What Is General Business Credit Form 3800

Please review Form 3800 Instructions for more information. The individual credits are tallied up separately on their individual forms each calculated under its own set of rules.

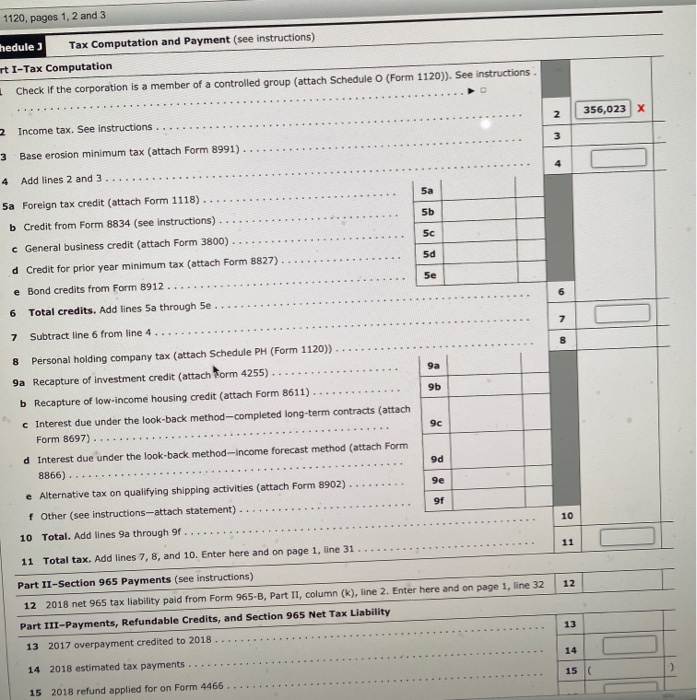

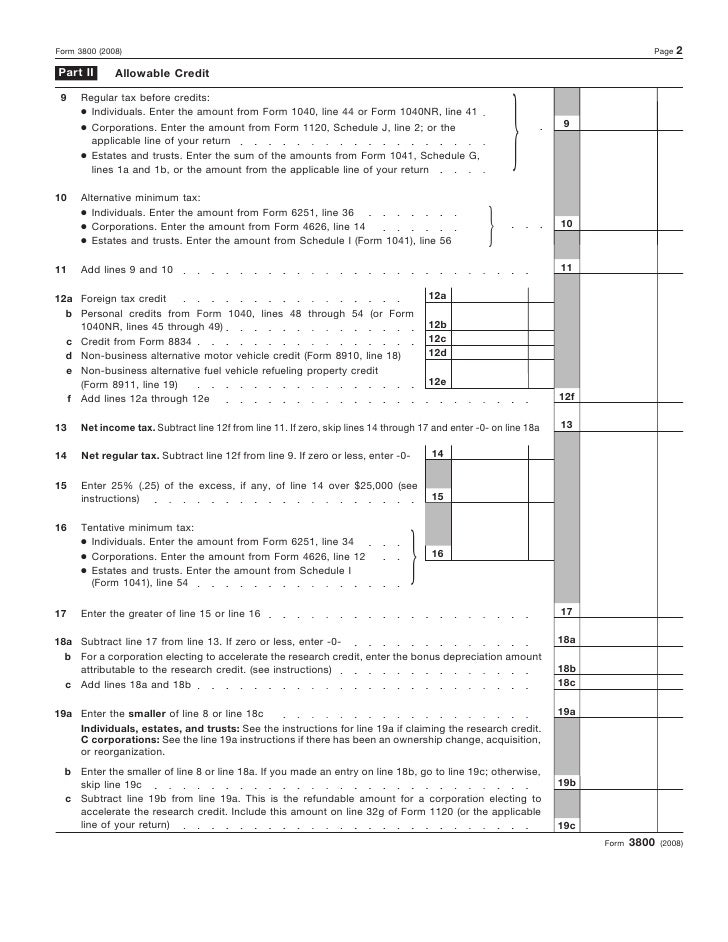

Instructions Form 1120 Pages 1 2 And 3 Form 1120 Chegg Com

Instructions Form 1120 Pages 1 2 And 3 Form 1120 Chegg Com

What is the General Business Credit Form 3800.

What is general business credit form 3800. File Form 3800 to claim any of the general business credits. Some common tax credits apply to many taxpayers while others only apply to extremely specific situations. 38 limitation is calculated on Form 3800 General Business Credit.

