How To Send 1099 To Employees

You must send a 1099-NEC form to any non-employees to whom you paid 600 or more during the year. If you sold physical products subtract your returns and cost of good sold to get your gross income.

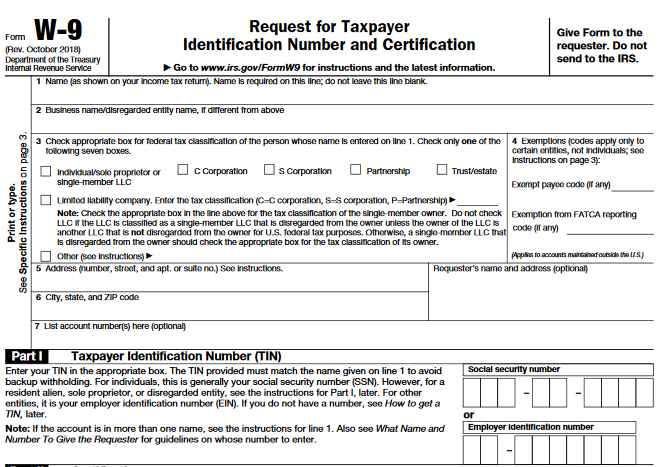

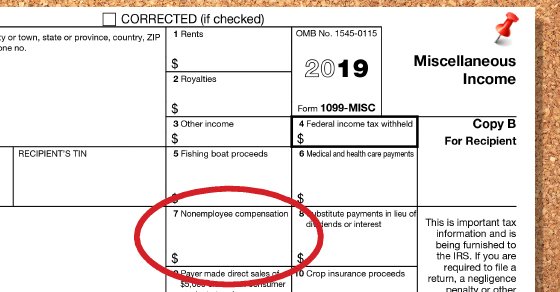

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

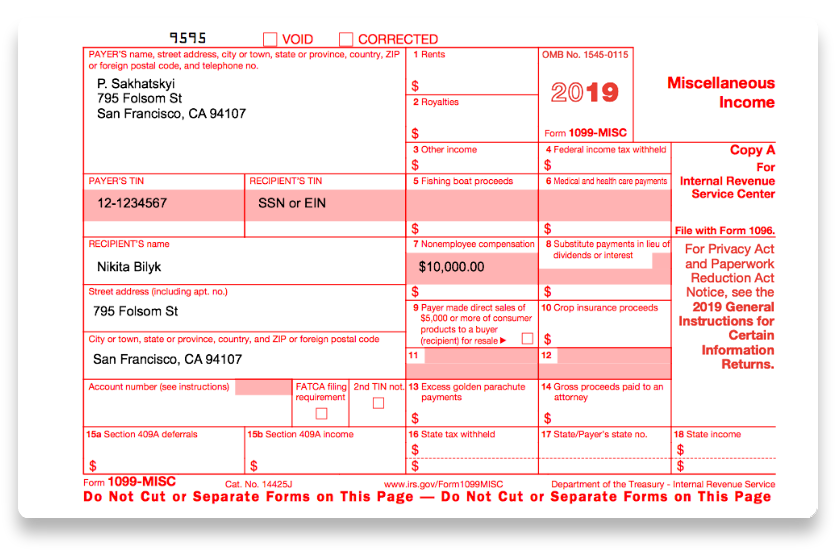

Send Copy A to the IRS.

How to send 1099 to employees. Determine who is a contractor. The IRS uses three categories to evaluate 1099 employee vs W2 employee relationships. The first step is determining which of the people you work with are contractors and which are employees.

The IRS will also send you a Form 4852 PDF Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc along with a letter containing instructions. If you hire 1099 workers directly rather than through an employment agency you will need to set up the following IRS paperwork. How to file a 1099 form.

This form is NOT used for employee wages and salaries. If youre using a 1099 employee you will first want to create a written contract. To file 1099s with the IRS electronically through the FIRE system youll need a Transmitter Control Code TCC which can be requested via Form 4419.

If you do not receive the missing form in sufficient time to file your tax return timely you may use the Form 4852 to complete. To get more time to send 1099-MISCs to contractors you can send a letter to the IRS requesting an extension. Assuming you pay your contractor more than 600 in any calendar year you will need to send a copy of the 1099-NEC to the contractor and the IRS by January 31.

Independent contractors use a 1099 form and employees use a W-2. Follow these steps to prepare and file a Form 1099. Form 1099-NEC Nonemployee Compensation is transmitted with Form 1096 Annual Summary and Transmittal of US.

This category analyzes who has control ie what and how the 1099 employee does his or her job. Fill out the 1099. Heres a brief rundown of how to fill out Schedule C.

A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made. Obtain a blank 1099 form which is printed on special paper from the IRS or an office supply store. NEC stands for non-employee compensation and Form 1099-NEC includes information on payments you made during the previous calendar year to non-employees.

This is a cover sheet for paper submissions. Actually youll likely need to submit two extension requests. Review your 1099 Forms and make sure that the information brought over from QuickBooks Online is correct.

Annual Summary and Transmittal of US. If you choose to mail your 1099-NEC Copy A to the IRS be sure to include Form 1096. Pick all or select only the 1099 forms you want to submit.

The separate instructions for filersissuers for Form 1099-NEC are available in the 2020 Instructions for Forms 1099-MISC and 1099-NEC. This category examines benefits. One for sending your 1099-MISCs to contractors and one for your IRS filing.

If you need help with employee classification or filing the appropriate paperwork post your need in UpCounsels marketplace. Contractors are responsible for paying their own payroll taxes and submitting them. If you pay them 600 or more over the course of a year you will need to file a 1099-MISC with the IRS and send a copy to your contractor.

After preparing your 1099s select the E-File for me option. For W-2 employees all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer. Each Form 1099 comes with 5 copies so make sure to write or type on the top copy so it transfers.

Information Returns which is similar to a cover letter for your Forms 1099-NEC. Calculate your gross income by adding up all the income from your 1099 forms and any employer who paid you less than 600. Your letter must include the name TIN address and signature of the payer as well as the type of return a statement that the extension is being requested.

Verify your 1099 Forms then choose Continue. Forms 1099 and W-2 are two separate tax forms for two types of workers. Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return.

This category explores how the 1099 employee is paid expense reimbursement and buyer of supplies. Use Form W-2 to report these payments. How to file Schedule C for 1099-MISC.

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Misc Form Reporting Requirements Chicago Accounting Company

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

What Is A 1099 Employee And Should You Hire Them Employers Resource

What Is A 1099 Employee And Should You Hire Them Employers Resource