How Do I Get A Replacement 1099 R

You can also update your mailing address permanently using a separate online form. Following the three steps provided below will present you with a range of options in selecting a variety of tax forms such as 1099 1099R 1099-INT among others.

Https Www Osc Ct Gov Docs 1099faq Pdf

Contact the payer and ask the individual or company to send you a new copy if you have lost your Form 1099 by accident.

How do i get a replacement 1099 r. If you dont already have an account you can create one online. Click 1099-R Summary under My Payroll Information. With all of the turmoil in the Postal Service and planned closings of processing facilities they may come a little later from now on.

Go to Sign In or Create an Account. Online Ordering for Information Returns and Employer Returns. You can call OPM or download a copy from OPM Services Online if you have an access code.

You can also call them and request that they send a copy of your Form 1099-R at 888 767-6738. Replacement forms will be mailed to the retirees address on file within 24-48 business hours of receipt of the request. Each year by January 31 a Form 1099-R similar to Form W-2 Statement of Income and Tax Withheld that you received annually while you were working will be sent to you.

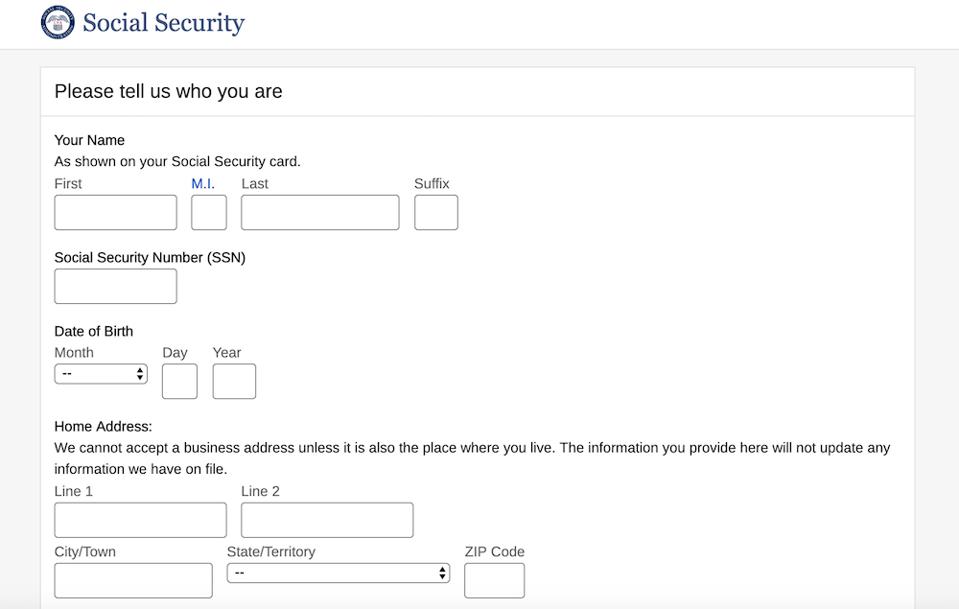

Click My Account Login in the upper right corner. If you currently live in the United States and you need a replacement form SSA-1099 or SSA-1042S we have a new way for you to get an instant replacement quickly and easily beginning February 1st by. If you live in the United States and you need a replacement form SSA-1099 or SSA-1042S simply go online and request an instant printable replacement form through your personal my Social Security account.

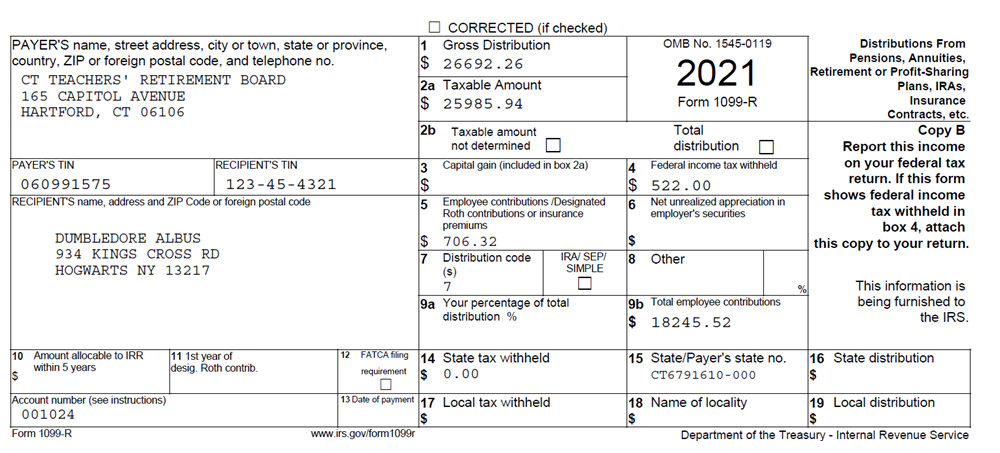

Establish change or stop an allotment to an organization. The images displayed below are from an example account with hypothetical numbers and are. Edited 3232020 213 pm CDT - updated link.