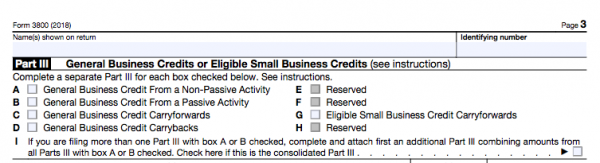

Department of the Treasury Internal Revenue Service 99 General Business Credit. Therefore the order in. Carryback and Carryforward of Unused Credit The carryforward may have to be reduced in the event of any recapture event change in ownership change in use of property etc.

For instructions and the latest information. If a section 1603 grant is. Passive or nonpassive current year credits.

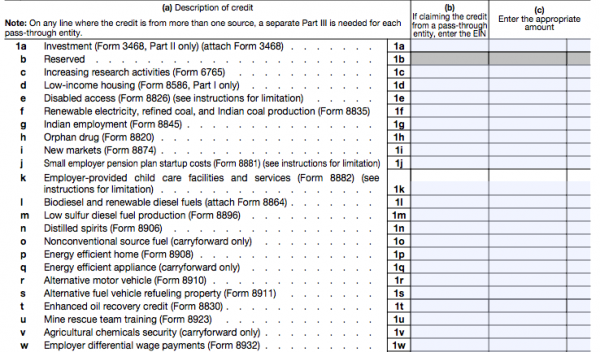

The credits supported by our program that will populate on this form are. 25 of your regular income tax liability after other credits over 25000. Youll figure each sub-investment credit separately.

There are two principal methods for entrepreneurs to save lots of on their small-business taxes. For each credit attach a statement showing the tax year the credit originated the amount of the credit reported on the original return and the amount of credit allowed for that year. To claim credits carried over from a prior year taxpayers must provide details.

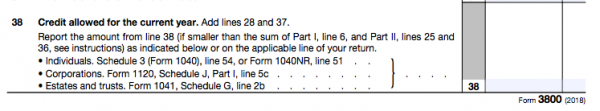

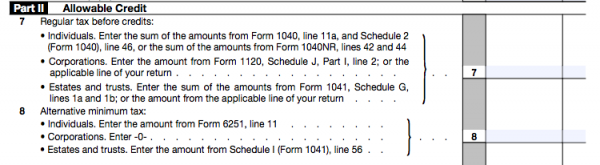

2 days agoNerdWallet - Here are step-by-step instructions for IRS Form 3800 for entrupeneurs claiming small-business tax credits. You must file Form 3800 to claim any of the general business credits. It is the taxpayers net income tax the sum of regular tax and alternative minimum tax less any other allowable credits over the greater of 1 tentative minimum tax or 2 25 of the taxpayers regular tax in excess of 25000.

The General Business Credit Form 3800 calculates the total amount of tax credits youre eligible to claim in a particular tax year. The IRSs website currently lists 25 eligible business credits although this can change from year to year. The investment credit is also made up of several different credits.

A method is to Form 3800 Instructions. You must attach all pages of Form 3800 pages 1 2 and 3 to your tax return. The general business credit Form 3800 is made up of many other credits like.

General Business Credit Form 3800. Using this program there is no direct entry into form 3800. Here are step-by-step instructions for IRS Form 3800 for entrepreneurs claiming small-business tax credits.

The tentative AMT from Form 6251. Form 3800 is a Federal Corporate Income Tax form. General Business Credit - Form 3800 While the name is singular the general business credit form consists of numerous credits that may be taken by an individual who qualifies for the credit.

There are two main ways for entrepreneurs. How to Fill out the General Business Credit Form - Options Call Today. The resulting combined credit is carried over to the General Business Tax.

In some cases each credit must be claimed on its own unique form the source form. General business credits reported on Form 3800 are treated as used on a first-in first-out basis by offsetting the earliest-earned credits first. Credits are aggregated according to several criteria.

About Form 3800 General Business Credit. States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar-for-dollar reduction of tax liability. How to Fill out the General Business Credit Form - NerdWallet - Flipboard.

The General Business Credit Form 3800 is used to accumulate all of the business tax credits you are applying for in a specific tax year to come up with a total tax credit amount for your business tax return. Your limit for the general business credit on Form 3800 is your regular tax liability after tax credits other than the general business credit plus actual AMT liability from Form 6251 if any minus whichever of the following is larger. Complete Form 3800 and the source credit form for each specific credit you claim.

IRS Form 3800 instructions state that they can be carried forward for 20 years but then may be taken as a deduction in the tax year following the last tax year of the 20-year carry forward period Do I have to get TurboTax to override some sections of Form 3800 in order to finally claim the 20 year old credits in spite of ongoing tentative minimum tax limits. If you claim multiple business credits then our program will draft Form 3800 General Business Credits onto your return.

Form 3800 General Business Credit 2014 Free Download

Form 3800 General Business Credit 2014 Free Download

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Fill Online Printable Fillable Blank Pdffiller

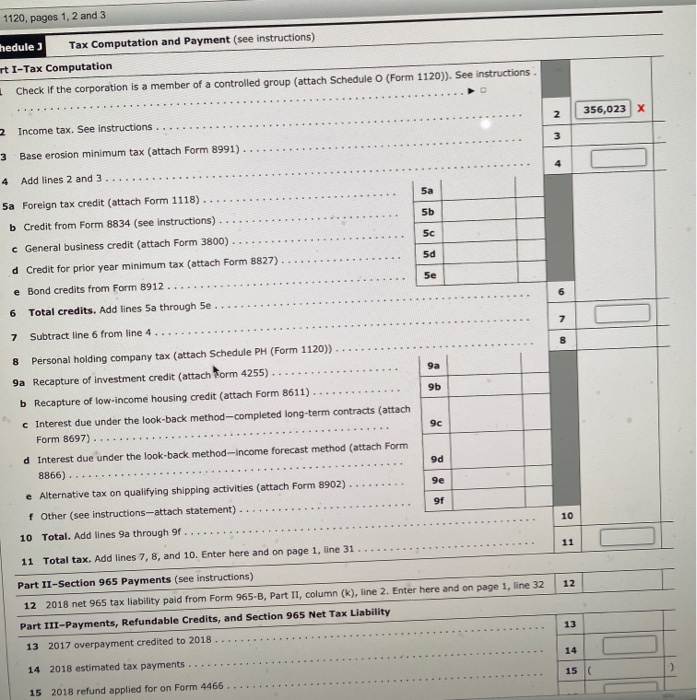

Gbc And 3800 Screens For General Business Credits

Gbc And 3800 Screens For General Business Credits

Gbc And 3800 Screens For General Business Credits

Gbc And 3800 Screens For General Business Credits

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Small Business Tax Credits The Complete Guide

Small Business Tax Credits The Complete Guide

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 How To Complete It Fora Financial Blog

Form 3800 How To Complete It Fora Financial Blog

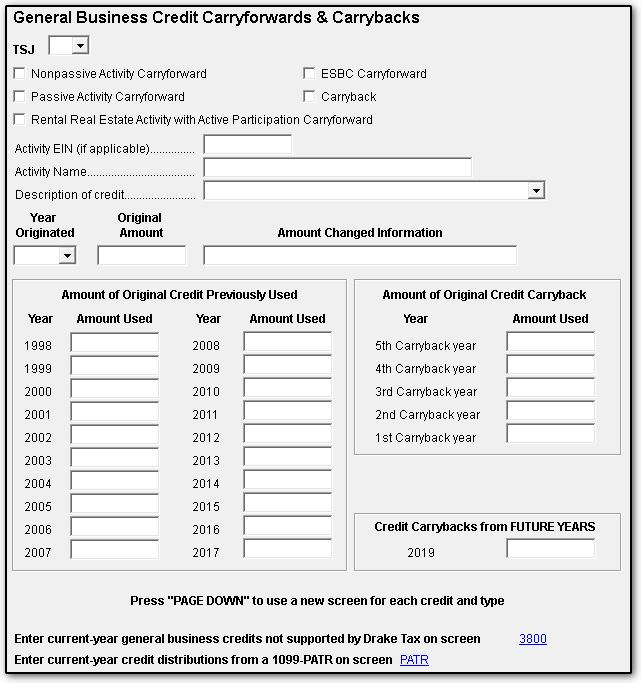

Tax Form 3800 Page 2 Line 17qq Com

Tax Form 3800 Page 2 Line 17qq Com

Form 3800 General Business Credit

Form 3800 General Business Credit

Form 3800 General Business Credit 2014 Free Download

Form 3800 General Business Credit 2014 Free Download

Form 3800 General Business Credit

Form 3800 General Business Credit

Form 3800 General Business Credit

Form 3800 General Business Credit