United States even if the foreign person or its US. Otherwise you do not need to fill the forms and the money is not taxable. Form W-8BEN is a tax form that US.

Failure to provide a Form W-8BEN when requested may lead to withholding at a 30 rate or the. We are a Canadian software company selling into the USA. Form W-9 is used to gather information only from US persons and businesses.

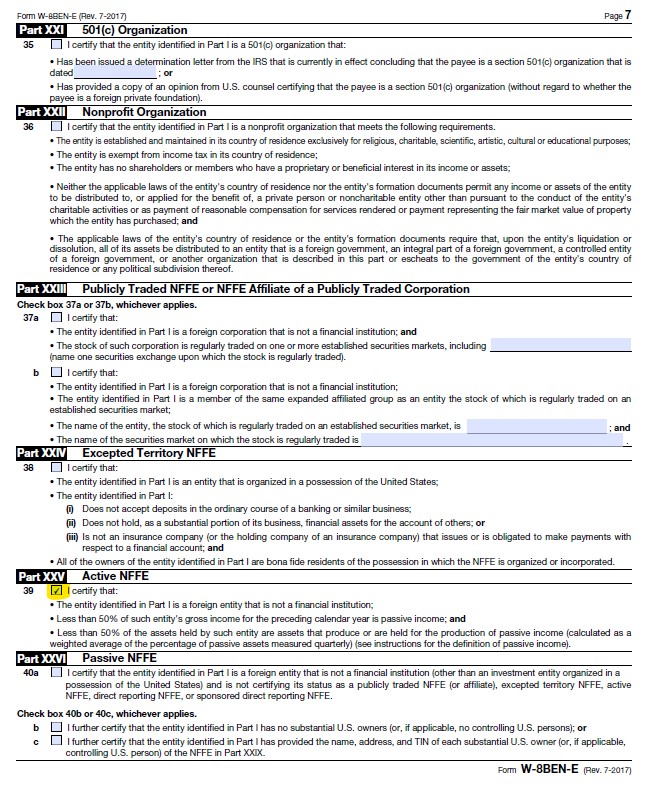

We frequently receive requests to assist with filling out the form W-8BEN-E from Canadian eCommerce sellers. By stating that youre an Active NFFE Part XXV in the 2016 version of the form youre stating that youre not a financial institution and that more than half of your income was produced from active business in Canada. The requirement seems to be that you submit the form if you have an office in the US or own operating equipment there.

A W-8BEN and Form 8233 are both usually required in the event that a treaty benefit is being claimed for services income.

How To Fill Out A W8 Ben E Liveca Llp

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer

How To Fill W 8ben E Tax Form Private Limited India Uk Canada Australia

How To Fill W 8ben E Tax Form Private Limited India Uk Canada Australia

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben Fill Out And Sign Printable Pdf Template Signnow

W 8ben Fill Out And Sign Printable Pdf Template Signnow

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer

Https Www Privatebank Citibank Com Taxinformation Docs Guidelinesw 8ben E Fatcaentityclassification Pdf

W 8ben Form Instructions For Canadians Cansumer

W 8ben Form Instructions For Canadians Cansumer

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8

How To Complete W 8ben E Form For Business Entities Youtube

How To Complete W 8ben E Form For Business Entities Youtube