What To Do With W2 Earnings Summary

After that time and after receiving permission from the IRS by telephone you can file your tax return using your paycheck stubs W-2 summary sheet or other incomplete documentation as a best guess estimate. Also do this for Box 3 Social Security Wages and Box 1 Wages Tips and Other Compensation.

D08ihh006h6754810295223161109102 Doc 2018 W 2 And Earnings Summary Employee Reference Wage And Tax Statement Copy W 2 2018 D Control Number C The Course Hero

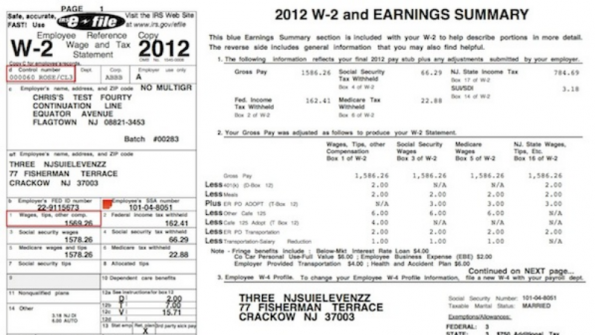

Easy-to-read Form W-2 copies.

What to do with w2 earnings summary. Reminder Tax Year 2020 wage reports must be filed with the Social Security Administration by February 1 2021. Add the amount in Box 5 for all Forms W-2 for Medicare wages and tips and compare it to the total Form W-3 amount. Easy-to-read W-2 copies Detailed explanation of the W-2.

If they do flip the 1040ez to the back side and fill out the worksheet. 2005 W-2 and Earnings Summary. If an employer pays you as an employee at least 600 in compensation cash or another type for the year it is required to file a Form W-2 on your behalf.

A W-2 form is a statement that you must prepare as an employer each year for employees showing the employees total gross earnings Social Security earnings Medicare earnings and federal and state taxes withheld from the employee. Or if your employer withheld income Social Security or Medicare tax from your paycheck it is required to file a Form W-2 even if they paid you less than 600 during the tax year. A form W-2 is issued by an employer to an employee.

Its a single-page form that gives you all the important information you need to answer your W-2 questions. Start Organizing Your Taxes. Also review the taxes withheld in Boxes 2 4 and 6.

If wages include tips compare Social Security Tips found in Box 7. Guide to Understanding Your 2014 W-2 and Earnings Summary When Will My 2014 W-2 Be Available. The Earnings Summary Report adds the pay code totals for all checks within a date.

You will be asked by the IRS to attempt to contact your employer again and ask about mailing an accurate duplicate of the original W-2 statement. W-2s containing your 2014 information will be available electronically in PeopleSoft Employee Self Service ESS. This site uses cookies.

Please visit our Whats New for Tax Year 2020 page for important wage reporting updates. As of January 24 2020 W-2s containing your 2019 information are available electronically in PeopleSoft Employee Self Service. This has everything you should need from Lyft to file your taxes.

If its incorrect well have to delete and recreate the paychecks to correct your W-2. That carries with it some significance and not only for tax reasons. Every employer engaged in a trade or business who pays remuneration including noncash payments of 600 or more for the year all amounts if any income social security or Medicare tax was withheld for services performed by an employee must file a Form W-2 for each employee even if the employee is related to the employer from whom.

Though youll have to delete the most recent paychecks before you can delete the older ones. The form also includes taxes withheld from your pay as well as Social Security and Medicare payments made on. By IRS regulations all employers must have.

This year youll be receiving a W-2 and Earnings Summary that is easy to read and understand. Income Social Security or Medicare tax was. What to Do After You Receive Your W-2.

As long as youre single and no kids and your life is no more complicated than it is now thats really all you do. Youll notice these useful and well organized features. Read The Balances editorial policies.

Since drivers classify as independent contractors you wont get a W-2 from Lyft. By IRS regulations all employers must have 2019 W-2s available no later than January 31 2020. Youll notice ANYTOWN USA 12345 these useful and well organized features.

You do have to find out if your parents are going to claim you. If its a direct deposit paycheck I suggest contacting our Payroll Support to make an adjustment. Attention Tax Year 2020 Wage Filers.

What is a W-2 earnings summary. Updated November 15 2019. Guide to Understanding Your 2019 W-2 and Earnings Summary When Will My 2019 W-2 Be Available.

Look for More Than One W-2. Form W-2 is the annual Wage and Tax Statement that reports your taxable income earned from an employer to you and to the Internal Revenue Service IRS. Some drivers also qualify to get a 1099 form from Lyft depending on how much they earned that year.

This year youll be receiving a Form W-2 and Earnings Summary that is easy to read and understand. The W-2 form may look official and as if everything is completely fine but there could be a mistake on it. All drivers get an Annual Summary as long as they have earnings in 2020.

Wage reports for Tax Year 2020 are now being accepted. Some of these cookies are essential to the operation of the site while others help to improve your experience by providing insights into how the. Its a single-page form that gives you all the important information you need to answer your W-2 questions.

Http Adpinsightsandsolutionsbulletin Com Portals 0 What S 20new 20on 20w 2 Pdf

Federal Adjusted Gross Income On W 2 Page 3 Line 17qq Com

W2 And Earnings Summary Fill Online Printable Fillable Blank Pdffiller

Texas City Loses 800 Employees W 2s In Phishing Scam American City And County

Document 3 Pdf 2017 W 2 And Earnings Summary Employee Reference Wage And Tax Statement Copy W 2 2017 167149 C Dept Control Number Clev Na0 1 The Course Hero

W2 Earnings Detail At Your Fingertips

Elina Shinkar W2 2014 Irs Tax Forms Social Security United States

Fetch Details W2 Forms Using Iq Bot

Form W 2 Explained William Mary

Angeline And Beck Dussoldorf Are A Married Couple Chegg Com

W2 Summary Section Gross Pay Is Greater Than My Wages Box 1 Do I Need To Do Anything Tax

Wage Tax Statement Form W 2 What Is It Do You Need It

Understanding Your Tax Forms 2017 Form W 2 Wage And Tax Statement

Https Mijhtaxpro Com Uploads 3 1 6 0 3160681 W 2 Download Faq Pdf

James Clarence Burke Jr 5435 Norde Drive West Apt 32 Jacksonville Fl 32244 Social Security United States 401 K

What Is A 1099 G Form Credit Karma Tax

Understanding Your Pay Statement Office Of Human Resources

Adp 2019 02 12 Irs Tax Forms 401 K

Fillable Online The Following Information Reflects Your Final 2016 Pay Stub Plus Any Adjustments Submitted By Your Employer Fax Email Print Pdffiller