To get a copy of a 1099-R from a pension annuity or IRA administrator you will need to contact the administrator for that retirement fund. An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS. How to request your 1099-R tax form by mail.

Typically you will receive a 1099-R by the end of January each year. Using your online my Social Security account. You have several options for requesting a replacement.

Click Proceed to Login button if you have an ERS OnLine account or select Register now if you do not have an account. If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online call our toll-free number at 1-800-772-1213 or visit your Social Security office. My address has changed and I have not received my 1099 Form.

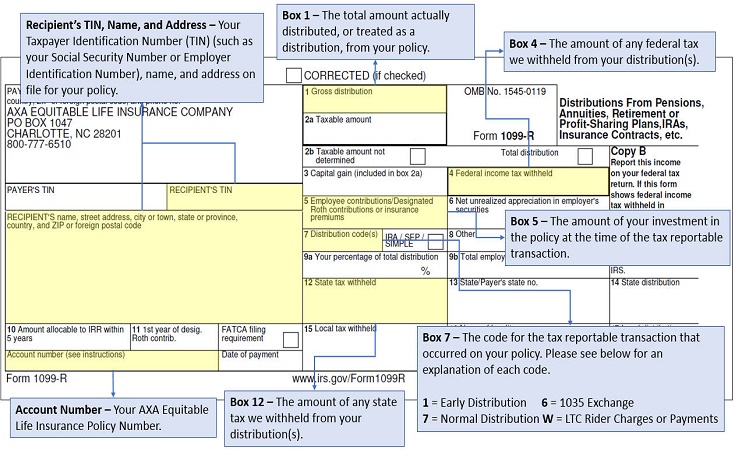

Shown on the Form 1099-R are the amount of your retirement benefits the taxable portion if any the amount of tax withheld if any and related information. Start change or stop Federal and State income tax withholdings. Your 1099R will be in the mail to you within 7 to 10.

Request a duplicate tax-filing statement 1099R. Well send your tax form to the address we have on file. Replacement 1099-R or 1099-INT forms can be obtained by contacting OSC Customer Service at 860-702-3480 or email to.

Change your Personal Identification Number PIN for accessing our automated systems. What do I need to do. Retirees who did not receive their 1099-R have questions about their 1099-R form or need to update their mailing address may contact Defense Finance and.

Change your mailing address. Follow the prompts to access your 1099-R. You can verify or change your mailing address by clicking on Profile in the menu and then clicking on the Communication tab.

Publication 1220 PDF Specifications for Filing Forms 10971098 1099 3921 3922 5498 8935and W2-G Electronically PDF Additional Publications You May Find Useful. If you are deaf or hard of hearing call our toll-free TTY number 1-800-325-0778 between 800 am. All Revisions for Form 1099-R and Instructions.

Sign in to your account click on Documents in the menu and then click the 1099-R tile. You can download your Form 1099-R by logging into your account online. Heres how to get your tax forms once youve logged in to your Prudential Retirement account.

The IRS computer might end up thinking you had twice the income you really did. A replacement SSA-1099 or SSA-1042S is. You can request your 1099R sent to your address of record or to a one-time seasonal address.

To get a replacement copy please see the Social Security Administration on this webpage that describes how to get a replacement form. Use Services Online Retirement Services to. If you are having a hard time finding your military or retirement W-2 or 1099R dont worry they are always available online on the Defense Finance and.

Step 2 Contact the payer or institution and ask a representative if your Form 1099 has been sent if you are expecting a Form 1099 and have not received it by January 31.

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

How Do I File A Substitute 1099r Using Form 4852

How Do I File A Substitute 1099r Using Form 4852

Taxes 1099 R Public Employee Retirement System Of Idaho

Taxes 1099 R Public Employee Retirement System Of Idaho

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Need A Copy Of Your Social Security Form For Tax Season Here S How To Get One

Need A Copy Of Your Social Security Form For Tax Season Here S How To Get One

Get A Replacement W 2 Or 1099r Military Com

Get A Replacement W 2 Or 1099r Military Com

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

State Of Nj Department Of The Treasury Njdpb

State Of Nj Department Of The Treasury Njdpb

Opers Tax Guide For Benefit Recipients

Opers Tax Guide For Benefit Recipients