How To Get Unemployment 1099 Form Virginia

Box 26441 Richmond VA 23261-6441. You will need to add the payments from all forms when.

Striking A Balance Between Saving And Making Debt Payments Us Dollars External Debt Money Laundering

Striking A Balance Between Saving And Making Debt Payments Us Dollars External Debt Money Laundering

Your local office will be able to send a replacement copy in the mail.

How to get unemployment 1099 form virginia. The tax year of your return. Once NYSDOL receives your completed Request for 1099-G Review form it will be reviewed and we will send you an amended 1099-G tax form. Click on the down arrow to select the right year.

Look up your 1099G1099INT. To look up your Form 1099-G1099-INT online youll need the following information from your most recently filed Virginia tax return. Unemployment Compensation Benefit Rate Table.

Follow the instructions on the bottom of the form. You may access your IRS Form 1099-G for UI Payments for current and previous tax years on MyUI portal by entering your social security number and four-digit personal identification number PIN. You may send the form back to NYSDOL via your online account by fax or by mail.

RTAA benefits are also reported on a separate form. If joint return filed for tax year. This 1099-G does not include any information on unemployment benefits received last year.

Log in to your UI Online account. 31 there is a chance your copy was lost in transit. Some taxpayers who collected unemployment benefits in 2020 and filed their returns in the early days of tax season may have to file an amended return to get their maximum refund.

Look for the 1099-G form youll be getting online or in the mail. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. If you disagree with any of the information provided on your 1099-G tax form you should complete the Request for 1099-G Review.

It will be deducted from the. It is possible you may receive more than one 1099-G form. Scroll down to the last option Miscellaneous Income 1099-A 1099-C and Start.

Heres how you enter the unemployment. This information is also sent to the IRS. Your adjusted gross income Line 1 If you filed a part-year return add together the amounts from both columns Line 1.

After each calendar year during which you get Unemployment Insurance benefits we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. Then you will be able to file a complete and accurate tax return. If you havent received your 1099-G copy in the mail by Jan.

Line 1 Adjusted Gross Income from your last filed 760 760PY or 763 Virginia return. Unemployment is taxable income. Choose the last option Other reportable income and Start and Yes.

Virginia Relay call 711 or 800-828-1120. If 760PY return add both columns of line 1. If you received unemployment compensation during the year you should receive Form 1099-G from your states unemployment office.

PUA will be reported on a separate form from any UC including PEUC EB TRA that you may have received. Key2Benefits Schedule of Card Fees. Open or continue your tax return in TurboTax online.

Search for unemployment compensation and select the Jump to link. Tax specialist Chadwick Elliot of the Denver Tax Group says anyone with errors on government-issued forms. Disaster Unemployment Assistance FAQ.

To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. Call your local unemployment office to request a copy of your 1099-G by mail or fax. The amount you paid back will need to go in this line.

On the Did you receive unemployment or paid family leave benefits in 2020. Click on View 1099-G and print the page. Add more income by scrolling down to the last option Less Common Income and Show more.

To look up your 1099GINT youll need your adjusted gross income from your most recently filed Virginia income tax return Line 1 or the sum of both columns of Line 1 for a part-year return. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. You should get your 1099-G in the mail by January 31 but you can always access it online.

Please provide one of. If you received unemployment compensation from a union private voluntary fund or as a state employee you might not get a 1099-G. That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax breaks like the earned income tax.

19 hours agoYou can also find a form on the CDLE website where you can request a corrected 1099-G. Request Your 1099 By Phone To request a copy of your 1099-G or 1099-INT by phone please call 304 558-3333. Top 10 Things You should Know about Unemployment Compensation.

If you received a 1099-G from the Virginia Employment Commission for the tax year 2020 and want to request a corrected form 1099-G be sent to you and the IRS you will need to submit your request in writing to the address listed below. If there is a problem with your PIN you can also access your form by selecting IRS Form 1099-G for UI Payments then enter other credentials. This is the fastest option to get your form.

Click on View and request 1099-G on the left navigation bar. From the left menu go to Federal and select the first tab Wages Income. Your Social Security number If you filed jointly youll also need your spouses SSN.

There will be a question on your tax form that will ask if you paid any unemployment back in the tax year 2020. Notice regarding federal income tax withholding debit cards and personal identification numbers WVUC-D-128 Form. The 1099 reflects all payments processed out to you for the current tax year 2020.

You can view 1099-G forms for the past 6 years.

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

1099 G Tax Form Causing Confusion For Some In Kentucky 13newsnow Com

1099 G Tax Form Causing Confusion For Some In Kentucky 13newsnow Com

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Vec Continues To Send Mistaken Unemployment Tax Forms Chesapeake Retiree Gets 18k Statement Wavy Com

Vec Continues To Send Mistaken Unemployment Tax Forms Chesapeake Retiree Gets 18k Statement Wavy Com

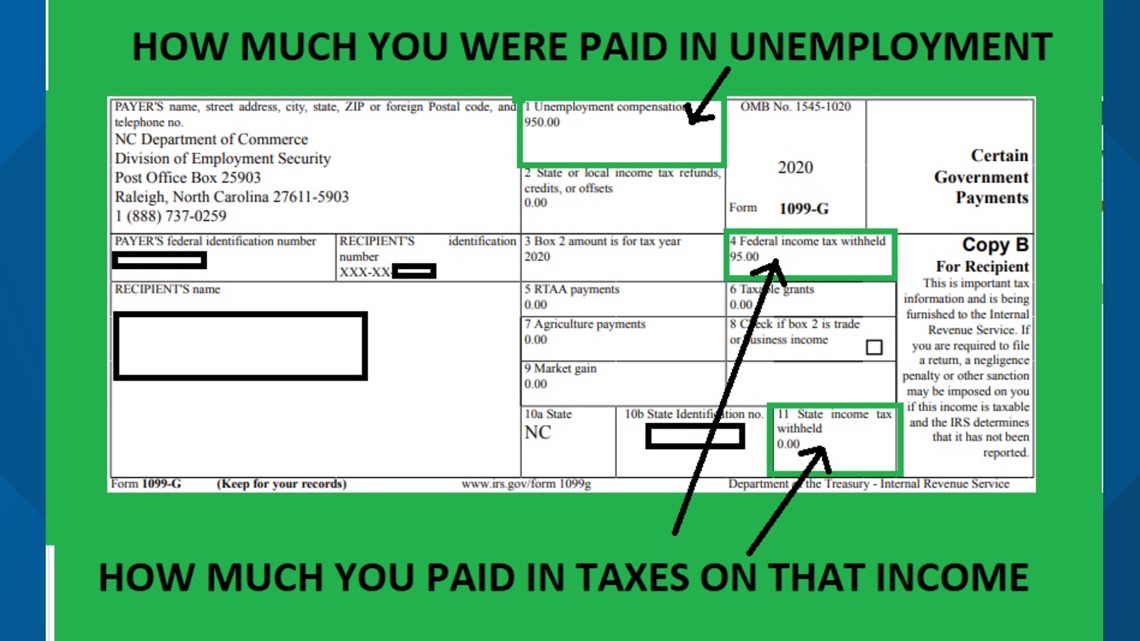

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

New Income Tax Table 2020 Philippines Tax Table Income Tax Income

New Income Tax Table 2020 Philippines Tax Table Income Tax Income

Https Www Vec Virginia Gov Printpdf 1099

State Tax Department No Longer Sending 1099s Wvpb

State Tax Department No Longer Sending 1099s Wvpb

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Didn T Receive A Form 1099 Don T Ask

Didn T Receive A Form 1099 Don T Ask

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition