How To Lodge A Business Activity Statement Online

This will make it easier to lodge your activity statemen. Due dates for lodging and paying your BAS.

How To Complete A Business Activity Statement With Pictures

Use it to lodge activity statements request refunds and more.

How to lodge a business activity statement online. In the Lodge Online tab click Prepare Statement. Start AccountRight and open your online company file. Sign in to your MYOB account as you normally do when accessing your online AccountRight company files.

From 1 July 2017 well be introducing changes which will transform the look of a number of screens. Lodging Your Statement 1 Submit your BAS and payment through ATO online services. We issue your business activity statement about two weeks before the end of your reporting period which for GST is usually every three months.

Log in to the Business Portal The Business Portal is a free secure website for managing your business tax affairs with us. If you have a registered tax or BAS agent they can lodge vary and pay on your behalf through their preferred electronic channel. Top 3 takeaways A Business Activity Statement BAS summarises the tax that your business has paid.

If you are registered through the ATOs business portal or have Standard Business Reporting SBR enabled accounting software you can lodge your statement using either of those methods. By having a registered tax or BAS agent generally an accountant or bookkeeper submit it for you. You can lodge your activity statement in a matter of minutes.

Step by step guide on how to lodge Business Activity Statement BAS using manual CSV File import or accounting software compatibility. Use it to lodge activity statements request refunds and more. You can lodge your BAS.

Lodge through your tax or BAS agent. If you have an accountant or bookkeeper this is a task that they can take care of for you. The date for lodging and paying is shown on your activity statement.

How to lodge a BAS You can lodge your BAS online. The Australian Taxation Office generally makes it easy for businesses to comply with their requirements. The most common lodgement period is quarterly.

To view or revise an already lodged activity statement select View or revise activity statements. Through your myGov account if youre a sole trader. Via your online accounting software.

Select Tax and then Activity statements from the menu. Online through your myGov account linked to the ATO only if youre a sole trader by phone for nil statements only by mail. Leanne Davis owner operator of Sort It Out Office Assist and member of Intuits Trainer Writer Network has put together some simple steps on how to lodge a.

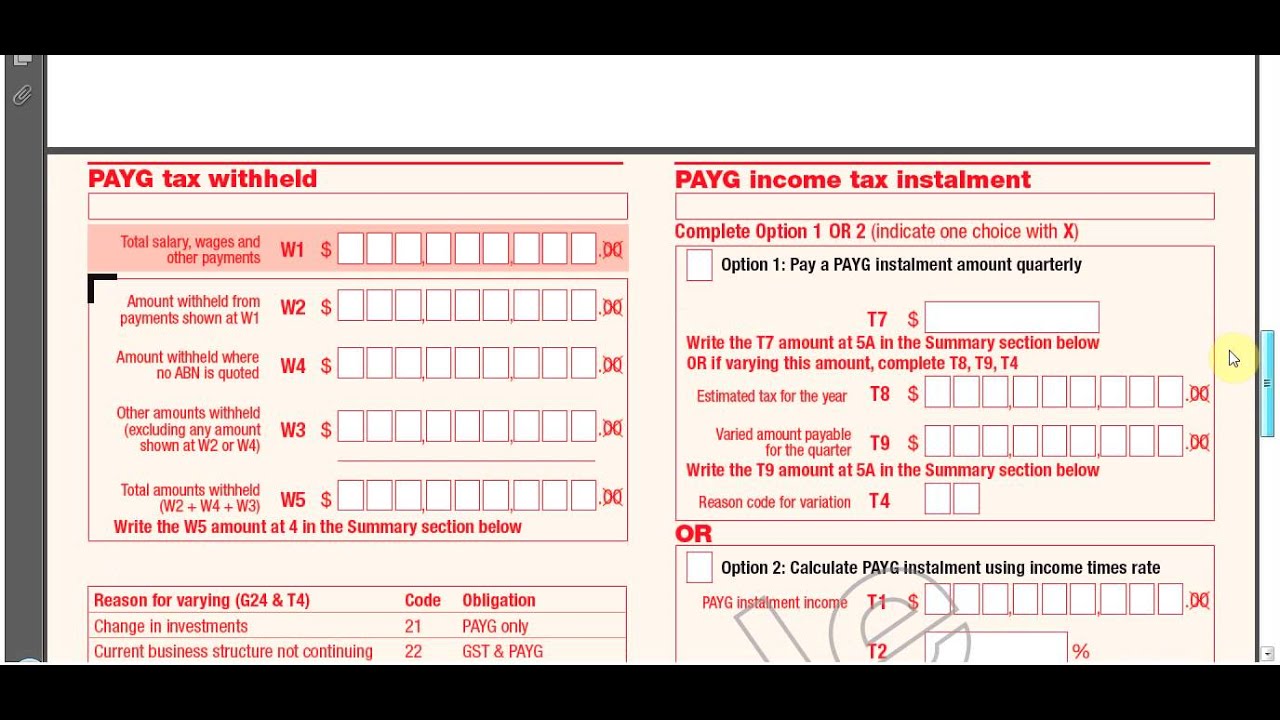

Online through the Business Portal or Standard Business Reporting SBR software. In Australia business owners need to submit a form called a business activity statement or BAS. Goods and services tax GST pay as you go PAYG instalments.

Through a registered tax or BAS agent. Your BAS will help you report and pay your. Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS.

They can view activity statements sent to your myGov inbox. Click Prepare BASIAS in the Accounts command centre. They also have an online business portal as well as a BAS portal although it is reserved for BAS Agents tax agents or.

Through the ATOs online business portal. How to Lodge Business Activity Statement. To lodge a new activity statement select Lodge activity statement.

When you use an agent. If youre registered for GST you are required to lodge your Business activity Statement BAS either monthly quarterly or annually. You report and pay GST amounts to us and claim GST credits by lodging a business activity statement BAS or an annual GST return.

You can lodge your BAS online through MyGov or through a registered tax agent. These forms report your tax obligations pay as you go information and other details to the Australian Taxation OfficeIf you are new to doing business in Australia it is important to understand how these. This is made possible by providing several different methods for lodgement.

Doing business in any country requires compliance with the regulations and laws of the land. To prepare your activity statement online.

Bas Preparation Business Activity Statement Bas Bbw Business Services

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

Completing Your Bas Australian Taxation Office

8 Business Activity Statement Templates In Pdf Doc Free Premium Templates

What Is A Bas Statement Small Business Guides Reckon Au

8 Business Activity Statement Templates In Pdf Doc Free Premium Templates

How To Complete A Business Activity Statement With Pictures

How Do I Complete My Business Activity Statement Youtube

Prepare Your Activity Statement Manually Myob Accountright Myob Help Centre

Completing Your Bas Australian Taxation Office

How To Complete A Business Activity Statement With Pictures

Lodging An Activity Statement Through The Business Portal Youtube

Completing Your Bas From Myob Essentials Myob Community

How To Complete A Business Activity Statement With Pictures

Bas Preparation Business Activity Statement Bas Bbw Business Services

Lodge Your Activity Statement Australia Only Myob Accountright Myob Help Centre