Will Doordash Send Me A 1099

These items can be. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC.

Everything You Need To Know About Doordash Taxes 1099 Taxes From An Accountant Youtube

Everything You Need To Know About Doordash Taxes 1099 Taxes From An Accountant Youtube

Working as an Instacart 1099 independent contractor youre a part of the emerging gig economy along with services such as Postmates Uber Lyft or Doordash.

Will doordash send me a 1099. All Dashers need to accept the invite from DoorDash 2018 in order to access their 2018 1099-MISC form. I want to file my taxes this year to prove income and had a very hard time figuring out what to do until I heard about TaxAct and. You may even receive it before then.

Incentive payments and driver referral payments. As many others have already posted a ton of information but Im going to go over the basicsand a little more And you dont have to read this but if you do I bet you. Form 1099-NEC reports income you received directly from DoorDash ex.

Before a 1099 form is sent to the IRS businesses must send a copy of the 1099 form to the recipient of the payment. Thats up to the driver to record mileage cell phone use PPE expenses and anything else to deduct against the income. Doordash will send you a 1099-NEC form to report income you made working with the company.

February 4 2021 534 AM Doordash will send a 1099-NEC. If you earn more than 600 in payments during the last year from the DoorDash app then you will receive a Form 1099-NEC Nonemployee Compensation from Payable. Why am I receiving a 1099-NEC and not a 1099-MISC.

You do not have to use. They use a 1099-K to report the bulk of payments to contractors. You should be receiving your 1099-MISC from DoorDash by or before January 31st.

We created this quick guide to help you better. This copy must be sent by January 31st and it covers payments from the prior year. If you had a Payable account for a previous year please register a new email in order to access your 2018 1099-MISC form.

How to file taxes for DoorDash 1099-NEC. Payable is the service helping deliver these tax forms to Dashers this year. Okay so Im not going to go into huge detail here well maybe kind of.

The most important box on this form that youll need to use is Box 7 Nonemployee Compensation. And legally DD has to send the 1099 to us. Also as independent contractors they cant control certain things.

Doordash can be reach via phone at 855-973-1040 or through their support team here. I started DoorDash last year in November and made 800. Uber Eats does not use the 1099-NEC the same way other delivery gig companies like Doordash and Grubhub do.

They wont have any idea what a drivers expenses are. Door Dash and any other company that pays employees or subcontractors as they call them will send out 1099K to show earnings. Recipients of a 1099-K are merchants and vendors who have received payment using a TPSO or third-party payment network.

Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year. Under Payables terms of service it scared the crap out of me states to consult a tax adviser they are not liable have a right to hold funds. Can I change my election for delivery preference.

Typically you will receive your 1099 form before January 31 2021. You are required to file it on your taxes. A DoorDash Merchant for example would receive a 1099-K from DoorDash as DoorDash has concluded it satisfies the criteria for a TPSO.

No only Dashers who earned 600 or more within a calendar year will receive a 1099-NEC form. Hello all 18 and ready to do taxes. It would be considered self employment on a schedule C.

It will look like this. The minimum earnings before they have to report on a 1099-K is 20000 much higher than the 600 for 1099-NEC earnings. In the past they would send a 1099-MISC form but the 1099-NEC is replacing that form as of the year 2020.

Businesses and self-employed individuals that are required to send out 1099 forms payors to taxpayers that received payments then have until the end of February to send a copy to the IRS. Essentially youre self-employed and get to decide when and how much you work. Im done being under the table and want to be able to prove income.

But Uber Eats does send out a 1099-NEC to some drivers. There are many varieties including 1099-INT for interest 1099-DIV for dividends 1099-G for tax refunds 1099-R for pensions and 1099-MISC for.

Home Old Line Fine Wine Spirits Bistro Restaurant Fine Wine And Spirits Bistro Restaurant Networking Event

Home Old Line Fine Wine Spirits Bistro Restaurant Fine Wine And Spirits Bistro Restaurant Networking Event

Tony Xu On Twitter Can You Email Me At Tony Doordash Com Would Love To Understand What Happened

Tony Xu On Twitter Can You Email Me At Tony Doordash Com Would Love To Understand What Happened

Does Doordash Withhold Taxes For Me Faq Series Entrecourier

Does Doordash Withhold Taxes For Me Faq Series Entrecourier

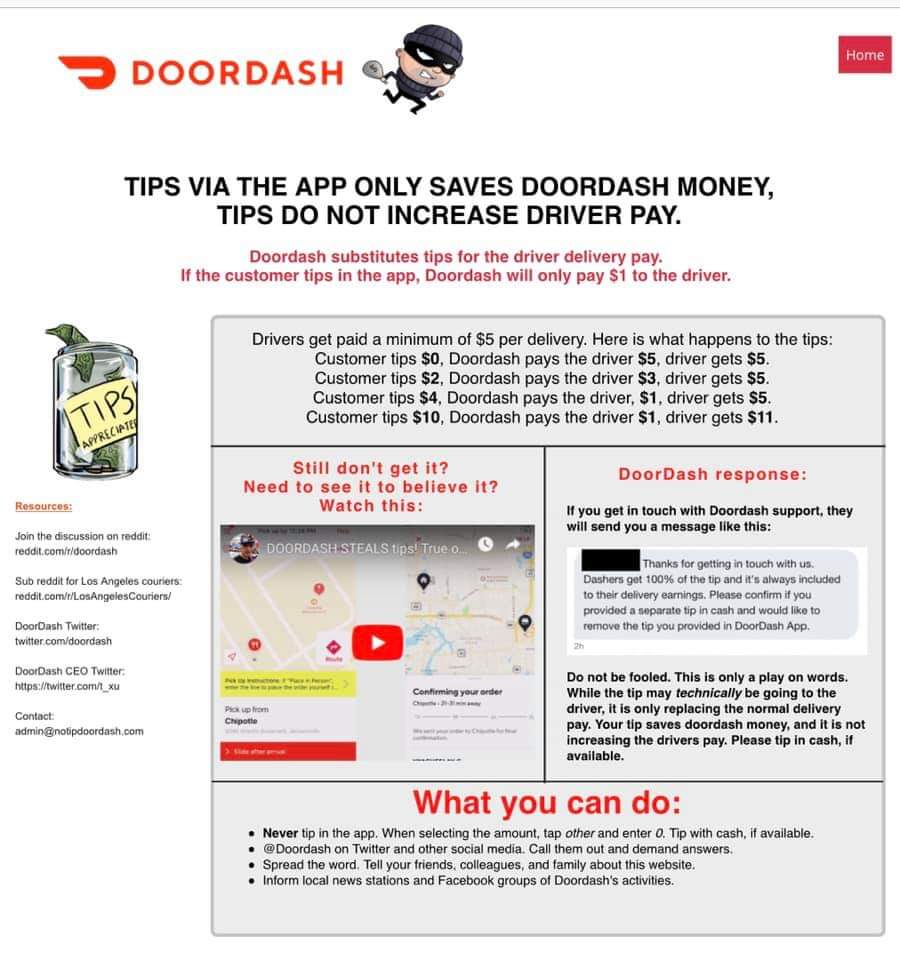

Doordash Class Action Lawsuit Alleges That Drivers Are Paid Substandard Wages Top Class Actions

Doordash Class Action Lawsuit Alleges That Drivers Are Paid Substandard Wages Top Class Actions

Does Doordash Withhold Taxes For Me Faq Series Entrecourier

Does Doordash Withhold Taxes For Me Faq Series Entrecourier

Understanding Merchant Fees For Years The Challenges Of Running A By Doordash Doordash

Understanding Merchant Fees For Years The Challenges Of Running A By Doordash Doordash

Doordash Taxes Made Easy A Complete Guide For Dashers

Doordash Taxes Made Easy A Complete Guide For Dashers

Paying Your Taxes As A Dasher 1099 Form Doordash Youtube

Paying Your Taxes As A Dasher 1099 Form Doordash Youtube

Doordash Filing 1099 Taxes The Process Youtube

Doordash Filing 1099 Taxes The Process Youtube

Will The Irs Know If I Don T File A 1099

Will The Irs Know If I Don T File A 1099

We Make Self Employment Taxes Easy Simplify Is Your Solution To Paying Self Employment Quarterly Taxes With The Fewest Tax Deadline Tax Deductions Tax Season

We Make Self Employment Taxes Easy Simplify Is Your Solution To Paying Self Employment Quarterly Taxes With The Fewest Tax Deadline Tax Deductions Tax Season

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

We Are All Busy And Everyone Can Use Some Assistance With Saving Time Our Virtual Tax Experience Using Our Secure Mytax Butle Tax Prep Business Tax Tax Return

We Are All Busy And Everyone Can Use Some Assistance With Saving Time Our Virtual Tax Experience Using Our Secure Mytax Butle Tax Prep Business Tax Tax Return

What Is The Form 1099 Nec The Turbotax Blog

What Is The Form 1099 Nec The Turbotax Blog

Can Someone Help Me Out Is Doordash Supposed To Send Us These Or No Doordash

Can Someone Help Me Out Is Doordash Supposed To Send Us These Or No Doordash

How Do I Get Started On Last Year S Taxes Entrecourier

How Do I Get Started On Last Year S Taxes Entrecourier

Doordash Cartoon Pic Thank You Stickers In 2021 Thank You Stickers Customize Pictures Stickers

Doordash Cartoon Pic Thank You Stickers In 2021 Thank You Stickers Customize Pictures Stickers

Delivery Driver Log Sheet Template Good Resume Examples Resume Examples Resume

Delivery Driver Log Sheet Template Good Resume Examples Resume Examples Resume

Tax Filing For Doordashers Other Independent Contractors Youtube

Tax Filing For Doordashers Other Independent Contractors Youtube