How To Get 1099 G Form Ohio

View all Ohio Income and School District income tax returns on file for the past 10 years. It is very important that you notify ODJFS to report identity theft and receive a corrected 1099-G.

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

We mailed you a paper Form 1099G if you have opted into paper mailing or are a telephone filer.

How to get 1099 g form ohio. BWC has stated BWC is compelled to issue the 1099-G according to IRS regulations. 1099-G1099-INT 1099s are available to view and print online by choosing the View Ohio 1099s selection after logging into Online Services. If there is no Ohio withholding please do not enter the W-2 or 1099 information into the I-File system.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. The Ohio Department of Job and Family Services said there will be a number of Ohioans who receive a 1099-G form in the mail stating that they received unemployment benefits in 2020 when in.

Can I Get A Copy Of My 1099 G Online. Follow the prompts to schedule a callback. Please notify ODJFS by visiting.

You may choose one of the two methods below to get your 1099-G tax form. 1099Gs are available to view and print online through our Individual Online Services. Ohio has set up a telephone hotline and created a website allowing residents to report identity theft.

Instead you should provide the income statements to. You can access your Form 1099G information on your Correspondence page in Uplink account. Once the state confirms fraud has been committed taxpayers will receive a.

Mailing address telephone number andor email address with the Department. Contact the 1099-G issuer for a corrected form showing 0 benefits received. Mail the completed form to.

File your return reporting the income you actually received. This page is for verifying Ohio withholding and the joint filing credit only. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st.

Please notify ODJFS by visiting. As a result BWC will be mailing the IRS Form 1099-G to businesses. Form 1099G is now available in Uplink for the most recent tax year.

You can elect to be removed from the next years mailing by signing up for email notification. Allows you to viewprint transcripts of previously filed returns up to 10 years and Ohio 1099-G1099-INT forms up to 5 years. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

Your tax preparer cannot access your 1099-G andor 1099-INT information. Httpsunemploymenthelpohiogov click on the REPORT IDENTITY THEFT button and complete the. You can also view outstanding balances if any and update certain contact information ie.

BWC has no discretion in this matter. I Need A 1099 G Form To Fill Out My Taxes Where Do I Find It. If you received both UC and PUA you can expect to receive both forms.

Your taxable income is already included in your federal adjusted gross income In other words you dont specifically enter the 1099-G anywhere in Ohios I-File. 1099-G Form for state tax refunds credits or offsets. How to Get Your 1099-G online.

To access this form please follow these instructions. The Ohio Department of Job and Family Services ODJFS says there are three steps you should take if you received a 1099-G without applying for. If received PUA you will receive PUA-1099G.

If you received regular UC including PEUC EB TRA you will receive UC-1099G. How Do I Get My 1099 -G Form For State Of Ohio. If you received unemployment compensation during the year you should receive Form 1099-G from the Office of Unemployment Compensation.

800-860-7482 and ask for a replacement 1099G. Check your state department of revenue website to see if the state issued additional directions. This will help save taxpayer dollars and allow you to do a small part in saving the environment.

If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631. Once ODJFS verifies the ID. BWC makes no representation to the IRS or individual employers as to whether or not the dividend payments are taxable.

If you need another paper copy of your 1099-G andor 1099-INT you may request one by contacting the Department via email or by calling 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment. Make the election to receive email notification through the My Notifications selection. IDES mailed paper copies of the 1099-G form in January to all claimants who opted NOT to receive their form electronically.

You can download Form 4506-T at IRSgov or order it from 800-TAX-FORM. Your local post office or library carries tax forms. Httpsunemploymenthelpohiogov click on the REPORT IDENTITY THEFT button and complete the form.

It is very important that you notify ODJFS to report identity theft and receive a corrected 1099-G. If the state issues you a refund credit or offset of state or local income that amount will be shown in Box 2 of.

Unemployment 1099 G Form Page 1 Line 17qq Com

Unemployment 1099 G Form Page 1 Line 17qq Com

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Unemployment Benefits Are Taxable Look For A 1099 G Form Wkyc Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Wkyc Com

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Ohio Form 1099 G Vincegray2014

Ohio Form 1099 G Vincegray2014

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Download Ds 82 Form Learn How To Fill The Form Ds 82 U S Passport Renewal Passport Application Form Passport Renewal Passport Application

Download Ds 82 Form Learn How To Fill The Form Ds 82 U S Passport Renewal Passport Application Form Passport Renewal Passport Application

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

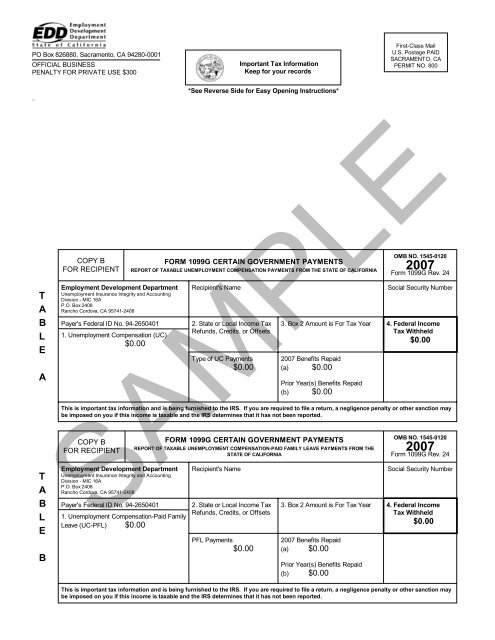

Irs Form 1099g Employment Development Department State Of

Irs Form 1099g Employment Development Department State Of

Millions Of Americans Victimized By Unemployment Fraud Orbograph

Millions Of Americans Victimized By Unemployment Fraud Orbograph

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Form 1099 G Vincegray2014

Michigan Tax Form 1099 G Vincegray2014

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Surprise Tax Forms Show Extent Of Unemployment Fraud In Us

Surprise Tax Forms Show Extent Of Unemployment Fraud In Us

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation